CVB Financial Corp. Aligns with Analyst EPS Projections in Q1 2024, Amidst Revenue Decline

Net Income: Reported $48.6 million for Q1 2024, nearly meeting the estimated $48.79 million.

Earnings Per Share (EPS): Achieved $0.35, aligning exactly with analyst estimates.

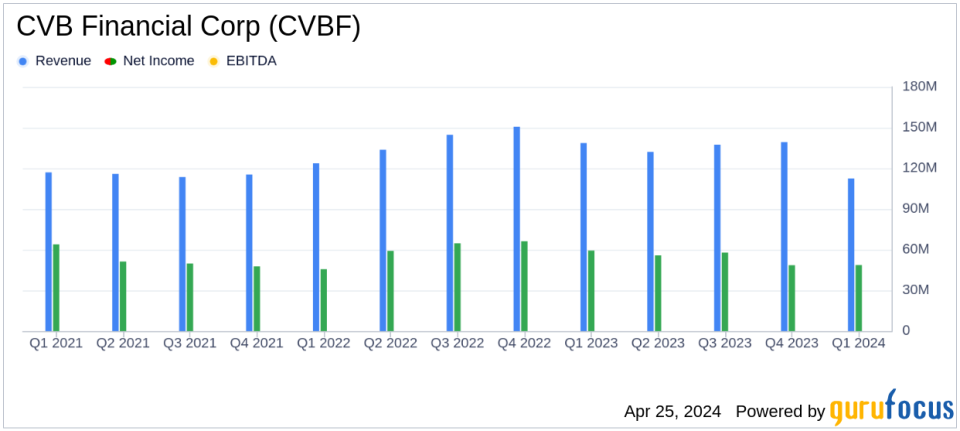

Revenue: Net interest income for Q1 2024 was $112.5 million, indicating a decline from previous periods and falling short of the estimated revenue of $116.58 million.

Return on Average Equity (ROAE): Recorded at 9.31% for Q1 2024, showing a decrease from 12.15% in Q1 2023.

Net Interest Margin (NIM): Decreased to 3.10% in Q1 2024 from 3.45% in the same quarter last year, reflecting higher interest expenses.

Provision for Credit Losses: No provision for Q1 2024, compared to a $1.5 million provision in Q1 2023, indicating improved credit conditions.

Noninterest Income: Totaled $14.1 million in Q1 2024, showing an increase from $13.2 million in Q1 2023, aided by death benefits and BOLI restructuring gains.

On April 24, 2024, CVB Financial Corp. (NASDAQ: CVBF) disclosed its earnings for the first quarter of 2024 through its 8-K filing. The company, which operates through its subsidiary Citizens Business Bank, reported a net income of $48.6 million and earnings per share (EPS) of $0.35, aligning closely with analyst expectations of $48.79 million in net income and $0.35 EPS.

Company Overview

CVB Financial Corp., the holding entity for Citizens Business Bank, offers a broad range of financial services including commercial, consumer, and real estate loans, alongside equipment and vehicle leasing. The bank is noted for its consistent performance, marked by 188 consecutive quarters of profitability and a longstanding history of dividend payments.

Financial Performance Highlights

The first quarter saw a slight decrease in net income compared to the previous quarter's $48.5 million and a more notable decline from $59.3 million in the first quarter of 2023. This year-over-year decrease is primarily attributed to a reduction in net interest income, which fell by 10.55% from the same period last year to $112.5 million. The bank's net interest margin also dipped to 3.10% from 3.45% in Q1 2023, largely due to increased interest expenses linked to higher time deposits and borrowings.

Despite these challenges, CVBF maintained robust capital ratios and continued its streak of profitability. The return on average equity (ROAE) stood at 9.31%, with the return on average tangible common equity (ROATCE) reaching 15.13%.

Asset and Liability Management

CVBF reported total assets of $16.47 billion as of March 31, 2024, which is a slight increase from $16.02 billion at the end of 2023. The bank experienced a shift in its asset composition, with a notable increase in interest-earning balances at the Federal Reserve, while loans and investment securities saw declines.

Loan portfolios also reflected a contraction, with total loans and leases at amortized cost decreasing by 1.51% from the end of 2023. This reduction was observed across several categories including commercial real estate and agribusiness loans.

Challenges and Strategic Adjustments

The bank faced several headwinds during the quarter, including rising interest expenses and a competitive banking environment that exerted pressure on margins. In response, CVBF has strategically adjusted its asset mix and continued to focus on high-quality lending opportunities to navigate the challenging economic landscape effectively.

Outlook and Forward Guidance

Looking ahead, CVBF remains committed to its strategic objectives of growth and profitability. The bank is focused on maintaining its risk management practices and capitalizing on opportunities to enhance shareholder value. Management's focus on cost control and efficient operations is expected to play a crucial role in navigating the current economic conditions.

CVB Financial Corp. will hold a conference call on April 25, 2024, to discuss detailed quarterly results and provide further insights into its strategic plans and economic outlook.

For more detailed financial information and future updates, investors and stakeholders are encouraged to visit the official Citizens Business Bank website.

Explore the complete 8-K earnings release (here) from CVB Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance