Crown Holdings (NYSE:CCK) Reports Sales Below Analyst Estimates In Q2 Earnings, But Stock Soars 5.9%

Metal packaging products manufacturer Crown Holdings (NYSE:CCK) missed analysts' expectations in Q2 CY2024, with revenue down 2.2% year on year to $3.04 billion. It made a non-GAAP profit of $1.81 per share, improving from its profit of $1.68 per share in the same quarter last year.

Is now the time to buy Crown Holdings? Find out in our full research report.

Crown Holdings (CCK) Q2 CY2024 Highlights:

Revenue: $3.04 billion vs analyst estimates of $3.06 billion (small miss)

EPS (non-GAAP): $1.81 vs analyst estimates of $1.59 (14.1% beat)

EPS (non-GAAP) Guidance for Q3 CY2024 is $1.80 at the midpoint, roughly in line with what analysts were expecting

Gross Margin (GAAP): 21.7%, up from 20.8% in the same quarter last year

Free Cash Flow of $361 million is up from -$183 million in the previous quarter

Market Capitalization: $9.26 billion

Commenting on the quarter, Timothy J. Donahue, Chairman, President and Chief Executive Officer, stated, "The Company performed well during the quarter, led by strong results in each of the global beverage businesses. Benefitting from our broad geographic presence and strategic customer alliances, beverage segment income improved by 21% in the second quarter on a combined global basis. Beverage can shipments improved 6% globally in the second quarter, including 9% in North America. Beverage can shipments in Europe and Latin America were also strong and exceeded longer-term expectations of low-to mid-single digit volume growth."

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Crown Holdings struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Crown Holdings's recent history shows its demand has stayed suppressed as its revenue has declined by 3.6% annually over the last two years. Crown Holdings isn't alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Crown Holdings missed Wall Street's estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $3.04 billion of revenue. Looking ahead, Wall Street expects sales to grow 2.5% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Crown Holdings has managed its expenses well over the last 5 years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it's a show of strength if they're high when gross margins are low.

Analyzing the trend in its profitability, Crown Holdings's annual operating margin rose by 1.8 percentage points over the last 5 years. Its expansion was impressive, especially when considering the cycle turned in the wrong direction and most of its Industrial Packaging peers observed plummeting revenue and margins.

This quarter, Crown Holdings generated an operating profit margin of 12.5%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

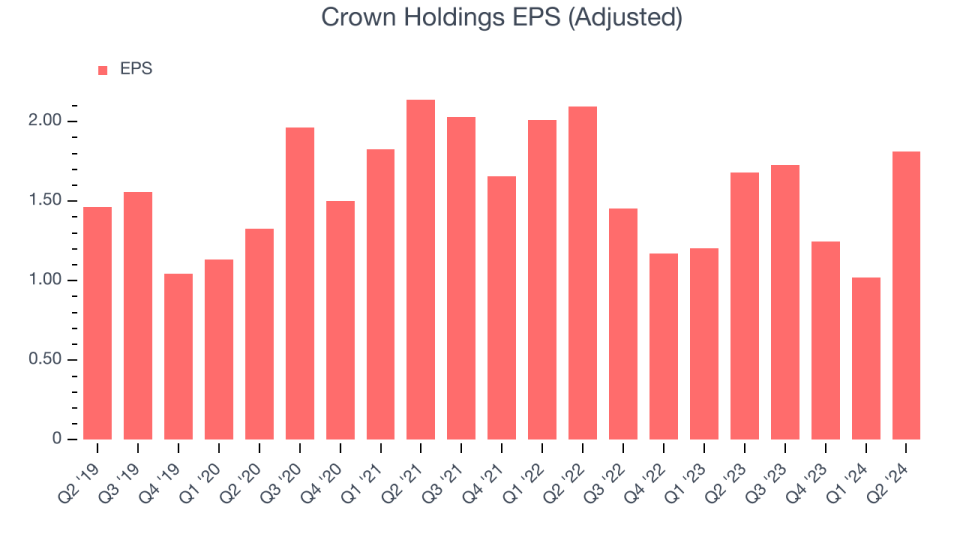

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Crown Holdings's EPS grew at a weak 2.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

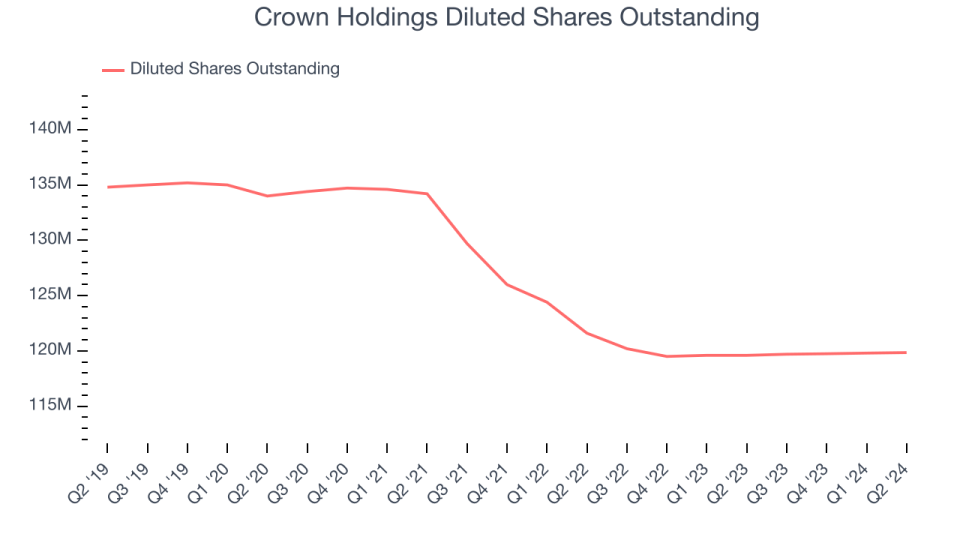

Diving into the nuances of Crown Holdings's earnings can give us a better understanding of its performance. As we mentioned earlier, Crown Holdings's operating margin was flat this quarter but expanded by 1.8 percentage points over the last five years. On top of that, its share count shrank by 11.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Crown Holdings, its two-year annual EPS declines of 13.7% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, Crown Holdings reported EPS at $1.81, up from $1.68 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Crown Holdings to grow its earnings. Analysts are projecting its EPS of $5.80 in the last year to climb by 12.2% to $6.51.

Key Takeaways from Crown Holdings's Q2 Results

Although its revenue missed slightly, we enjoyed seeing Crown Holdings significantly exceed analysts' EPS expectations this quarter. That shows the company is staying on track, and the stock traded up 5.9% to $82.01 immediately following the results.

So should you invest in Crown Holdings right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance