David Tepper Slims Alibaba Holding in the 1st Quarter

- By James Li

David Tepper (Trades, Portfolio), founder of Appaloosa Management, disclosed this week that his firm's top trades during the first quarter included a reduction in its Alibaba Group Holding Ltd. (NYSE:BABA) position and new buys in Chesapeake Energy Corp. (NASDAQ:CHK), ViacomCBS Inc. (NASDAQ:VIAC) and Paysafe Ltd. (NYSE:PSFE).

A distressed-debt specialist, Tepper became interested in the stock market while watching his father trade stocks in his hometown of Pittsburgh. The hedge fund guru has earned international reputation for producing one of the highest returns among Wall Street fund managers.

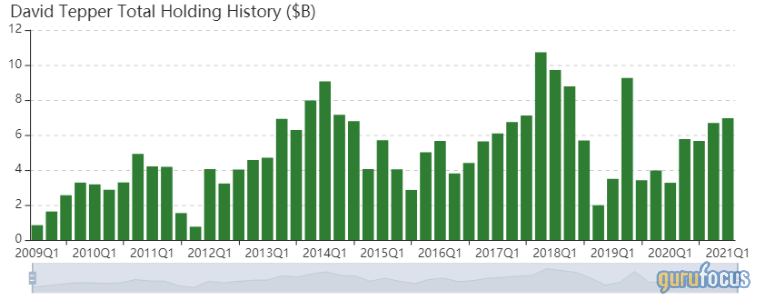

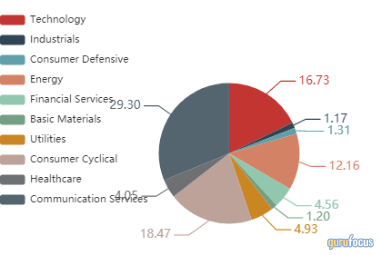

Tepper announced in 2019 that he plans to convert the hedge fund into a family office. As of March 31, the firm's $6.96 billion equity portfolio contains 62 stocks, with 20 new positions and a turnover ratio of 14%. The top three sectors in terms of weight are communication services, consumer cyclical and technology, representing 29.30%, 18.47% and 16.73% of the equity portfolio.

Alibaba

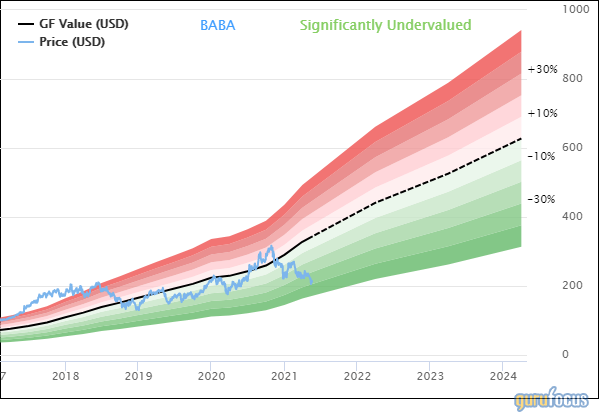

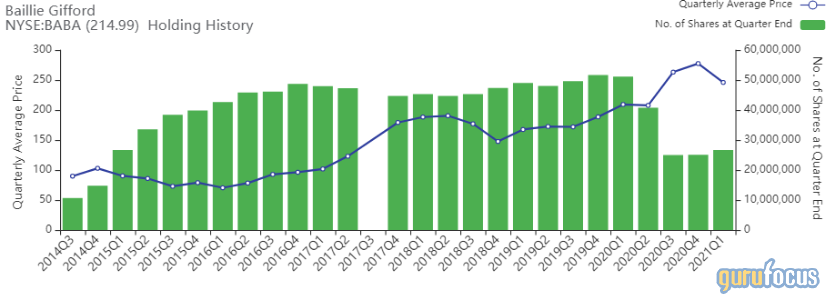

Tepper sold 760,000 shares of Alibaba (NYSE:BABA), chopping 40% of the stake and 2.64% of the equity portfolio. Shares averaged $245.98 during the first quarter; the stock is significantly undervalued based on Tuesday's price-to-GF Value ratio of 0.63.

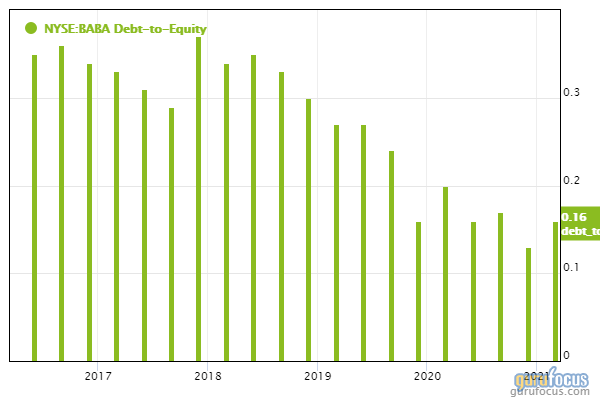

GuruFocus ranks the Chinese e-commerce giant's financial strength and profitability 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 5.02 and debt ratios, profit margins and returns that outperform over 82% of global competitors.

Gurus with large holdings in Alibaba include Baillie Gifford (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and Ken Fisher (Trades, Portfolio)'s Fisher Investments.

Charlie Munger (Trades, Portfolio)'s Daily Journal (NASDAQ:DJCO) and Mohnish Pabrai (Trades, Portfolio) introduced a stake in Alibaba to their U.S.-based equity portfolios during the first quarter.

Chesapeake Energy

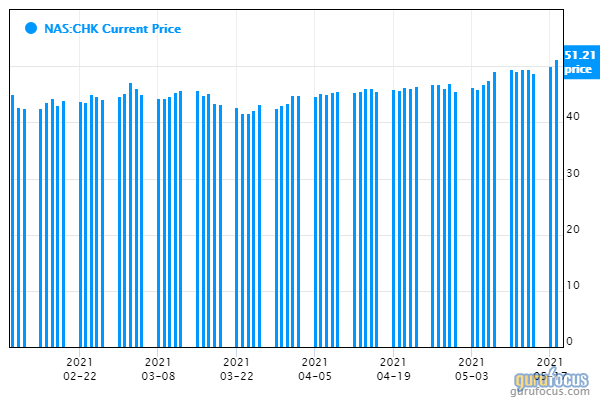

Tepper purchased 3,728,685 shares of Chesapeake Energy (NASDAQ:CHK), giving the position 2.32% equity portfolio space. Shares averaged $44.03 during the first quarter.

According to GuruFocus, the Oklahoma City-based energy company has a solid Piotroski F-score of 6 and a debt-to-equity ratio that outperforms over 55% of global competitors.

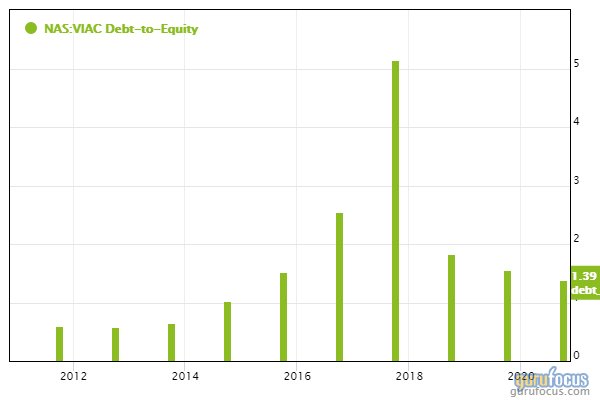

ViacomCBS

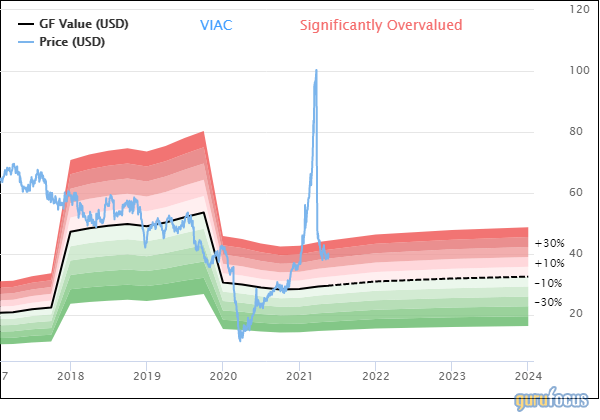

Tepper purchased 3.445 million shares of ViacomCBS (NASDAQ:VIAC), giving the position 2.23% weight in the equity portfolio. Shares averaged $61.05 during the first quarter; the stock is significantly overvalued based on Tuesday's price-to-GF Value ratio of 1.36.

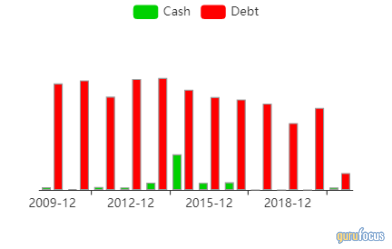

GuruFocus ranks the New York-based diversified media company's profitability 8 out of 10 on the back of profit margins outperforming over 82% of global competitors. Despite this, ViacomCBS' financial strength ranks 4 out of 10, driven by interest coverage and debt ratios underperforming more than 70% of global diversified media companies.

Paysafe

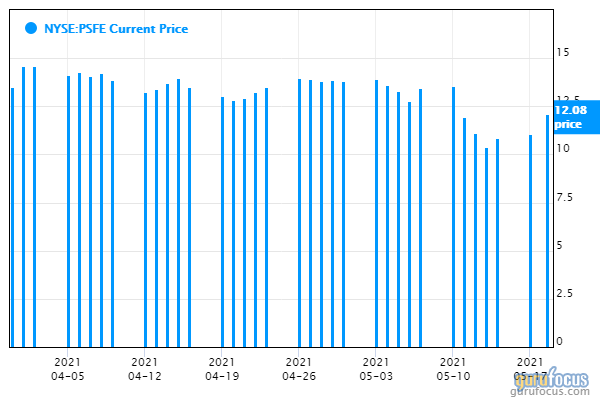

Tepper purchased 10 million shares of Paysafe (NYSE:PSFE), giving the position 1.94% equity portfolio space. Shares averaged $13.50 during the first quarter.

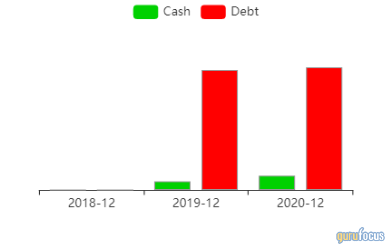

GuruFocus ranks the U.K.-based payment processing company's financial strength 3 out of 10 on several warning signs, which include interest coverage and debt ratios underperforming more than 90% of global competitors.

Disclosure: Long Alibaba.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance