Daily Mail and General Trust's (LON:DMGT) Dividend Will Be Increased To UK£0.076

Daily Mail and General Trust plc (LON:DMGT) will increase its dividend on the 2nd of July to UK£0.076, which is 1.3% higher than last year. This will take the annual payment from 2.7% to 2.7% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Daily Mail and General Trust

Daily Mail and General Trust's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Daily Mail and General Trust's dividend made up quite a large proportion of earnings but only 43% of free cash flows. This leaves plenty of cash for reinvestment into the business.

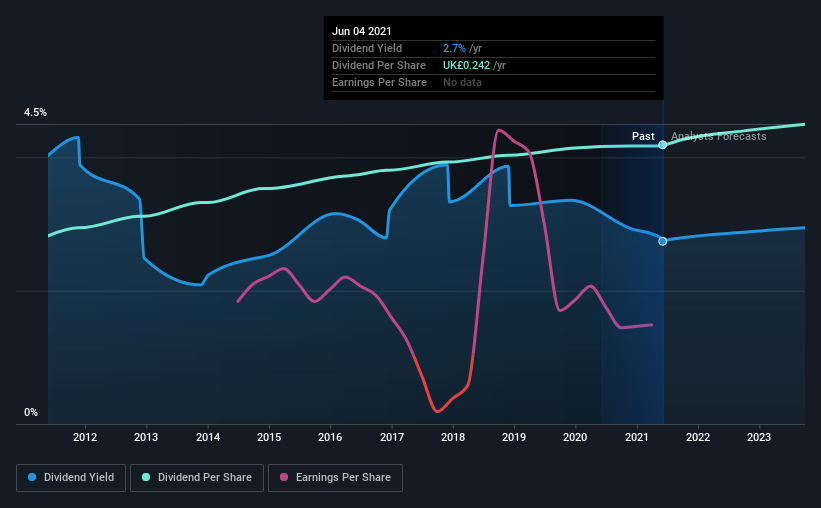

EPS is set to grow by 2.9% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 93%. This is definitely on the higher side, but we wouldn't necessarily say this is unsustainable.

Daily Mail and General Trust Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from UK£0.16 in 2011 to the most recent annual payment of UK£0.24. This means that it has been growing its distributions at 4.0% per annum over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Earnings per share has been sinking by 17% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Our Thoughts On Daily Mail and General Trust's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Daily Mail and General Trust's payments are rock solid. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Daily Mail and General Trust (of which 1 is potentially serious!) you should know about. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance