Curtiss-Wright (CW) Q2 Earnings Top Estimates, EPS View Up

Shares of Curtiss-Wright Corporation CW improved 1.8% to reach $144.50 on Aug 5, reflecting investors’ optimism following its second-quarter results.

The company reported second-quarter 2022 adjusted earnings of $1.83 per share, which surpassed the Zacks Consensus Estimate of $1.68 by 8.9%. The bottom line also surged 22.8% on a year-over-year basis.

Operational Performance

In the quarter under review, the company’s net sales of $609.4 million went down 2% year over year. However, the top line beat the Zacks Consensus Estimate of $605 million by 0.8%.

The gross profit increased 1.7% year over year to $228.5 million. The operating income of $98 million surged 4% from $95 million a year ago.

Curtiss-Wright’s total backlog at the end of the second quarter of 2022 was $2.4 billion. New orders of $776 million increased 13% in the second quarter compared with the prior-year period, driven by solid demand in the Aerospace & Defense market.

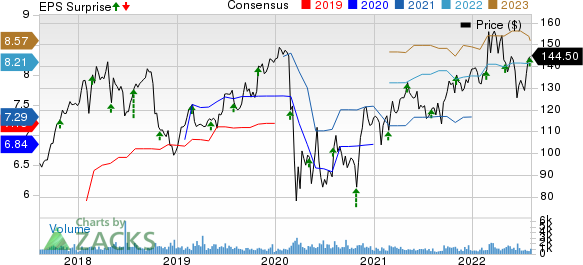

CurtissWright Corporation Price, Consensus and EPS Surprise

CurtissWright Corporation price-consensus-eps-surprise-chart | CurtissWright Corporation Quote

Segmental Performance

Aerospace & Industrial: Sales in this segment improved 7.7% year over year to $209 million, primarily attributable to higher commercial aerospace market revenues, mainly due to the strong demand for actuation and sensor products, as well as surface treatment services. Further, higher general industrial market revenues, driven by the increased sale of industrial vehicle products, fueled the sales performance of the segment.

While the operating income increased 7% to $32 million, the operating margin contracted 10 basis points (bps) to 15.6%. The downside in the margin was mainly due to higher research and development investments.

Defense Electronics: Sales in this segment declined 8% year over year to $150 million. This decline was due to ongoing supply-chain headwinds and the delayed signing of the fiscal 2022 defense budget. Also, the timing of revenues within the aerospace and ground defense markets hurt the top line of this segment.

The operating income plunged 21% to $24 million, while the operating margin contracted 250 bps to 16.4%. The deterioration can be attributed to unfavorable absorption on lower A&D revenues.

Naval & Power: Sales in this segment dropped 0.4% year over year to $251 million due to lower revenues from the CVN-80 aircraft carrier and Virginia-class submarine programs.

The unit’s operating income increased 15% to $50 million. The operating margin expanded 270 bps to 19.9%. This acceleration was due to a favorable mix in the naval defense and process markets and the benefits of ongoing operational excellence initiatives.

Financial Update

CW’s cash and cash equivalents as of Jun 30, 2022 was $171.4 million, compared to $171 million as of Dec 31, 2021.

Long-term debt was $1,006.6 million as of Jun 30, 2022 compared with $1,050.6 million as of Dec 31, 2021.

The operating cash outflow totaled $31 million at the end of the second quarter of 2022 compared with $75 million in the prior-year period.

Adjusted free cash flow at the end of the reported quarter was $22 million compared with the year-ago period’s $66 million.

2022 Guidance

Curtiss-Wright updated its financial guidance for 2022. The company now expects adjusted earnings in the band of $8.10-$8.30 (up from the $8.05-$8.25 band) per share.

The Zacks Consensus Estimate for the company’s full-year earnings is pegged at $8.21 per share, slightly higher than the midpoint of the company’s guided range.

The company also updated its adjusted sales guidance and now expects sales in the range of $2,570-$2,620 million, up from the prior expectation in the range of $2,530-$2,580 million in 2022. The Zacks Consensus Estimate for its full-year sales is pegged at $2.59 billion, almost in line with the midpoint of the company’s guided range.

Zacks Rank

Curtiss-Wright currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Recent Defense Releases

Lockheed Martin LMT reported second-quarter 2022 earnings of $6.32 per share, which surpassed the Zacks Consensus Estimate of $6.29 by 0.5%. However, the bottom line declined 1.6% year over year.

Lockheed Martin’s top line declined 9.3% from the $17.03 billion reported in the year-ago quarter. LMT ended the second quarter of 2022 (on Jun 26, 2022) with $134.64 billion in the backlog compared with $135.23 billion at the end of the first quarter of 2022.

AAR Corp. AIR reported fourth-quarter fiscal 2022 adjusted earnings of 72 cents per share, which surpassed the Zacks Consensus Estimate of 68 cents by 5.9%. Earnings recorded a solid surge of 53.2% from the year-ago quarter.

AAR generated net sales worth $476.1 million, which improved 8.8% from the $437.6 million recorded in the year-ago quarter. AIR’s cash and cash equivalents amounted to $53.5 million as of May 31, 2022 compared with $51.8 million as of May 31, 2021.

Raytheon Technologies’ RTX second-quarter 2022 adjusted earnings per share (EPS) of $1.16 beat the Zacks Consensus Estimate of $1.12 by 3.6%. Moreover, the bottom line improved 13% from the year-ago quarter’s adjusted earnings of $1.03.

Raytheon Technologies had cash and cash equivalents of $4,767 million as of Jun 30, 2022 compared with $7,832 million as of Dec 31, 2021. RTX projects the 2022 adjusted EPS in the range of $4.60-$4.80.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

AAR Corp. (AIR) : Free Stock Analysis Report

CurtissWright Corporation (CW) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance