Crown Point Energy (CVE:CWV) shareholders are up 12% this past week, but still in the red over the last three years

It's nice to see the Crown Point Energy Inc. (CVE:CWV) share price up 12% in a week. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 45% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Crown Point Energy

Crown Point Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Crown Point Energy's revenue dropped 29% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 13% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

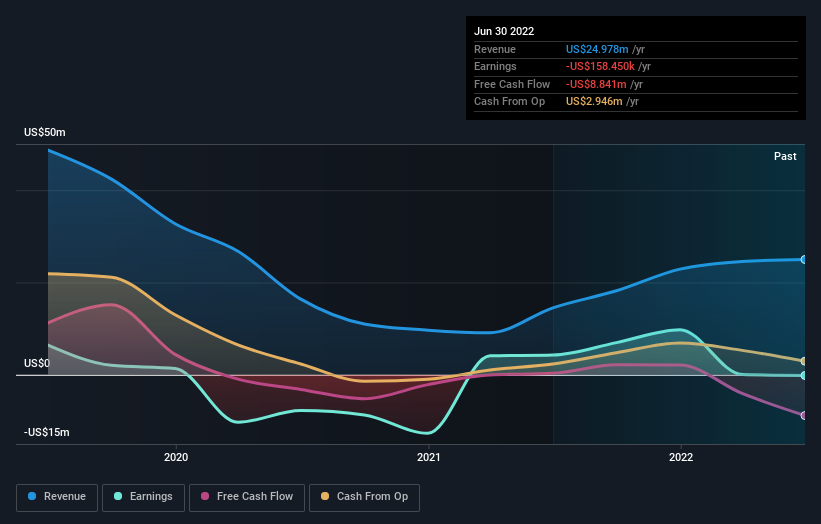

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Crown Point Energy's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Crown Point Energy shareholders, and that cash payout explains why its total shareholder loss of 12%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

It's good to see that Crown Point Energy has rewarded shareholders with a total shareholder return of 33% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Crown Point Energy better, we need to consider many other factors. Even so, be aware that Crown Point Energy is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

But note: Crown Point Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance