Decoding Williams Companies Inc (WMB): A Strategic SWOT Insight

Williams Companies Inc showcases robust revenue growth in service sectors despite a decline in net income.

Strategic acquisitions and expansions position the company for future growth.

Challenges include fluctuating commodity prices and derivative losses.

Opportunities for Williams Companies Inc in energy transition and infrastructure development.

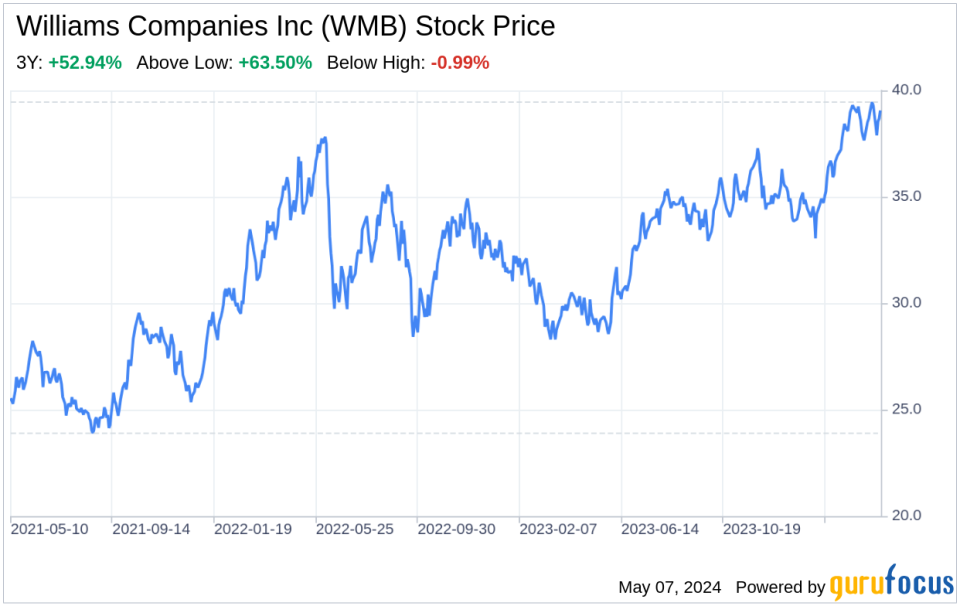

Williams Companies Inc (NYSE:WMB), a leading midstream energy company, recently filed its 10-Q report on May 6, 2024, providing a snapshot of its financial performance and strategic positioning. The company, known for its extensive Transco and Northwest pipeline systems, reported a mixed financial outcome for the first quarter of 2024. While service revenues increased from $1,694 million in Q1 2023 to $1,905 million in Q1 2024, net income available to common stockholders saw a decrease from $926 million to $631 million in the same period. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as revealed by the latest SEC filings, offering investors a comprehensive view of Williams Companies Inc's market standing and future prospects.

Strengths

Robust Infrastructure and Strategic Acquisitions: Williams Companies Inc's strength lies in its expansive pipeline infrastructure, which includes the Transco and Northwest pipeline systems. The company's recent acquisitions, such as the remaining 26% ownership of Williams Partners in 2018, have further solidified its market position. The 2024 Q1 report indicates a strong service revenue growth, underscoring the company's ability to leverage its assets for consistent income streams.

Financial Resilience: Despite a challenging economic environment, Williams Companies Inc has maintained a strong balance sheet. The company's service revenues have seen a significant increase, which is indicative of its pricing power and ability to generate stable cash flows. This financial resilience positions the company well to navigate market volatility and invest in growth opportunities.

Weaknesses

Exposure to Commodity Price Fluctuations: Williams Companies Inc's financials reveal a vulnerability to volatile commodity prices. The net loss from commodity derivatives was $10 million in Q1 2024, compared to a gain of $497 million in Q1 2023. This volatility can impact the company's earnings and margins, highlighting a need for improved risk management strategies.

Decline in Net Income: The company's net income has decreased from $957 million in Q1 2023 to $662 million in Q1 2024. This decline reflects challenges in maintaining profitability and could be attributed to various factors, including increased operating expenses and interest expenses. Addressing these issues is crucial for sustaining long-term financial health.

Opportunities

Energy Transition and Infrastructure Development: As the global economy shifts towards cleaner energy sources, Williams Companies Inc has the opportunity to play a pivotal role in the energy transition. The company's infrastructure can be adapted to support renewable energy distribution, presenting a significant growth avenue.

Expansion Projects: Williams Companies Inc has several expansion projects underway, such as the Regional Energy Access and Deepwater Shenandoah Project, which are expected to enhance capacity and meet growing energy demands. These projects, once completed, could lead to increased revenues and market share.

Threats

Regulatory and Environmental Challenges: The energy sector is highly regulated, and Williams Companies Inc faces the threat of stringent environmental policies that could increase operational costs or delay projects. The company must navigate these regulations carefully to avoid potential setbacks.

Competitive Landscape: Williams Companies Inc operates in a competitive industry where market dynamics can shift rapidly. The company must continuously innovate and improve efficiency to maintain its competitive edge and protect its market position from emerging competitors.

In conclusion, Williams Companies Inc (NYSE:WMB) presents a mixed financial picture with strong revenue growth in its service sectors, balanced by a decline in net income. The company's robust infrastructure and strategic acquisitions position it well for future growth, but it must contend with challenges such as fluctuating commodity prices and derivative losses. Opportunities for expansion and a role in the energy transition are promising, yet regulatory and competitive threats loom. Investors should weigh these factors carefully when considering Williams Companies Inc's prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance