Credit Suisse warns stocks haven't looked this worrisome since the tech bubble

The stock market recently hit new all-time highs. Understandably, there a plenty of folks who doubt the market can keep rallying like this, especially with earnings being so lackluster.

When prices climb at a faster rate than earnings, the price/earnings (PE) ratio climbs, which indicates that stocks are getting expensive.

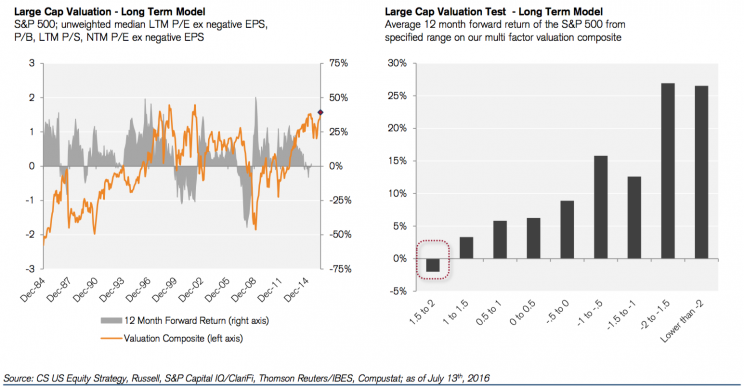

Currently, the PE ratio based on next-twelve-month (NTM) earnings is well above its long-term average. In a new note to clients, Credit Suisse’s Lori Calvasina is warning clients that the S&P 500 (^GSPC) has hit a “post tech bubble peak” on a NTM P/E.

“Given the rally in US equities seen so far in July, we have refreshed our various valuations models for the July 13th close,” Calvasina noted. “The most dramatic change is that our S&P 500 model is back in worrisome territory, at 1.57 standard deviations above its +30 year average.”

This is troublesome, Calvasina notes, because history is not on the side of the longs.

“The S&P 500 has been down 58% of the time on a 12 month forward basis from these levels, and in our opinion, expensive valuations will continue to keep US equities vulnerable to bad news in the back half of the year,” she said.

It’s critically important to remember that P/Es can revert back down to a long-term average if earnings growth outpaces prices. In other words, stock prices don’t necessarily have to fall for valuations to correct.

—

Sam Ro is managing editor at Yahoo Finance.

Read more:

The most important question in the stock market right now: Will earnings grow again?

How history’s most successful investors think about wild market swings

The dumbest math mistake investors make in the stock market

Now’s a great time to reread Warren Buffett’s op-ed he wrote after one of history’s worst sell-offs

Gutsy Wall Street analyst dares to debunk a sacred truism about the stock market

Yahoo Finance

Yahoo Finance