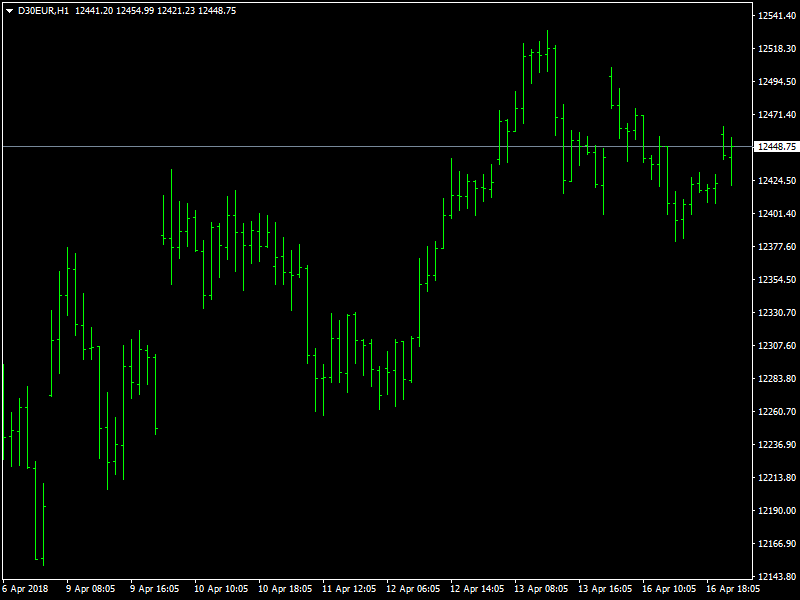

DAX Index Continues to Consolidate

The DAX index continues to trade near the highs of its range over the last 24 hours as the index is likely to continue to be buoyant as long as the market believes that the QE is still far away. There have also been many geopolitical developments but those do not seem to have had much of an impact on the index so far.

DAX Nears Range Highs

There was the launch of missiles in targets in Syria by the US and the other countries but this was something that was quite anticipated through the course of last week. Also, we had a situation where it is believed that these attacks would be only one-off and since the traders believe so, the likelihood of the conflict escalating in the near future is likely to be that much less. But even then, it is indeed a surprise that the markets have chosen to largely ignore these developments and focus on the fundamentals.

The markets and the traders seem to have chosen to focus on the QE program and its eventual tapering and ending. Though it is quite well known and accepted that the tapering and ending would happen, it is the timeline for the same that is bringing in a lot of uncertainty. The market believes that the end of the QE would be delayed and that is why we are seeing the index rise higher in the hope that extra funds would be available in due course of time to help support the buy side of the market.

Looking ahead to the rest of the day, we do not have any major economic news or data or fundamentals to rock the markets for the day. The market is likely to be generally buoyed due to the fact that the US markets closed higher yesterday but there would not be much momentum for any breakout of the range as such.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance