Covenant Logistics Group Inc (CVLG) Reports Mixed Q1 2024 Results: Challenges and Strategic ...

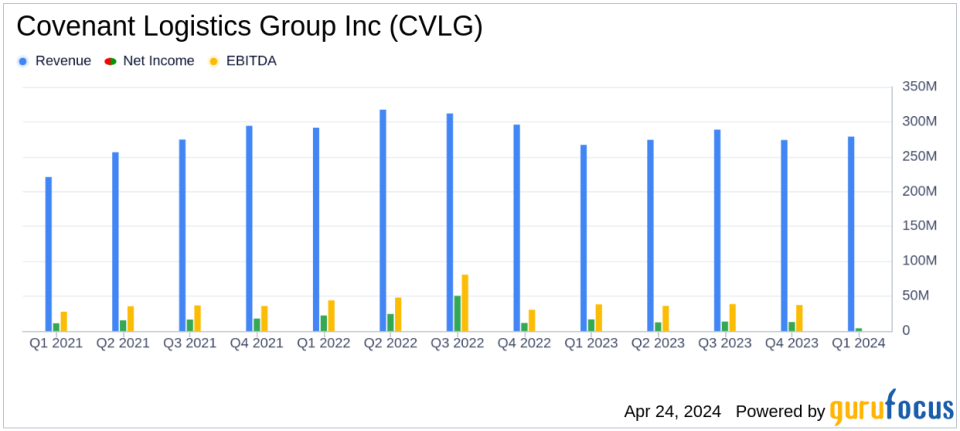

Total Revenue: Reported at $278.76 million, up 4.5% from $266.85 million in the previous year, surpassing the estimate of $273.30 million.

Net Income: Reached $3.97 million, significantly below the estimated $10.35 million and down from $16.63 million year-over-year.

Earnings Per Share: Recorded at $0.29 per diluted share, falling short of the estimated $0.78 and down from $1.20 in the prior year.

Adjusted Operating Income: Increased to $14.80 million from $12.63 million in the previous year, showing improved operational efficiency.

Operating Ratio: Deteriorated to 98.4% from 93.4% a year ago, indicating higher costs relative to revenue.

Freight Revenue: Excluding fuel surcharge, rose to $247.69 million, up 6.1% from $233.42 million, driven by increased tractor count and utilization.

Equity Method Investment Income: From Transport Enterprise Leasing decreased to $3.7 million from $5.9 million, reflecting challenges in the equipment market.

Covenant Logistics Group Inc (NASDAQ:CVLG) released its 8-K filing on April 24, 2024, disclosing its financial and operating results for the first quarter ended March 31, 2024. The company reported earnings of $0.29 per diluted share and adjusted earnings of $0.84 per diluted share, which includes adjustments for acquisition-related expenses. These results fell short of analyst estimates which projected earnings of $0.78 per share and net income of $10.35 million.

Covenant Logistics Group Inc, a key player in the transportation sector, offers truckload transportation and freight brokerage services across the continental United States. The company operates through various segments including Expedited, Dedicated Services, Managed Freight, and Warehousing, with the majority of its revenue generated from the expedited segment.

Financial Highlights and Operational Challenges

The company's total revenue for the quarter was $278.76 million, up from $266.85 million in the previous year, reflecting a 4.5% increase. This growth was driven by a 6.1% increase in freight revenue, although it was partially offset by a 7.0% decrease in fuel surcharge revenue. Despite the revenue growth, the company faced significant challenges, including soft freight rates and volumes, declining used equipment prices, and adverse weather conditions which increased operational costs.

Operating income significantly decreased to $4.33 million from $17.63 million a year ago, and the operating ratio deteriorated to 98.4% from 93.4%. Adjusted operating income was $14.80 million, compared to $12.63 million in the prior year, with an adjusted operating ratio of 94.0%, showing a slight improvement from 94.6%.

Segment Performance and Strategic Responses

The Expedited segment saw revenue increase by 6.1%, while the Dedicated segment revenue grew by 9.4%, driven by strategic exits from underperforming businesses and investments in niche areas. However, the Dedicated segment experienced an operating loss, reflecting the costs associated with these strategic shifts. The Managed Freight and Warehousing segments both showed improved performance with increases in both revenue and operating income.

Paul Bunn, President and COO of Covenant, noted the operational challenges and strategic adjustments, stating, "Our truckload operations saw a revenue increase of 4.9%... despite significant operational challenges." He also highlighted the strategic focus on exiting underperforming businesses and investing in areas with true value-added services.

Financial Position and Outlook

As of March 31, 2024, Covenant's net indebtedness increased slightly by $3.8 million to approximately $252.1 million. The company's capital expenditure for the quarter included significant investments in revenue equipment, reflecting ongoing efforts to modernize the fleet and improve operational efficiency.

Looking forward, CEO David R. Parker expressed cautious optimism, acknowledging the tough operating environment but reaffirming the company's focus on strategic initiatives aimed at enhancing supply chain integration, adding value for customers, and improving operational efficiencies.

Despite the mixed financial results and ongoing challenges, Covenant Logistics Group Inc remains committed to navigating the current market dynamics and strengthening its position in the transportation and logistics industry.

Explore the complete 8-K earnings release (here) from Covenant Logistics Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance