CoStar Group Reports Mixed Q1 2024 Earnings, Misses EPS Estimates But Sees Revenue Growth

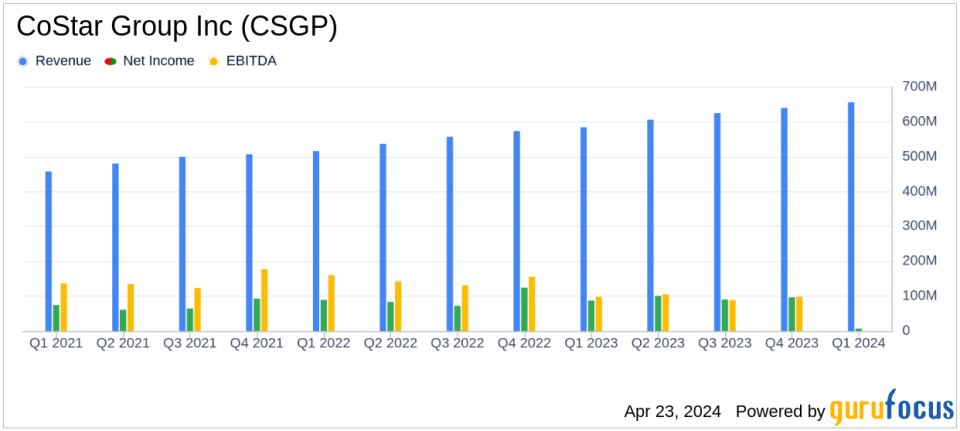

Revenue: Reported at $656 million for Q1 2024, marking a 12% increase year-over-year, surpassing the estimated $649.68 million.

Net Income: Achieved $7 million in Q1 2024, falling short of the estimated $26.55 million.

Earnings Per Share (EPS): Recorded at $0.02, significantly below the estimated $0.07.

Annual Revenue Forecast: Raised to a range of $2.76 billion to $2.77 billion, indicating an expected growth of approximately 13% year-over-year.

Adjusted EBITDA: For the full year 2024, now anticipated to be between $185 million and $205 million, an increase from prior forecasts.

Non-GAAP Net Income Per Share: Expected to range from $0.58 to $0.62 for the full year 2024, based on 409 million shares.

Market Performance: Notable revenue growth in Apartments.com and CoStar segments, both surpassing $250 million in Q1 2024.

On April 23, 2024, CoStar Group Inc (NASDAQ:CSGP) released its 8-K filing, revealing a quarter of contrasting financial outcomes. The company reported a revenue of $656 million for the first quarter ended March 31, 2024, marking a 12% increase from the previous year's $584 million. This performance exceeded the analyst's revenue estimate of $649.68 million. However, net income stood at $7 million, resulting in earnings per diluted share of $0.02, significantly below the estimated $0.07 per share.

Company Overview

CoStar Group is a prominent provider of commercial real estate data and marketplace listing platforms. It offers detailed analytical information on over 5 million commercial real estate properties across various sectors such as office, retail, and multifamily. The company operates notable brands including CoStar Suite, LoopNet, and Apartments.com. Recently, CoStar has expanded its operations into international markets including Canada and the UK, maintaining a strong focus on subscription-based revenue which constitutes over 80% of its total income.

Financial Highlights and Operational Achievements

The quarter witnessed significant strides in operational achievements, particularly with the successful monetization of Homes.com, which contributed nearly $40 million in net new bookings. This robust performance led to a record $86 million in total net new bookings for the quarter. CoStar's CEO, Andy Florance, highlighted the exceptional sales and marketplace traffic driven by Homes.com, which has rapidly become one of the top residential marketplace portals in the U.S.

Despite these operational successes, the company faced challenges as reflected in its earnings metrics. The net income of $7 million and EPS of $0.02 fell short of expectations, primarily due to increased operating expenses and a challenging economic environment impacting the broader real estate market.

Detailed Financial Analysis

The income statement reveals a gross profit of $515.2 million, up from the previous year's $465.2 million. However, increased selling and marketing expenses, which rose to $366.1 million from $226.3 million, contributed to a loss from operations of $42.8 million. This was a significant shift from an income of $72.2 million in the same quarter the previous year.

On the balance sheet, CoStar Group reported a strong cash position with $4,951.6 million in cash and cash equivalents, although this was a decrease from $5,215.9 million at the end of the previous year. Total assets stood at $9,034.5 million.

The cash flow statement highlighted net cash provided by operating activities at $139.6 million, up from $123.2 million in the prior year. However, substantial investments in property and equipment, primarily for new campuses, resulted in a net cash used in investing activities of $380.3 million.

Outlook and Forward Guidance

Looking ahead, CoStar Group has raised its full-year 2024 revenue forecast to between $2.76 billion and $2.77 billion, anticipating a revenue growth of approximately 13% year-over-year. Adjusted EBITDA expectations were also increased to a range of $185 million to $205 million. These adjustments reflect the company's confidence in its operational strategies and market demand for its offerings.

In conclusion, while CoStar Group's EPS did not meet analyst expectations, its revenue growth and strategic expansions underscore its resilience and potential for future growth. Investors and stakeholders will likely watch closely how the company navigates the evolving market dynamics and capitalizes on its strategic initiatives.

Explore the complete 8-K earnings release (here) from CoStar Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance