Dave And Two More US Growth Companies With Significant Insider Ownership

As the S&P 500 and Nasdaq Composite recently hit record highs, buoyed by optimism around potential interest rate cuts and strong performances in sectors like chipmaking, the U.S. stock market presents a complex landscape for investors. In this environment, growth companies with significant insider ownership can offer unique investment appeal, as high insider stakes often align management’s interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's dive into some prime choices out of from the screener.

Dave

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dave Inc. operates a financial services platform offering a range of products and services, with a market capitalization of approximately $375.78 million.

Operations: The company generates revenue primarily through service-based and transaction-based operations, totaling approximately $273.80 million.

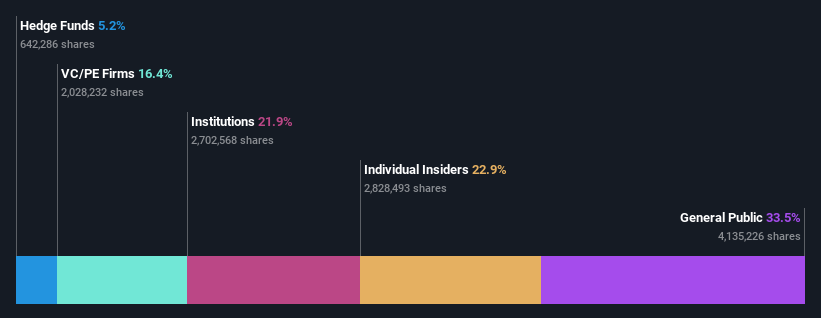

Insider Ownership: 22.9%

Dave Inc. has demonstrated significant financial improvement, with a recent earnings report showing revenue rising to US$73.63 million from US$58.93 million year-over-year and a shift from a net loss to a net income of US$34.24 million. Despite its highly volatile share price, insider activities show more buying than selling, albeit not in substantial volumes. Analysts project the stock price could increase by 103.8%, and the company's inclusion in multiple Russell indexes may boost investor confidence further.

RH

Simply Wall St Growth Rating: ★★★★☆☆

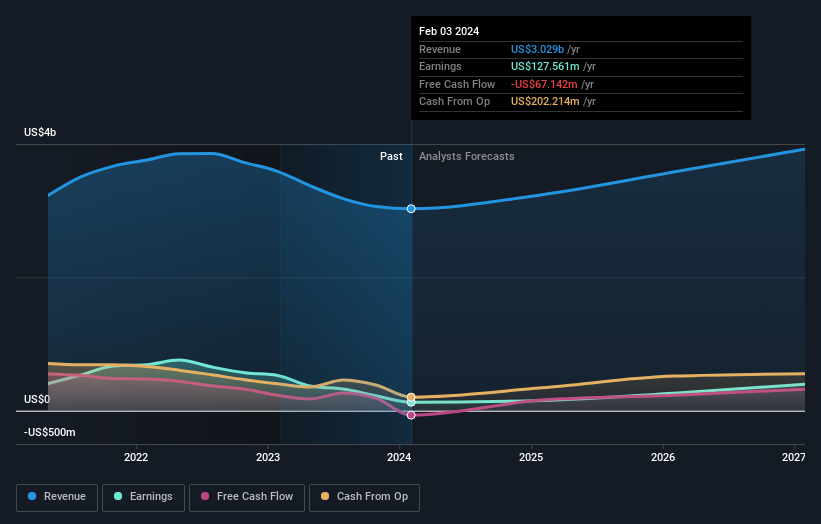

Overview: RH, along with its subsidiaries, operates as a retailer in the home furnishings market and has a market capitalization of approximately $4.39 billion.

Operations: The company generates its revenue primarily through the Restoration Hardware segment, which brought in $2.82 billion, and the Waterworks segment, contributing $194.76 million.

Insider Ownership: 18.3%

RH, despite a recent net loss of US$3.63 million compared to a net income of US$41.89 million last year, is poised for substantial growth with earnings forecasted to increase by 49.7% annually. Insider activities underscore confidence as more shares have been bought than sold in the past three months, and no significant insider sales occurred. The opening of RH Palo Alto highlights ongoing expansion and innovation efforts, further supporting its growth trajectory amidst challenging financial conditions.

Take a closer look at RH's potential here in our earnings growth report.

Our valuation report unveils the possibility RH's shares may be trading at a premium.

TAL Education Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TAL Education Group is a company that offers K-12 after-school tutoring services in the People’s Republic of China, with a market capitalization of approximately $6.50 billion.

Operations: The company generates approximately $1.49 billion in revenue from its K-12 after-school tutoring services.

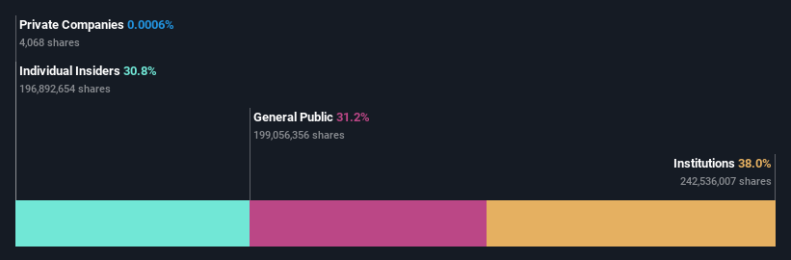

Insider Ownership: 31.7%

TAL Education Group has shown a significant turnaround, with its latest annual and quarterly reports indicating a recovery from prior losses, evidenced by a net income of US$27.51 million in the most recent quarter compared to a loss last year. Sales have also surged to US$429.56 million from US$268.99 million. Despite trading 47.8% below its estimated fair value, analysts predict substantial price growth of 52.8%. The company is expected to become profitable within three years, aligning with an extended buyback plan till April 2025, signaling strong insider confidence in its growth prospects despite a forecasted low return on equity of 7.5%.

Dive into the specifics of TAL Education Group here with our thorough growth forecast report.

Our valuation report here indicates TAL Education Group may be undervalued.

Where To Now?

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 181 companies by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:DAVE NYSE:RH and NYSE:TAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance