David Abrams Sells O'Reilly Automotive, Buys TransDigm and Energy Transfer

Abrams Capital Management leader David Abrams (Trades, Portfolio) released his first-quarter portfolio last week, disclosing he entered two new positions and exited another.

The former protege of Seth Klarman (Trades, Portfolio) follows a fundamental, value-oriented approach to stock picking, investing in a fairly concentrated number of stocks. His Boston-based firm looks for long-term opportunities across a wide array of asset types in both foreign and domestic markets. He also prefers companies in which the CEO has a significant stake, or where the CEO's salary is primarily stock-based.

With these criteria in mind, Abrams established new holdings in TransDigm Group Inc. (NYSE:TDG) and Energy Transfer LP (NYSE:ET) and divested of his stake in O'Reilly Automotive Inc. (NASDAQ:ORLY) during the three months ended March 31. Other notable trades were increases in his Facebook Inc. (NASDAQ:FB) and Alphabet Inc. (NASDAQ:GOOGL) positions.

TransDigm Group

The guru invested in 539,305 shares of TransDigm, allocating 6.8% of the equity portfolio to the position. The stock traded for an average price of $547.94 per share.

The Cleveland-based manufacturer of engineered aerospace components, systems and subsystems has a $20.3 billion market cap; its shares were trading around $373.16 on Friday with a price-earnings ratio of 25.31 and a price-sales ratio of 3.59.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 5 out of 10, however, leans more toward it being fairly valued.

GuruFocus rated TransDigm's financial strength 3 out of 10. As a result of issuing approximately $7.3 billion in new long-term debt over the past three years, the company has poor interest coverage. Additionally, the weak Altman Z-Score of 1.26 warns it could be in danger of going bankrupt.

The company's profitability fared much better, scoring a perfect 10 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 4, which indicates business conditions are stable. Due to consistent earnings and revenue growth, TransDigm also has a perfect business predictability rank of five out of five stars. According to GuruFocus, companies with this rank generally return an average of 12.1% per annum over a 10-year period.

With a 3.25% stake, Chase Coleman (Trades, Portfolio) is the company's largest guru shareholder. Other investors who established positions in TransDigm during the quarter were George Soros (Trades, Portfolio), John Hussman (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio).

Energy Transfer

Abrams pick up 13.5 million shares of Energy Transfer, dedicating 2.45% of the equity portfolio to the stake. Shares traded for an average price of $10.77 each during the quarter.

The midstream oil and gas company, which is headquartered in Dallas, has a market cap of $21.61 billion; its shares were trading around $8.03 on Friday with a price-earnings ratio of 11.33, a price-book ratio of 1.11 and a price-sales ratio of 0.4.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 7 out of 10 supports this assessment.

Energy Transfer's financial strength was rated 3 out of 10 by GuruFocus since it has issued approximately $2.9 billion in new long-term debt over the past three years and has low interest coverage. The Altman Z-Score of 0.93 also warns the company could be at risk of bankruptcy. Additionally, the weighted average cost of capital surpasses the return on invested capital, suggesting poor profitability.

Driven by an expanding operating margin and strong returns that outperform a over half of its industry peers, the company's profitability scored a 7 out of 10 rating. Energy Transfer also has a moderate Piotroski F-Score of 4 and a one-star business predictability rank, which is on watch as a result of a decline in revenue per share over the past five years. GuruFocus says companies with this rank return, on average, 1.1% per year.

Of the gurus invested in Energy Transfer, David Tepper (Trades, Portfolio) has the largest stake with 0.60% of outstanding shares. During the quarter, Seth Klarman (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) also established positions in the stock.

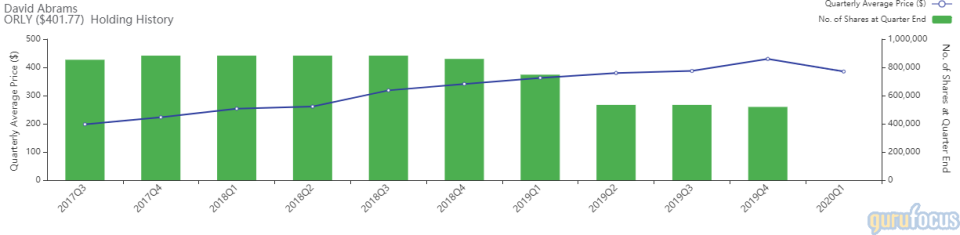

O'Reilly Automotive

With an impact of -7.07% on the equity portfolio, the investor sold his 519,476 remaining shares of O'Reilly Automotive. During the quarter, the stock traded for an average per-share price of $385.19.

GuruFocus estimates Abrams gained 91.39% on the investment since establishing it in the third=quarter of 2017.

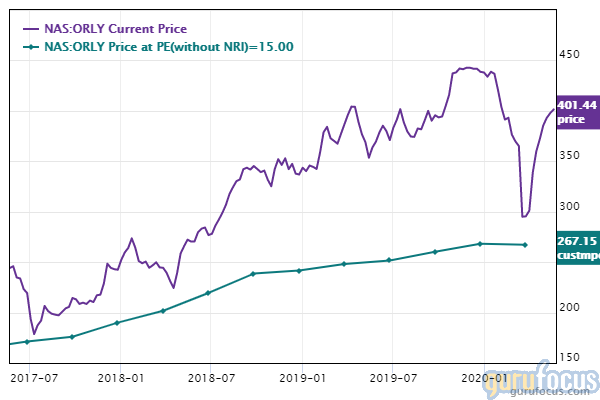

The Springfield, Missouri-based retailer of aftermarket auto parts, tools, supplies, equipment and accessories, has a $29.98 billion market cap; its shares were trading around $401.91 on Friday with a price-earnings ratio of 22.68, a price-book ratio of 280.69 and a price-sales ratio of 3.04.

Based on the Peter Lynch chart, the stock appears to be overvalued. The GuruFocus valuation rank of 2 out of 10 aligns with this assessment since the share price and price-book ratios are near 10-year highs.

GuruFocus rated O'Reilly's financial strength 4 out of 10. Although the company has issued approximately $2.5 billion in new long-term debt over the past several years, it is still at a manageable level due to having adequate interest coverage. The Altman Z-Score of 2.93 suggests the company is under some pressure, however. In addition, the ROIC is more than three times the WACC, indicating good profitability.

The company's profitability scored a 10 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a high Piotroski F-Score of 7, which means business conditions are healthy. O'Reilly also has a five-star business predictability rank based on steady earnings and revenue growth.

Chuck Akre (Trades, Portfolio) has the largest stake in O'Reilly among the gurus with 2.48% of outstanding shares. During the quarter, Andreas Halvorsen (Trades, Portfolio), Bacon and Jerome Dodson (Trades, Portfolio) established new positions in the stock, while Diamond Hill Capital (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Mario Gabelli (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and First Pacific Advisors (Trades, Portfolio) curbed their holdings.

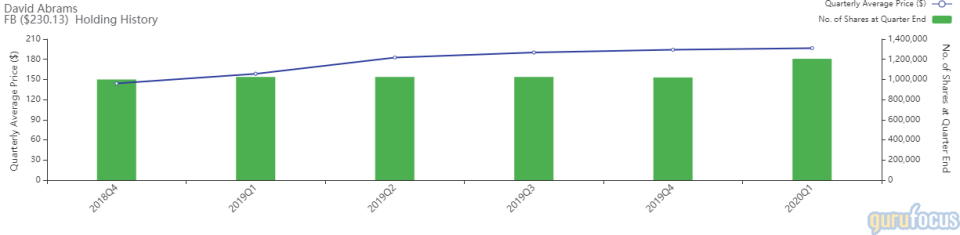

Abrams boosted his stake in Agilent Technologies by 18.17%. He purchased 185,331 shares, bringing his total holding to 1.2 million shares, representing 7.91% of total assets managed. The trade had an impact of 1.22% on the equity portfolio. During the quarter, the stock traded for an average price of $196.62 per share.

According to GuruFocus, he has gained an estimated 50.93% on the investment since establishing it in the fourth quarter of 2018.

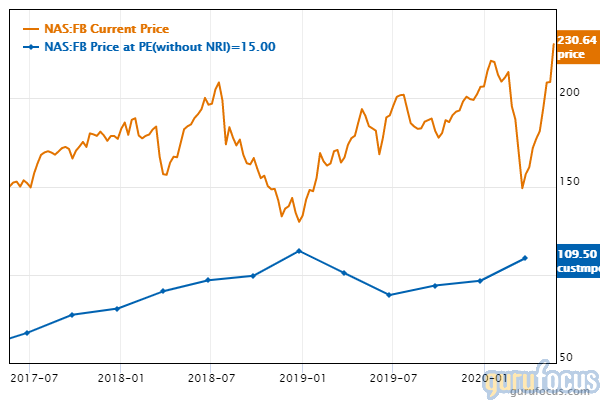

The social media company, which is headquartered in Menlo Park, California, has a market cap of $655.32 billion; its shares were trading around $229.56 on Friday with a price-earnings ratio of 31.51, a price-book ratio of 6.26 and a price-sales ratio of 9.01.

The Peter Lynch chart suggests the stock is overvalued.

Facebook's financial strength and profitability were both rated 9 out of 10 by GuruFocus. In addition to having comfortable interest coverage, the robust Altman Z-Score of 14.21 indicates the company is in good financial standing.

The company is also being supported by operating margin expansion, strong returns that outperform a majority of industry peers and a moderate Piotroski F-Score of 5.

Of the gurus invested in Facebook, Coleman has the largest stake with 0.31% of outstanding shares. Other top guru shareholders include Pioneer Investments (Trades, Portfolio), Frank Sands (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Chris Davis (Trades, Portfolio), Fisher, Steve Mandel (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Tepper, Ruane Cunniff (Trades, Portfolio) and Halvorsen.

Alphabet

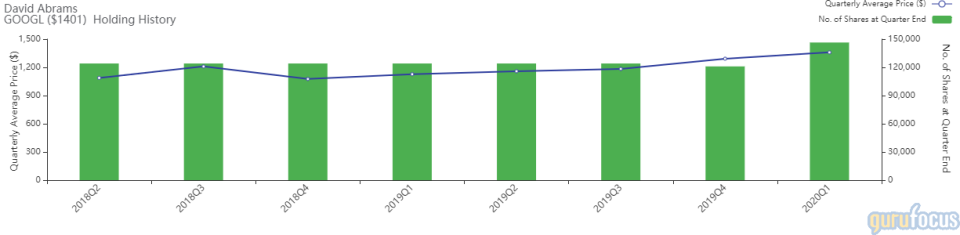

With an impact of 1.16% on the equity portfolio, the investor expanded his stake in Alphabet by 21.01%, buying 25,421 Class A shares. Abrams now owns 146,440 shares total, which represent 6.7% of total assets managed. During the quarter, shares traded for an average price of $1,359.46 each.

GuruFocus data shows Abrams has gained an estimated 23.35% on the investment since establishing it in the second quarter of 2018.

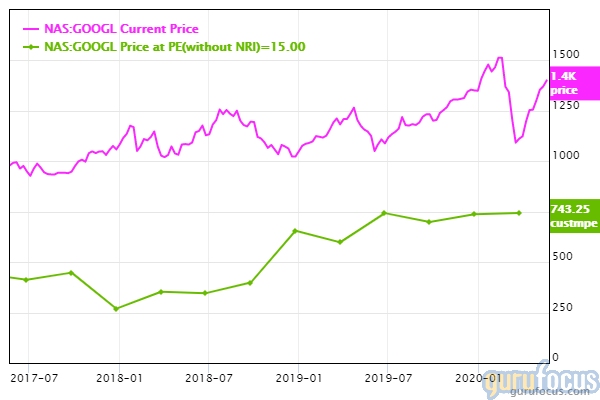

The Mountain View, California-based internet giant, which is the parent company of Google and YouTube, has a $953.24 billion market cap; its Class A shares were trading around $1,400.3 on Friday with a price-earnings ratio of 28.21, a price-book ratio of 5.07 and a price-sales ratio of 6.

According to the Peter Lynch chart, the stock is overvalued. This is supported by the GuruFocus valuation rank of 4 out of 10 since the share price and price-book ratio are at 10-year highs.

Alphabet's financial strength was rated 9 out of 10 by GuruFocus on the back of comfortable interest coverage and a high Altman Z-Score of 10.58. In addition, the company has good profitability since the ROIC is nearly four times higher than the WACC.

The company's profitability scored a perfect rating of 10 out of 10. Even though its margins are in decline, Alphabet is supported by strong returns that outperform a majority of competitors, a moderate Piotroski F-Score of 5, steady earnings and revenue growth and a four-star business predictability rank. GuruFocus data shows companies with this rank typically return 9.8% on average annually.

With 0.25% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is Alphabet's largest guru shareholder. Other top guru investors include Fisher, Sands, Pioneer, Segalas, Davis, Diamond Hill, Bill Nygren (Trades, Portfolio) and Halvorsen.

Additional trades and portfolio composition

During the quarter, Abrams also added to his holdings of Kinder Morgan Inc. (NYSE:KMI), O-I Glass Inc. (NYSE:OI) and Asbury Automotive Group Inc. (NYSE:ABG). He trimmed his position in Suburban Propane Partners LP (NYSE:SPH) by 10.74%.

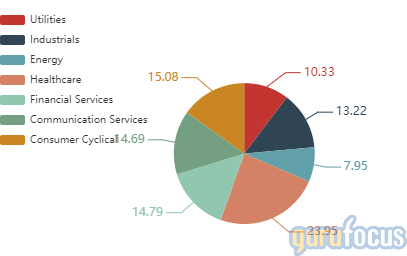

Nearly 24% of the guru's $2.54 billion equity portfolio, which was composed of 22 stocks, is invested in the health care sector, followed by smaller positions in the consumer cyclical (15.08%) and financial services (14.79%) spaces.

Disclosure: No positions.

Read more here:

Jeff Auxier Buys Ingersoll Rand, Sells Smucker

Bill Ackman Adds 2 Stocks to Portfolio, Expands Agilent and Howard Hughes Stakes

David Rolfe Curbs Fastenal Holding, Buys 3 Stocks in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance