Could This Be The Next Big Thing In Marijuana Markets

In 2007 Netflix rolled out a novel new business model known as “streaming”, starting with 1,000 titles available to watch online. Now, ten years later, Netflix’s 100 million users in more than 190 counties are watching 125 million hours of Netflix content per day and eating up a whopping 37 percent of all internet traffic at peak hours.

This single idea has not only revolutionized the way that we unwind after work, but has essentially restructured the way that the free market functions in the internet age.

Now, the concept of streaming can be applied to just about anything--even weed. A small Canadian company that has so far flown under the radar may be about to revolutionize the cannabis industry by introducing a streaming model to one of the fastest-growing markets that exists today (estimated to have a base retail value of $8-billion in Canada alone).

Cannabis Wheaton Income Corp. (TSX-V:CBW; OTC: CBWTF) has a lot of competition amongst the many clamoring marijuana opportunists in Canada, but it’s aiming to be the dominant financier of the marijuana industry with this bold new innovation to set it apart from the pack.

As Canada swiftly moves toward legalizing recreational marijuana, with an expected rollout date set for July 1, 2018, many companies are racing to get in on the ground floor. Cannabis Wheaton could have a distinct advantage on that front, as it offers diversified, reduced risk exposure in a market with skyrocketing demand.

Canada’s more-than 200,000 medical marijuana patients are already complaining about supply bottlenecks, and the number of such patients is expected to grow to 500,000 by 2021. To meet this demand Canada’s growers will have to produce another 150,000 kilograms of pot, according to Canaccord Genuity. And that’s just the medicinal market. When recreational marijuana is legalized next year, as expected, there will be an enormous cannabis demand that the nation’s producers are not currently prepared to meet.

Canaccord Genuity estimates that by 2021 there will be an additional 3.8 million recreational users consuming 420,000 kilograms, or $6 billion of this green gold. At the moment, Canada only has 80 licensed producers and last year they grew only 31,000 kilograms—in other words, approximately 7 percent of anticipated demand, according to the Financial Post. In other words, by next year, Canada may have a major cannabis problem if it can’t meet demand.

Enter Cannabis Wheaton. The world’s first cannabis streaming company is backed by a powerhouse team and political heavyweights from both conservative and liberal platforms. Not only is Cannabis Wheaton jumping into a huge market where supply is likely to struggle to reach demand, but it’s offering a lifeline to new and existing growers who need financing to get off the ground fast. This is all thanks to their innovative financing strategy, a “royalty” business model that is new to this market and a big draw for investors who take some comfort in the fact that they aren’t putting all their money into a single-crop producer.

Here are 5 reasons to keep a close eye on weed-streamer Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF)

#1 Legalization on the Way

The time is ripe for a major innovation in the cannabis industry. Canada is poised to legalize recreational marijuana in July and once that happens, the industry will see significant growth in demand. in a country already unable to meet demand for medical weed, the number of pot-hungry customers could be about to increase significantly, leaving a vacuum and an opportunity for an innovative company with a new business model to take up some of the slack.

With such a potentially large industry and so many small cannabis companies lined up for their piece of the pie, it will be essential to have something that makes a company stand out. This is what makes Cannabis Wheaton ripe for success, thanks to its royalty-streaming model, an innovation totally new to the industry.

#2 ‘Streaming’ Deals Already Lined Up

This pot-financing pioneer is a major catalyst for change in Canada’s projected $8 billion market, thanks to its innovative royalty-streaming business model, which is expected to offer low risk but lucrative exposure to cannabis demand. Investors won’t be putting all their eggs in one basket and producers will have more opportunities to get financed and get growing.

But it’s not just about risk—it’s about exposure. Through Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF), exposure isn’t limited to a single crop: investors get access to multiple licensed producers to take advantage of this burgeoning industry.

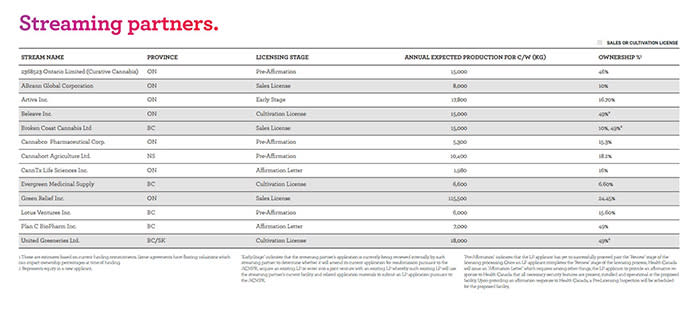

15 partners are already lined up to ‘stream’ pot with Cannabis Wheaton, along with a hefty potential to hit 1.4 million effective square feet of growing acreage by 2019. In return, Cannabis Wheaton will get minority equity interests and a portion of the pot produced. It also has 39 clinic relationships, with access to over 30,000 registered medical marijuana patients.

#3 Fast Track Scale-Up

Cannabis Wheaton is all about scaling up quickly and capitalizing on market share, made possible by the royalty-streaming model, which frees the company of single-crop limitations.

Bottom line: What Netflix is to movies and TV series, Cannabis Wheaton is to pot. Investors see value in it because it gives them lower-risk and diversified exposure to the industry.

#4 Canada’s Pot Problem: Very Tight Supply

The supply picture is so tight that Health Canada has had to streamline the approval process for growers because medical marijuana users have tripled in number since last year alone, according to Quartz. When it becomes legal recreationally, Deloitte estimates the economic impact of this industry will be worth $22.6 billion annually—in other words, more than sales of beer, wine and spirits combined.

But shortages are where things can get lucrative, and the Canadian government is also keen to make sure supply meets demand. The gap Cannabis Wheaton is looking to exploit is a huge one: “There is a segment of the marketplace where people are trying to get their facilities built and they don’t have access to capital at all,” Hugo Alves, President and Director of Cannabis Wheaton, states.

#5 Canada’s Pot Solution: Cannabis Wheaton

Pot producers are now under significant pressure. Massive market share potential is being dangled in front of them—but without financing that still allows them to maintain control over their product, it’s hard to get off the ground. And investors are wary because this is a risky business.

Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) has discovered how to take this growing industry to the next step in its evolution. Producers get the best of both worlds, maintaining control over their companies but gaining access to financing and expertise on everything from regulations and licensing to cultivation. It proposes the full package and a boost for investor confidence. And Cannabis Wheaton, well, it is set up to get a nice, steady stream of pot royalties in an industry that is likely soon to be demanding much more product.

This is the Cannabis Market 2.0, and Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) not only has first-mover advantage, but it could have only-mover advantage, with the expertise and political weight to back it up. Once Canada is secured, this model could be looking to set up with first-mover advantage internationally.

Honorable mentions:

THC Biomed International Ltd (CNSX: THC) operates as a licensed producer under Canada's Marihuana for Medical Purposes Regulations. It is also engaged in the research & development of the products and services to medical marijuana. THC’s share price bounced back in November after the company announced the creation of THC2Go dispensaries – a fully owned subsidiary, focused at the retail cannabis products – in the province of Manitoba.

Fennec Pharmaceuticals Inc (TSX:FRX): Fennec Pharmaceuticals Inc., formerly Adherex Technologies Inc., is a biopharmaceutical company focused on cancer therapeutics. The Company's lead product candidate in the clinical stage of development includes Sodium Thiosulfate (STS), which has completed patient enrollment of over two Phase III clinical trials for the prevention of cisplatin induced hearing loss, or ototoxicity in children Because of the company’s focus on cancer therapeutics, it is in the same realm of many other companies providing care for this difficult diagnosis.

iAnthus Capital Holdings (CNSX: IAN) iAnthus is a U.S. based cannabis company listed in Canada.The company has recently taken an interest in cannabis based businesses in four U.S. states. While uncertainty about changing regulation has kept many companies from investing in U.S. cannabis, in Q3 2017, the Trump administration reaffirmed the Cole Memorandum which allows states to legalize marijuana and precludes the federal government from pursuing action against operators in compliance with state cannabis regulations.

Harvest One Cannabis (TSXV:HVST): Harvest One Cannabis Inc, formerly Harvest One Capital Inc, is a Canadian company focused on servicing both recreational and medicinal markets. Harvest One recently raised $25 million in equity financing and $9 million will be used to finance Phase 1 production capacity expansion at United Greeneries’ Duncan Facility.

Aphria Inc (TSX:APH): Aphria Inc is engaged in the production and selling of medicinal marijuana, and while the stock has trended downward since April, the constant profits here suggest there is a lot of upside. The recent pro-marijuana legislation from the Canadian government is sure to boost companies with the reputation of Aphria Inc.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENT. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that new cannabis legalizing legislation will create an $8-billion-dollar industry; that there will likely be a supply shortage; that this industry will be $25 billion annually in the US; that Cannabis Wheaton’s business model reduces risk for investors; the ability to generate revenue or take production through the streaming agreements. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that markets may not materialize as expected; marijuana may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Cannabis Wheaton may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; and other risks affecting Cannabis Wheaton in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton Income Corp. to conduct public awareness advertising and marketing for [TSX:CBW.V]. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated public awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of public awareness marketing, which often end as soon as the public awareness marketing ceases. The public awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.

Yahoo Finance

Yahoo Finance