Couchbase (NASDAQ:BASE) Posts Better-Than-Expected Sales In Q1, Next Quarter's Growth Looks Optimistic

Database as a service company Couchbase (NASDAQ: BASE) reported Q1 CY2024 results exceeding Wall Street analysts' expectations , with revenue up 25.2% year on year to $51.33 million. The company also expects next quarter's revenue to be around $51 million, slightly above analysts' estimates. It made a non-GAAP loss of $0.10 per share, improving from its loss of $0.27 per share in the same quarter last year.

Is now the time to buy Couchbase? Find out in our full research report.

Couchbase (BASE) Q1 CY2024 Highlights:

Revenue: $51.33 million vs analyst estimates of $48.62 million (5.6% beat)

EPS (non-GAAP): -$0.10 vs analyst estimates of -$0.15

Revenue Guidance for Q2 CY2024 is $51 million at the midpoint, above analyst estimates of $50.59 million

The company reconfirmed its revenue guidance for the full year of $206.5 million at the midpoint

Gross Margin (GAAP): 88.9%, up from 85.6% in the same quarter last year

Free Cash Flow of $564,000 is up from -$7.55 million in the previous quarter

Annual Recurring Revenue: $207.7 million at quarter end, up 20.6% year on year

Market Capitalization: $1.07 billion

"We grew ARR by 21% year-over-year, continued to increase our Capella mix, and made meaningful progress in our efforts to improve our operational rigor and efficiency," said Matt Cain, Chair, President and CEO of Couchbase.

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Sales Growth

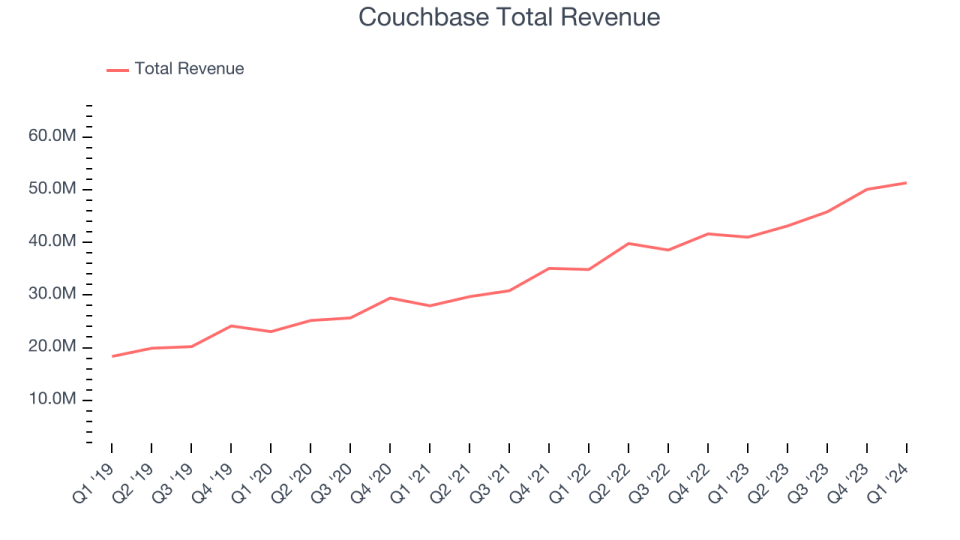

As you can see below, Couchbase's revenue growth has been strong over the last three years, growing from $27.96 million in Q1 2022 to $51.33 million this quarter.

This quarter, Couchbase's quarterly revenue was once again up a very solid 25.2% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $1.24 million in Q1 compared to $4.28 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Couchbase is expecting revenue to grow 18.2% year on year to $51 million, improving on the 8.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 12.1% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

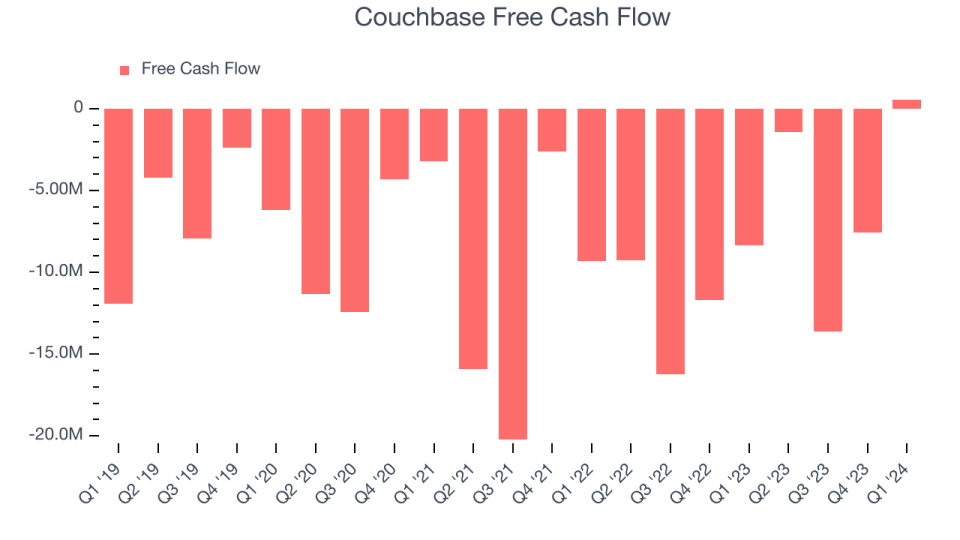

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Couchbase's free cash flow came in at $564,000 in Q1, turning positive over the last year.

Couchbase has burned through $22.03 million of cash over the last 12 months, resulting in a negative 11.6% free cash flow margin. This low FCF margin stems from Couchbase's constant need to reinvest in its business to stay competitive.

Key Takeaways from Couchbase's Q1 Results

We enjoyed seeing Couchbase exceed analysts' revenue expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 4.4% after reporting and currently trades at $22.47 per share.

So should you invest in Couchbase right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance