Create a Pension Passive-Income Stream With This TSX Stock

Written by Brian Paradza, CFA at The Motley Fool Canada

Canadian investors looking to create new passive-income streams for retirement have a wealth of options in July. Several Canadian dividend stocks have maintained or raised payouts for 2024, and some powerhouses are poised to keep making stable or growing monthly payouts over the next decade. Choice Properties Real Estate Investment Trust (TSX:CHP.UN) is a favourite passive-income play as it offers a compelling combination of steadily growing revenue, consistent distribution payouts, and a strong track record — all contributing to a reliable retirement passive-income stream.

Why choose Choice Properties REIT for passive income?

Choice Properties REIT is one of the largest property owners in Canada. It boasts a diversified portfolio of 705 primarily consisting of retail properties, some flex-industrial, and a growing mixed-use and residential segment, all worth nearly $17 billion. Investors can buy Choice Properties REIT for its well-covered monthly dividend payments yielding a respectable 5.7% annually, its strong financial position, stable growth business outlook, and its resilient real estate portfolio.

The real estate investment trust’s (REIT’s) portfolio retains strong occupancy rates close to 98%, and its mostly comprised of necessity-based retail assets, mostly anchored by Loblaw — its biggest single tenant contributing 56% of the REIT’s gross annual rent, which helps to ensure stable rental income.

What’s more, Choice Properties REIT is seeing steady growth in same-property net operating income (NOI) as its property economics improve. A recent Colliers International report found that “foot traffic is rising for most merchants, both month over month and since the beginning of 2024,” as Canada’s strong population growth rates in recent years have reflected in increased customer visits to grocery stores, bank branches, and coffee shops. The trust has a firmer negotiating hand in rent negotiations.

Management expects to realize 2.5-3% year-over-year growth in same property NOI on a cash basis and to grow funds from operations (FFO) per unit by up to 3% in 2024. The trust’s distribution quality could improve in 2025.

A top performer among REITs

Choice Properties REIT is a high-quality real estate investment for recurring monthly income that continued to shine when peers in its asset class faltered since interest rates soared in 2022. Its strong balance sheet, with a debt-to-total assets ratio of 40.3%, is one of the most fortified in its class. Regardless, the trust has been a historical outperformer even before the recent rate hikes.

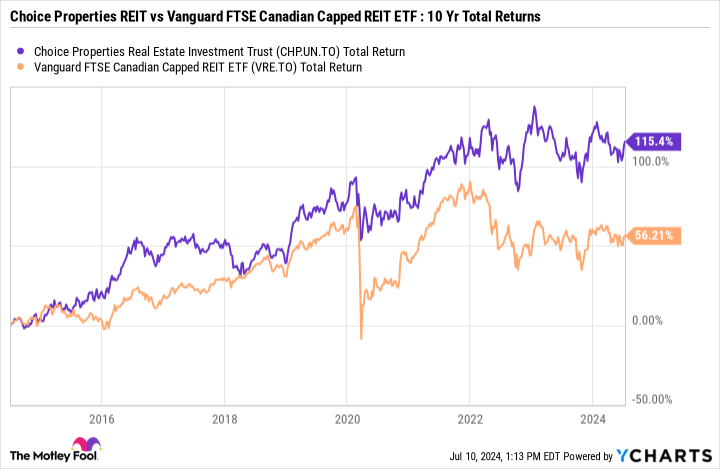

CHP.UN Total Return Level data by YCharts

The REIT significantly outperformed peers over the past decade on a total-return basis. It could have more than doubled your money with a 115% total return over the past decade. Vanguard FTSE Canadian REIT ETF, which holds 15 REITs in its portfolio, could only generate a 56% total return during the same period.

Strong distribution coverage

Investors should closely monitor an investment’s capacity to keep paying stable dividends and meet regular income distributions when creating a pension passive-income stream. Choice Properties REIT’s most recent distributions during the first quarter comprised just 78.7% of its adjusted funds from operations (AFFO).

AFFO measures a REIT’s most recurring distributable cash flow, and payout rates below 100% may be sustainable for decades. This REIT pays out under 80% of its AFFO, a 310% improvement year over year! Management expects to grow funds from operations per unit by up to 3% in 2024. Distribution quality could improve going into 2025, providing room for distribution raises in the future.

Growing AFFO allows for payout increases and creates more room for reinvesting cash flows into development projects. The trust could sustain its distributions for many years to come.

How much to invest to create $577 annual passive-income streams

As shown in the table below, a hypothetical $10,000 investment in Choice Properties could create $48 per month in passive-income streams or more than $577 every year to augment cash income during retirement.

Company | Recent Price | Investment | Number of Units | Distribution Rate | Total Distribution | Frequency | Total Annual Income |

Choice Properties REIT (TSX:CHP.UN) | $13.11 | $10,000 | 763 | $0.063 | $48.07 | Monthly | $577.10 |

Be warned that REIT distributions may be taxed as ordinary income; you could improve tax efficiency by stashing REIT investments in tax-advantaged accounts, especially the Tax-Free Savings Account.

The post Create a Pension Passive-Income Stream With This TSX Stock appeared first on The Motley Fool Canada.

What Stocks Should You Add to Your Retirement Portfolio?

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when "the eBay of Latin America," MercadoLibre, made this list on January 8, 2014 ... if you invested $1,000 at the time of our recommendation, you’d have $18,111.92.*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 27 percentage points since 2013*.

See the 10 stocks * Returns as of 5/22/24

More reading

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Colliers International Group. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance