D B And Two More Leading Dividend Stocks In India

The Indian market has shown robust growth, rising 1.7% in the last week and achieving a remarkable 45% increase over the past year, with earnings projected to grow by 16% annually. In such a thriving environment, dividend stocks that offer consistent payouts can be particularly appealing to investors looking for both stability and growth potential.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.13% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.06% | ★★★★★★ |

D. B (NSEI:DBCORP) | 3.80% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.50% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.23% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.50% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.32% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.69% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.29% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.73% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

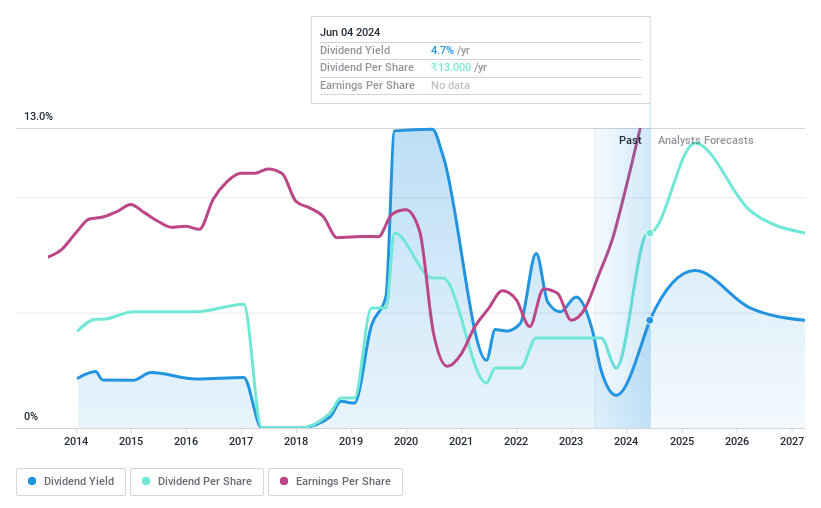

D. B

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with additional involvement in event management both domestically and internationally, boasting a market cap of approximately ₹60.97 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business, which contributed ₹22.43 billion, and its radio segment, which added ₹1.59 billion.

Dividend Yield: 3.8%

D. B. Corp Limited, despite a history of volatile dividends, has shown significant improvement with a recent 80% dividend payment of the face value, backed by strong earnings growth (INR 4,255.23 million net income). The company's dividends are well-supported by both earnings and cash flow with payout ratios at 54.4% and 43.6%, respectively. Additionally, the appointment of Upendra Kumar Gupta as President Finance hints at a strengthened financial leadership which may positively impact future financial management and sustainability.

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is engaged in the manufacturing, marketing, and trading of lubricants for the automotive and industrial sectors in India, with a market capitalization of approximately ₹64.89 billion.

Operations: Gulf Oil Lubricants India generates its revenue primarily from the sale of lubricants, amounting to ₹33.01 billion.

Dividend Yield: 3%

Gulf Oil Lubricants India offers a dividend yield of 3.03%, ranking in the top quarter of Indian dividend payers, supported by a payout ratio of 57.4% and cash flow coverage at 62.7%. Despite its robust earnings growth, with net income rising to INR 3,079.61 million this year from INR 2,323.04 million last year, the company has experienced volatility in dividend payments and share price fluctuations over recent months. Recent management changes and auditor rotations could influence future financial strategies.

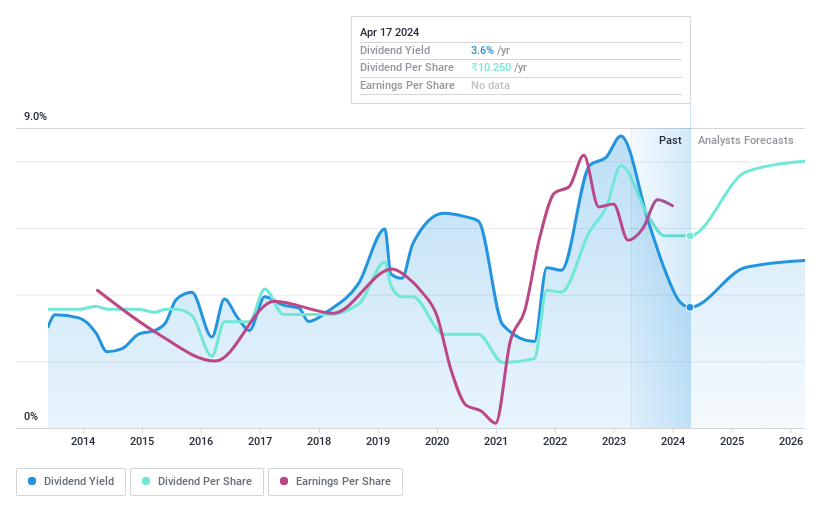

Oil and Natural Gas

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, operating both domestically and internationally, is engaged in the exploration, development, and production of crude oil and natural gas with a market capitalization of approximately ₹3.46 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through its refining and marketing segment in India, which accounts for ₹56.75 billion, followed by offshore exploration and production at ₹9.43 billion, and onshore exploration and production at ₹4.39 billion.

Dividend Yield: 4.5%

Oil and Natural Gas Corporation Limited (ONGC) exhibits a mixed scenario for dividend seekers. With a price-to-earnings ratio of 7x, it stands below the broader Indian market average of 33.4x, indicating potential undervaluation. The dividends, yielding 4.46%, place ONGC in the top quartile of Indian dividend payers. However, its dividend history shows instability with fluctuations over the past decade. Despite this, both earnings and cash flows substantiate current payouts—31.3% payout ratio and a cash payout ratio at 32.5%. Recent executive shifts could steer future financial strategies impacting dividend reliability.

Next Steps

Click through to start exploring the rest of the 15 Top Dividend Stocks now.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:DBCORP NSEI:GULFOILLUB and NSEI:ONGC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance