CrowdStrike's (CRWD) Q3 Earnings & Revenues Top Estimates

CrowdStrike CRWD reported third-quarter fiscal 2020 non-GAAP earnings of 8 cents per share as against the Zacks Consensus Estimate of break-even profit. Quarterly earnings also marked significant improvement from the year-ago quarter’s loss per share of 7 cents.

Top Line Details

CrowdStrike’s fiscal third-quarter revenues of $232.5 million surged 86% year over year as well as beat the consensus mark of $213.7 million. Subscription revenues jumped a whopping 87% year over year to $213.5 million.

An 85% increase in subscription customers led to this impressive growth. CrowdStrike added 1,186 net new subscription customers during the reported quarter. The company had a total of 8,416 subscription customers as of Oct 31, 2020.

Moreover, CrowdStrike’s subscription customers that adopted four or more cloud modules increased to 61%, those with five or more cloud modules rose to more than 44%, and for six or more cloud modules jumped to 22% as of Oct 31, 2020.

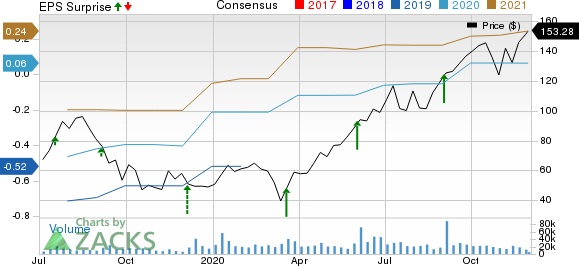

CrowdStrike Holdings Inc. Price, Consensus and EPS Surprise

CrowdStrike Holdings Inc. price-consensus-eps-surprise-chart | CrowdStrike Holdings Inc. Quote

Revenues from professional services soared 73.7% year over year to $18.9 million.

The company added $116.8 million to its net new average run rate (ARR) year over year, achieving $907.4 million, up a whopping 81% from the year-ago quarter.

Dollar-based net retention rate exceeded 120% in the reported quarter.

Operating Details

CrowdStrike’s non-GAAP gross margin expanded 400 basis points (bps) on a year-over-year basis to 76%. Subscription gross margin advanced 200 bps to 78%. Moreover, professional services gross margin increased to 45% from the year-ago quarter’s 33%.

Non-GAAP research & development (R&D) expenses as a percentage of revenues shrunk 530 bps on a year-over-year basis to 19.7%. In addition, non-GAAP general & administrative (G&A) expense, as a percentage of revenues, contracted 330 bps to 8%.

Further, non-GAAP sales & marketing (S&M) expenses as a percentage of revenues were 39.9%, significantly down from the year-ago quarter’s 49%.

Total non-GAAP operating expenses as a percentage of revenues were 67.6% compared with the prior-year quarter’s 85.3%.

Non-GAAP operating income was $18.9 million against the loss of $16.5 million reported in the year-ago quarter. Non-GAAP operating margin for the quarter was 8%.

Balance Sheet & Cash Flow

As of Oct 31, 2020, cash and cash equivalents were $1.06 billion compared with $1.07 billion as of Jul 31, 2020.

During the fiscal third quarter, the company generated operating and free cash flows of $88.5 million and $76.1 million, respectively.

Guidance

For fourth-quarter fiscal 2021, CrowdStrike anticipates revenues between $245.5 million and $250.5 million. As far as the bottom line is concerned, the company expects to report earnings per share between 8 cents and 9 cents.

For fiscal 2021, management raised its revenue guidance range to $855-$860 million from the $809.1-$826.7 million projected earlier. The company now anticipates non-GAAP earnings per share of 21-22 cents compared with the previous expectations of 2-8 cents.

Zacks Rank & Stocks to Consider

CrowdStrike currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include NVIDIA Corporation NVDA, Arrow Electronics ARW and Texas Instruments TXN, all carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for NVIDIA, Arrow and Texas is currently pegged at 20.4%, 9.8% and 9.3%, respectively.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance