Despite currently being unprofitable, DMG Blockchain Solutions (CVE:DMGI) has delivered a 980% return to shareholders over 1 year

DMG Blockchain Solutions Inc. (CVE:DMGI) shareholders might be concerned after seeing the share price drop 15% in the last month. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Indeed, the share price is up a whopping 980% in that time. So the recent fall isn't enough to negate the good performance. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for DMG Blockchain Solutions

DMG Blockchain Solutions isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, DMG Blockchain Solutions' revenue grew by 2.7%. That's not a very high growth rate considering it doesn't make profits. So it's truly surprising that the share price rocketed 980% in a single year. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

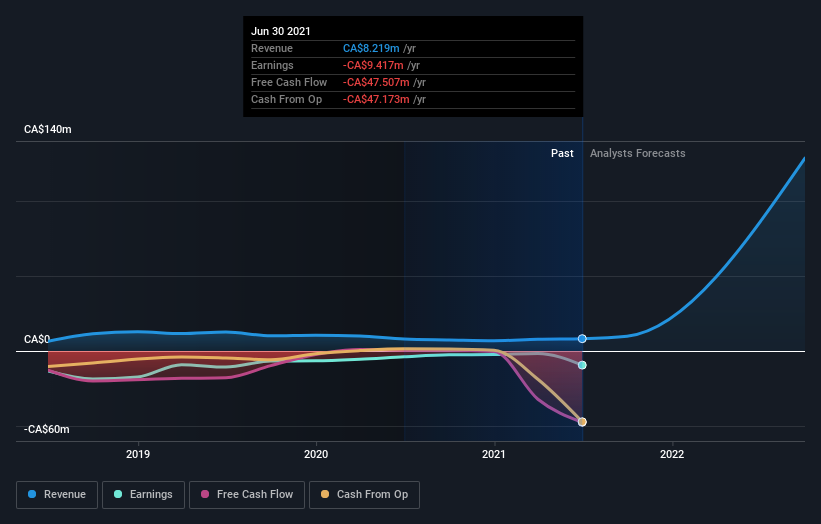

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on DMG Blockchain Solutions' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that DMG Blockchain Solutions shareholders have gained 980% (in total) over the last year. That's better than the annualized TSR of 57% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting DMG Blockchain Solutions on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - DMG Blockchain Solutions has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance