Curve Founder Raises $42.4M to Pay Off $80M On-Chain Debt

Curve Finance founder Michael Egorov is almost halfway to paying off his $80 million in debt with a new round of over-the-counter sales of the Curve (CRV) token.

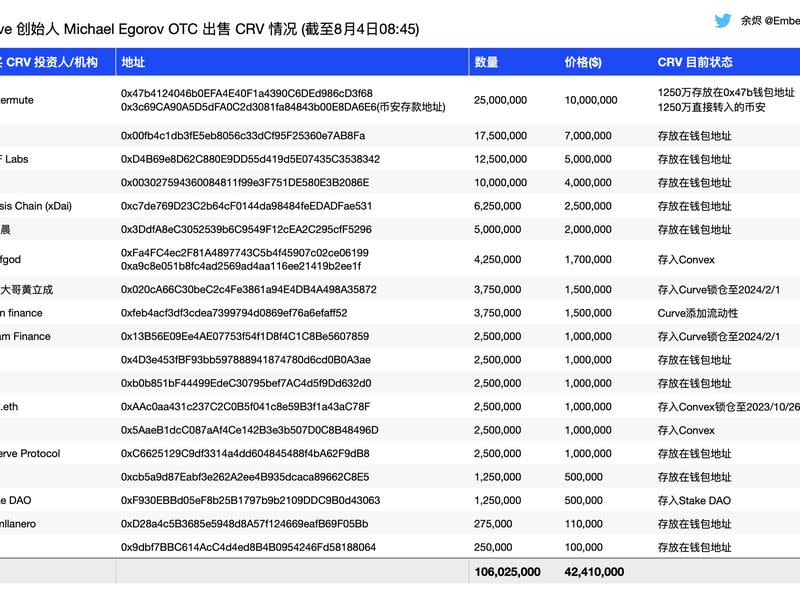

Data compiled by twitter user EmberCN shows that Wintermute Trading recently purchased 25 million CRV tokens for $10 million across two transactions.

Wintermute purchased the tokens for approximately 40 cents each in the OTC deal, while they trade for 58 cents on the open market, according to CoinDesk market data.

Other recent large buyers of CRV tokens in OTC deals include Gnosis Chain and Reserve Protocol.

That cash has helped him pay down some – but not all – of his borrows from Aave, Abracadabra, FraxLend and Inverse Finance, data from blockchain analytics firm DeBank shows.

Egorov, and others, fear contagion if the price of CRV hits $0.368. DeFi risk management firm Gauntlet said in the forums that Aave would have to sell his CRV collateral into a market that has low liquidity, a move that it calls risky.

“While some have claimed that the Curve OTC deals decentralize the token, most of the traders are whales or institutional firms,” Nick Ruck, COO of Defi Protocol ContentFi Labs told CoinDesk. “It’s not necessarily a bad thing for DeFi but it enables risky behavior or protocol founders to expect the industry to save themselves from contagion stemming from an irresponsible loan.”

The price of CRV has remained steady around 58 cents in the past 24 hours, after dropping more than 20% since its exploit several days ago, per CoinDesk Indices.

UPDATE (Aug 4, 04:34 UTC): Updates headline and story with latest figure.

Yahoo Finance

Yahoo Finance