Decoding Charles River Laboratories International Inc (CRL): A Strategic SWOT Insight

Strengths: Robust Service Revenue and Diverse Portfolio

Weaknesses: Declining Total Revenue and Operating Income

Opportunities: Expansion through Acquisitions and Market Demand

Threats: Competitive Pressure and Economic Uncertainty

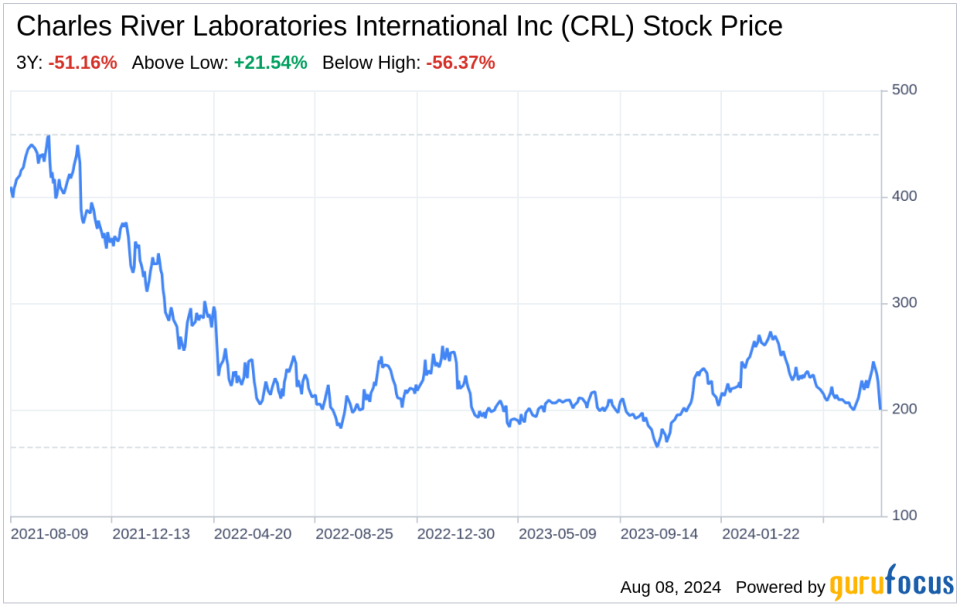

On August 7, 2024, Charles River Laboratories International Inc (NYSE:CRL) filed its 10-Q report, offering a window into its financial health and strategic positioning. As a leading provider of drug discovery and development services, CRL's financial tables from the filing reveal a nuanced picture. Service revenue showed resilience, with a slight decrease from $874,891 in the previous year to $842,900 for the three months ended June 29, 2024. However, total revenue experienced a dip from $1.06 million to $1.03 million for the same period. Operating income also saw a downturn, from $164,945 to $151,652, indicating increased costs or reduced efficiency. These figures set the stage for a detailed SWOT analysis, providing investors with a comprehensive understanding of CRL's strategic outlook.

Strengths

Diverse Service Portfolio and Market Leadership: Charles River Laboratories International Inc (NYSE:CRL) boasts a robust portfolio of services that spans across research models, discovery services, and manufacturing support. This diversity not only mitigates risks associated with market volatility but also positions CRL as a one-stop-shop for pharmaceutical and biotechnology companies. The company's leadership in providing animal models for laboratory testing is a testament to its entrenched position in the market. With a history dating back to 1947, CRL has established a reputation for quality and reliability, which is crucial in the highly regulated pharmaceutical industry.

Financial Resilience in Service Revenue: Despite a challenging economic environment, CRL has demonstrated financial resilience, particularly in its service revenue. The slight decrease in service revenue from $874,891 to $842,900 for the three months ended June 29, 2024, is relatively modest compared to the broader industry context. This resilience is indicative of the company's strong client relationships and the essential nature of its services in the drug development pipeline. Furthermore, CRL's ability to maintain a steady stream of revenue from its services underscores the company's operational strength and strategic pricing power.

Weaknesses

Declining Total Revenue and Operating Income: The recent financials indicate a concerning trend in CRL's total revenue and operating income. The decrease in total revenue from $1.06 million to $1.03 million, alongside a reduction in operating income from $164,945 to $151,652 for the three months ended June 29, 2024, suggests that CRL is facing headwinds that could impact its profitability. These figures may reflect increased competition, pricing pressures, or a shift in demand for CRL's services. It is imperative for the company to analyze the underlying causes and implement strategies to reverse this trend and improve its financial performance.

Operational Efficiency Challenges: The decline in operating income also raises questions about CRL's operational efficiency. With costs and expenses remaining relatively stable, the reduction in operating income could be attributed to inefficiencies in the company's operations or an inability to scale effectively. This weakness could hinder CRL's competitive edge and profitability if not addressed promptly. The company must focus on optimizing its operations, possibly through process improvements, cost-cutting measures, or strategic investments in technology to enhance productivity.

Opportunities

Strategic Acquisitions and Market Expansion: CRL has a history of growth through strategic acquisitions, as evidenced by the recent acquisition of Noveprim, which has expanded its large research models portfolio. This move not only broadens CRL's service offerings but also opens up new market opportunities. The company can leverage such acquisitions to enter new geographical markets, enhance its technological capabilities, and diversify its client base. In a rapidly evolving pharmaceutical industry, CRL's proactive acquisition strategy presents significant opportunities for growth and market penetration.

Rising Demand for Drug Development Services: The global pharmaceutical industry is witnessing an increase in demand for drug development services, driven by a robust pipeline of drugs in various stages of development. This trend presents a lucrative opportunity for CRL to capitalize on its comprehensive suite of services. With its expertise in both preclinical and early development processes, CRL is well-positioned to meet the growing needs of pharmaceutical companies seeking to expedite their drug development timelines. By focusing on innovation and client-centric solutions, CRL can capture a larger share of the market and drive revenue growth.

Threats

Intense Competition and Market Saturation: The drug development services industry is highly competitive, with numerous players vying for market share. CRL faces competition from both large multinational corporations and specialized service providers. This competitive landscape could lead to pricing pressures, margin erosion, and the need for continuous investment in technology and services to maintain differentiation. CRL must navigate this competitive environment carefully, ensuring that it remains agile and responsive to market changes while preserving its value proposition.

Economic Uncertainty and Regulatory Changes: Economic uncertainty, including fluctuations in currency exchange rates and potential changes in healthcare regulations, poses a significant threat to CRL's operations. These external factors can impact client spending, project timelines, and overall demand for CRL's services. Additionally, regulatory changes can affect the drug development process, potentially leading to increased compliance costs or shifts in market dynamics. CRL must remain vigilant and adaptable, with a keen focus on risk management and strategic planning to mitigate these threats.

In conclusion, Charles River Laboratories International Inc (NYSE:CRL) exhibits a strong market presence with a diverse service portfolio and financial resilience in its service revenue. However, the

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance