Denny's Corp (DENN) Q1 2024 Earnings: Misses Revenue Estimates, Adjusted EPS Aligns with Projections

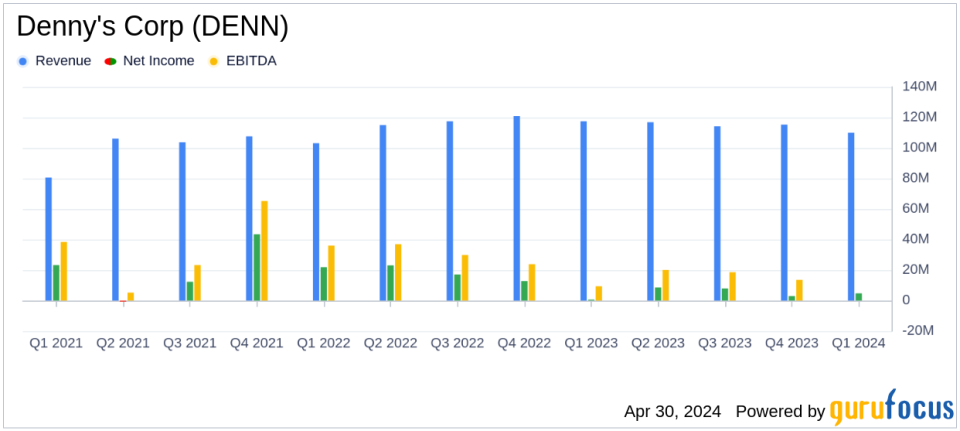

Revenue: Reported $110.0 million, down from $117.5 million in the prior year quarter, falling short of estimates of $115.16 million.

Net Income: Achieved $4.7 million, up significantly from $0.6 million in the prior year quarter, falling short of estimates of $7.53 million.

Earnings Per Share (EPS): Recorded at $0.09 per diluted share, compared to $0.01 in the prior year quarter, falling short of estimates of $0.14.

Same-Restaurant Sales: Domestic system-wide same-restaurant sales decreased by 1.3%, with a more pronounced decline of 3.0% at company-operated restaurants.

New Store Openings: Opened eight new restaurants, including expansions of the Keke's brand outside of Florida.

Operating Income: Declined to $10.0 million from $16.1 million in the prior year quarter.

Adjusted EBITDA: Stood at $18.4 million, indicating a focus on operational efficiency despite revenue challenges.

Denny's Corp (NASDAQ:DENN) disclosed its financial results for the first quarter ended March 27, 2024, through its 8-K filing on April 30, 2024. The company reported a decline in total operating revenue to $110.0 million from $117.5 million in the prior year quarter, falling short of the estimated $115.16 million. Adjusted earnings per share were $0.11, aligning with analyst expectations of $0.14 per share, considering adjustments for non-recurring items.

Denny's Corporation, a prominent franchised full-service restaurant chain in America, operates under the Denny's and Keke's Breakfast Cafe brands. The company's revenue streams include food and beverage sales and franchise-related revenues such as royalties and licensing fees. Despite the challenging operating environment, CEO Kelli Valade highlighted the company's strategic initiatives aimed at driving sales, including the expansion of virtual brands and remodeling programs.

Financial Highlights and Strategic Developments

In Q1 2024, Denny's faced a slight downturn in domestic same-restaurant sales by 1.3%, with a more pronounced 3.0% drop in company-operated restaurants. This decline was partially offset by the opening of new restaurants, including international Denny's locations and Keke's company locations. The adjusted franchise operating margin improved to 52.2% of franchise and license revenue, reflecting a more efficient operational model despite lower overall sales.

The company's net income saw a significant increase to $4.7 million, or $0.09 per diluted share, compared to $0.6 million, or $0.01 per diluted share, in the prior year quarter. This improvement was primarily due to the absence of losses related to interest rate swap valuation adjustments that impacted the previous year's results.

Operational and Financial Challenges

Denny's operational challenges included higher worker's compensation and general liability costs, which impacted the company restaurant operating margin, reducing it to 11.5% from 13.2% in the prior year. The company also noted an increase in general and administrative expenses, mainly due to higher corporate administration costs.

From a balance sheet perspective, Denny's ended the quarter with $271.4 million in total debt, including $261.2 million under its credit facility. The company's capital allocation strategy included $4.9 million in cash capital expenditures, primarily for new Keke's cafe openings, and $4.8 million allocated to share repurchases.

Outlook and Forward Guidance

Looking ahead, Denny's management expects domestic system-wide same-restaurant sales to range between 0% and 3% for the full year 2024. The company anticipates opening 40 to 50 new restaurants, including 12 to 16 new Keke's restaurants, though it also projects a net decline of 10 to 20 restaurants overall. Expected commodity inflation is forecasted between 0% and 2%, with labor inflation projected at 4% to 5%. Adjusted EBITDA is anticipated to be between $87 million and $91 million for the year.

The company's strategic focus remains on enhancing operational efficiency and expanding its market presence through both the Denny's and Keke's brands, despite the current economic pressures and competitive landscape.

For more detailed information and ongoing updates, investors and interested parties are encouraged to refer to Denny's investor relations website.

Explore the complete 8-K earnings release (here) from Denny's Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance