DELL Expands Partnership With Red Hat for Container Solutions

Dell Technologies DELL recently announced that it is expanding its partnership with Red Hat to offer new solutions that will help in deploying and managing on-premises, containerized infrastructure in multi-cloud environments.

The Dell-Red Hat combined solutions will help enterprises speed up the development and operations (DevOps) of cloud-native applications while removing IT management barriers and bottlenecks.

APEX Containers for Red Hat OpenShift offers IT enterprises a Dell-managed on-premises Container-as-a-Service solution. The solution delivered as a subscription will supervise infrastructure management activities and operations.

The Dell Validated Platform for Red Hat OpenShift streamlines deployment processes and management of on-premises infrastructure for containers.

Moreover, Dell and Red Hat are co-developing a hybrid cloud solution that extends management of on-premises Red Hat OpenShift deployments across public clouds and the edge.

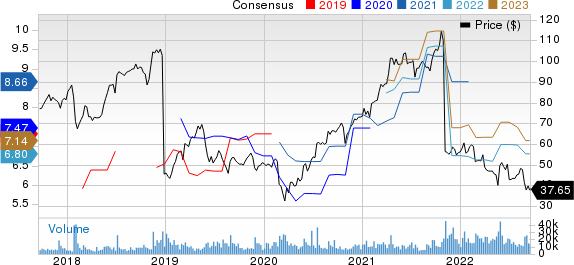

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

What Awaits Dell Shares in the Rest of 2022?

Dell shares have fallen 33% year to date compared with the Zacks Computer & Technology sector’s decline of 31.3%.

Dell’s prospects are suffering from a challenging demand environment in the Infrastructure Solutions Group (“ISG”). ISG offers servers and storage devices.

In the second quarter of 2022, Dell witnessed a shortage of parts and embedded integrated circuits, including power supplies and NICs in the reported quarter. ISG backlog, particularly servers, remained elevated.

In the Client Solutions Group (CSG) segment, Dell witnessed weak demand in both Consumer and Commercial segments.

These factors are expected to hurt Dell’s top-line growth in the near term. Dell expects fiscal third-quarter revenues between $23.8 billion and $25 billion, down 8% at the mid-point, with CSG declining in the high-teens and ISG growing in the low-teens.

The Zacks Consensus Estimate for fiscal third-quarter revenues is pegged at $24.58 billion, indicating a decline of 13.47% from the figure reported in the year-ago quarter.

Gross margin is expected to increase sequentially as the mix shifts to ISG. Operating expense is expected to decline sequentially.

Dell expects earnings between $1.53 and $1.79 per share, unchanged year over year at the mid-point. The consensus mark for earnings is pegged at $1.63 per share, down 2.4% over the past 30 days.

Zacks Rank & Stocks to Consider

Dell currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the same industry are Absolute Software ABST, Paylocity PCTY and Synchronoss SNCR, all three sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Absolute shares have gained 15.2% in the year-to-date period. The Zacks Consensus Estimate for ABST’s fiscal 2023 earnings has moved 487.5% higher over the past 30 days to 47 cents per share.

Paylocity shares have gained 7.3% in the year-to-date period. The Zacks Consensus Estimate for PCTY’s fiscal 2023 earnings has been steady over the past 30 days at $3.58 per share.

Synchronoss shares have lost 44% in the year-to-date period. The consensus mark for SNCR’s 2022 earnings has been steady at 16 cents per share over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Synchronoss Technologies, Inc. (SNCR) : Free Stock Analysis Report

Paylocity Holding Corporation (PCTY) : Free Stock Analysis Report

Absolute Software Corporation (ABST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance