Coupa (COUP) Shares Surge on Reported Takeover Deal by Vista

Coupa Software Incorporated COUP is likely to be acquired by a private equity firm - Vista Equity Partners - per a report from Bloomberg. The news seemed to have invoked positive investor sentiments as the stock appreciated 28.9% to $58.9 as of Nov 23, 2022.

The reported buyout deal is yet to be confirmed by either of the companies. According to unnamed sources, Coupa is working with a financial adviser to strike a deal with Vista, added the report. Also, the potential acquisition could be financed by private-credit lenders.

The tightening of the monetary policy amid rising inflation has led to wide-scale equities selloffs, reducing the valuations of public technology companies like Coupa. This presents an attractive opportunity to buy companies at a discounted price.

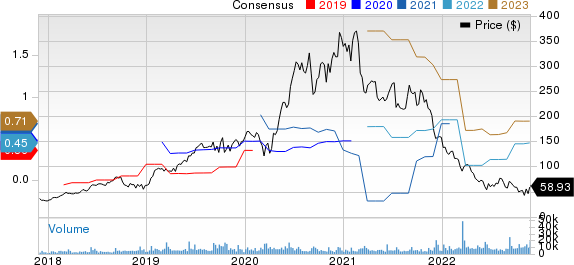

Coupa Software, Inc. Price and Consensus

Coupa Software, Inc. price-consensus-chart | Coupa Software, Inc. Quote

Vista has been an active participant as a private equity investor in the field of technology. In October 2022, the company agreed to pay $4.6 billion for the software security firm - KnowBe4 Inc - and in August, it agreed to pay $8.4 billion for Avalara Inc. It funded those transactions with private credit.

The potential acquisition of Coupa may help Vista to further expand its foothold in the technology sector and complement its previous buyouts.

Coupa is a leading provider of Business Spend Management (BSM) solutions and continues to develop its cloud-based platform through product innovations that offer customers increased spend visibility, aid in mitigating supply chain risk and increase business agility to adapt to changes in spending trends.

The company is likely to benefit from increased adoption of Coupa Pay offerings and cloud-based BSM solutions. Coupa CLM Advanced is expected to improve its position in the BSM software market by leveraging synergies from the combination of the Coupa BSM platform with Exari's technology amid the digital transformation.

Further, the company has been adding new capabilities to Coupa Supplier Insights and Coupa BSM solutions, which are anticipated to boost adoption. Moreover, the coronavirus pandemic has bolstered demand for digital payment offerings.

For fiscal 2023, the company has updated its revenue guidance from $838-$848 million to $838-$844 million. Subscription revenues are expected to be in the range of $766-$771 million. Professional services and other revenues are likely to be $72-$73 million.

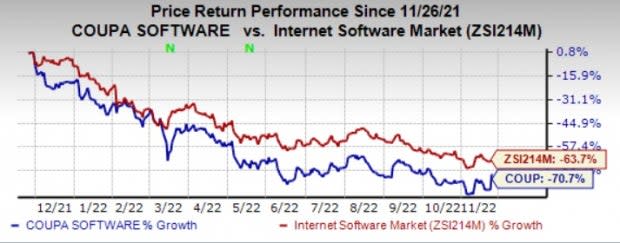

At present, Coupa has a Zacks Rank #2 (Buy). Shares of the company have lost 70.7% compared with the sub-industry’s decline of 63.7% in the past year.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Arista Networks ANET, Plexus PLXS and Jabil JBL, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have jumped 9.8% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have gained 24.9% in the past year.

The Zacks Consensus Estimate for Jabil’s fiscal 2023 earnings is pegged at $8.18 per share, rising 4.1% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 9.3%. Shares of JBL have soared 17.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plexus Corp. (PLXS) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Coupa Software, Inc. (COUP) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance