Costco's Upside Is Limited Due to Valuation

Shares of Costco Wholesale Corp. (NASDAQ:COST) have proven to be an exceptional investment historically. Over the past decade, the stock has delivered a total return of roughly 760%. Comparably, over the same period, the S&P 500 has delivered a total return of roughly 227%.

Costco's strong historical performance versus the broader market over the past 10 years is especially impressive given the fact the retail sector has been fairly challenging. The SPDR S&P Retail ETF (XRT) has delivered a total return of roughly 114% over the past 10 years.

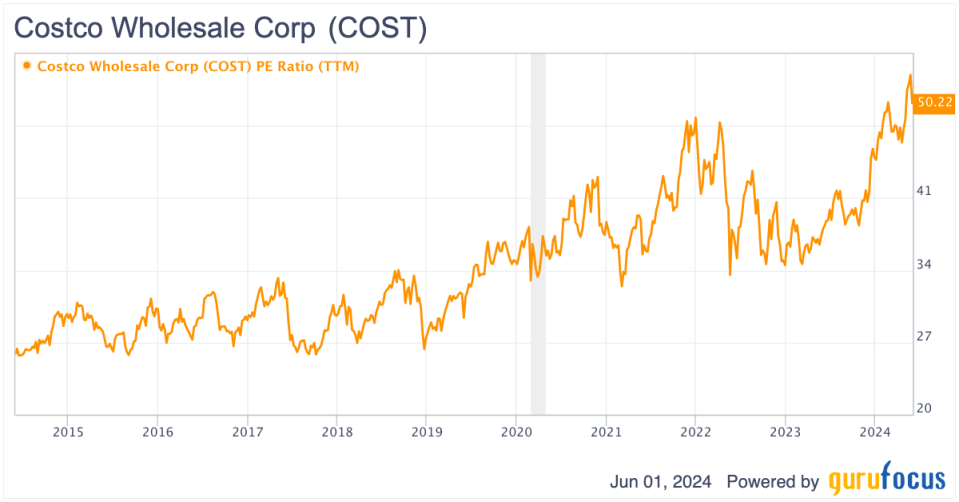

The wholesale retailer's strong performance over the past decade has been driven by solid execution of its growth strategy. The company has grown earnings per share at a compound annual rate of approximately 13% over the past decade. However, the stock has delivered an annualized return of roughly 24%. The stock has historically paid a very small dividend and thus, the key driver of outperformance relative to earnings growth has been multiple expansion.

Ten years ago, the stock traded at a price-earnings ratio of roughly 25. Currently, the company trades at an earnings multiple of roughly 50. While Costco is an excellent company, I believe upside is now limited due to its valuation.

Company overview

Costco is one of the largest retailers in the world. The company operates roughly 878 member-only warehouse stores that focus on offering low prices to consumers willing to purchase in bulk. The largest market for the company is the U.S., which accounts for nearly 73% of total revenue. Canada is the company's second-biggest market, accounting for roughly 14% of total revenue. Other key international markets include Mexico, Japan and the U.K.

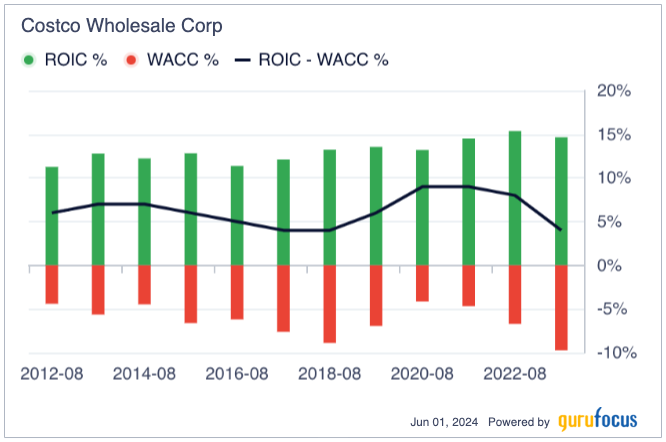

Despite operating in a highly competitive industry, Costco has proven to be a very efficient retailer and has consistently generated returns on invested capital in excess of its cost of capital. The company benefits from significant economies of scale versus smaller retailers and a highly loyal customer base.

Valuation comparisons

In order to determine if Costco's current valuation is reasonable, I believe there are three key comparisons that investors should consider: valuation versus historical norms, valuation versus other high-quality retailers and valuation versus other high-growth and quality companies.

In terms of valuation versus its own historical norms, Costco is trading at the top end of its historical valuation range. Over the past 10 years, the stock has traded at an average price-earnings ratio of roughly 34. Currently, the stock trades at roughly 50 times fiscal 2024 expected earnings per share. Thus, relative to historical norms, Costco is currently extremely expensive.

In my opinion, Costco's closest peer is Walmart Inc. (NYSE:WMT). Walmart is one of the few retailers in the U.S. that has scale and significant international operations. Moreover, Walmart also operates Sam's Club, a warehouse club retail store chain that is a direct competitor to Costco. Currently, Walmart trades at roughly 27 times forward earnings. Over the next three years, consensus estimates call for Walmart to report annual earnings per share growth of 9.50%, 9.50% and 10.50%. Comparably, consensus estimates call for Costco to report annual earnings per share growth of 9.80%, 9.90% and 15%. While Costco is clearly expected to grow faster than Walmart, I do not believe the difference in magnitude of growth justifies the massive difference in valuation between the two companies.

Another relevant peer comparison is BJ's Wholesale Club Holdings Inc. (NYSE:BJ), which trades at roughly 22 times forward earnings per share and is expected to grow earnings per share at annual rates of 0%, 11% and 12.40% over the next three years. While I believe Costco and Walmart deserve to trade at a premium to BJ's due to advantages related to scale, I believe the massive valuation disconnect between BJ's and Costco is unwarranted.

In addition to comparing Costco's valuation to its own historical norm and peers, I also believe other high-quality, high-growth businesses represent an interesting comparison. One business that comes to mind is Microsoft Corp. (NASDAQ:MSFT). Currently, Microsoft trades at roughly 31 times forward earnings and is expected to grow annual earnings per share by 12.6%, 17.5% and 17.3% over the next three years. Another high-growth, high-quality business is Mastercard (NYSE:MA), which trades at roughly 31 times forward earnings per share and is expected to grow annual earnings per share at 16.30%, 16.30% and 17% over the next three years. While Costco is in a very different business than Microsoft or Mastercard, I believe the relative valuations help make clear Costco's 50 times forward earnings is not justified by its earnings growth potential.

Costco currently has a GF Value of $605. At this level, the stock would be trading at roughly 37.50 times earnings. I view this level of valuation as much more reasonable than the current valuation as it is more in line with the stock's own historical valuation and is more reasonable relative to peers.

COST Data by GuruFocus

How Costco could grow into its current valuation

Given the stock's high valuation, I believe the bull case for Costco rests on the idea the company may be able to grow earnings more quickly and for a longer period of time than current consensus estimates call for.

Costco currently operates roughly 605 stores in the U.S. and 273 stores internationally. Thus, from a growth perspective, I believe the longer-term growth opportunity internationally is more exciting. Over the rest of fiscal 2024, the company plans to open an additional 12 stores, nine of which are expected to be in the U.S. while three are expected to be international locations. Currently, Costco operates just five stores in China. If the company is able to begin scaling up its operations in China and other key international markets, then I believe it is possible it could experience accelerated earnings growth well above the 13% historical annual rate over the past decade. However, executing in international markets is challenging as local players often have a leg up compared to American companies. For this reason, I believe international growth is unlikely to be rapid enough to justify the stock's current valuation.

Another way in which Costco could grow into its current valuation is if the company were to take steps to target significantly increased profit margins. Historically, it has capped gross margins around 14% and has not tried to maximize margins, but rather keep them low in order to deliver value to consumers and make it difficult for competitors. This strategy has worked well for the company, but even a modest increase in gross profit margins could significantly increase earnings. Comparably, Walmart operates with gross margins of close to 24%, while BJ's operates with gross margins of roughly 18%. On the company's most recent earnings call, CEO Ron Vachris suggested that an increase in gross margins is unlikely:

No, that 14%, 15% has been part of our life for many years. And so I think that's -- our objective, our buyer's goals is really how aggressive they can get on pricing and deliver the best value. So I don't see there's no plans to move that cap at all.

Takeaways

Costco is a company with a long history of delivering exceptional returns for investors. Its strong returns for shareholders over the past 10 years have been driven by a combination of strong earnings growth and multiple expansion.

The stock now trades at roughly 50 times earnings, which is well above the stock's historical average valuation. Moreover, shares also trade at a significant premium to its closest peer, Walmart, which has similar near-term growth prospects. Costco is also trading at a significant premium to faster-growing, high-quality businesses such as Microsoft and Mastercard.

International growth represents a key long-term opportunity for the company, but is unlikely to fuel the near-term earnings growth needed to justify a multiple of 50.

For these reasons, I believe Costco is overvalued and near-term upside for the stock may be limited.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance