Service Corporation (SCI) Benefits From Its Focus on Expansion

Service Corporation International SCI has been gaining from its focus on expansion. The company appears well-placed for growth due to the steady demand for its products and services.

The provider of deathcare products and services is committed to developing new cemeteries in order to increase returns. Also, management is confident in its long-term growth strategy, which it believes will increase revenues and shareholder value.

Focus on Expansion: Key Factor

Service Corp remains committed to pursuing strategic buyouts for both its segments and building new funeral homes to generate greater returns. During the 12 months that ended Dec 31, 2022, the company incurred capital expenditures of $369.7 million, including increased technology infrastructure spending, cemetery development spending and digital investments. Management now expects total maintenance, cemetery development and other capital expenditures in the band of $290-$310 million in 2023.

Moving to acquisitions, the company invested almost $90 million in acquiring three combination operations and 11 standalone funeral homes in the fourth quarter of 2022. It also concluded four separate transactions in the said period, bringing its full-year spending to $105 million. Previously, it concluded a small $2-million deal in the mid-Atlantic region in the second quarter of 2022.

Some notable acquisitions made by the company in the past include Alderwoods Group, Keystone North America, The Neptune Society, and Stewart Enterprises. Also, buyouts in the cemetery segment are aimed at exploiting increased opportunities to cater to Baby Boomers.

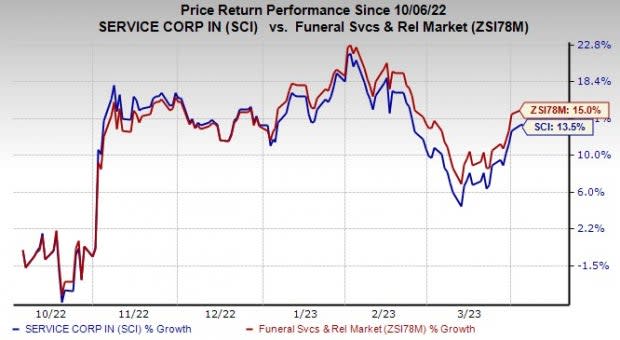

Image Source: Zacks Investment Research

Impressive Q4

Service Corp released its fourth-quarter 2022 results, wherein it posted adjusted earnings of 92 cents per share, surpassing the Zacks Consensus Estimate of 80 cents. Total revenues of $1,027.7 million came ahead of the Zacks Consensus Estimate of $966 million. Notably, the company witnessed better-than-expected growth from the fourth quarter of 2019 (pre-pandemic period).

Notably, results showed 26% compound annual growth in the company's full-year adjusted earnings per share from the pre-pandemic period.

We note that on a compounded annual growth basis, the number of comparable funeral services performed is trending higher than expected, approximately 5% higher than pre-pandemic 2019 levels. Additionally, comparable cemetery preneed sales production grew an astounding 14.5% annually compounded over 2019 levels.

Wrapping up

Although Service Corp's funeral segment’s revenues were soft in the fourth quarter, the number of services provided is trending better than management had anticipated.

Shares of this Zacks Rank #2 (Buy) company have rallied 13.5% in the past six months compared with the industry’s growth of 15%.

Key Picks

Some better-ranked stocks that investors may consider are Inter Parfums IPAR, General Mills GIS and KimberlyClark KMB.

IPAR has an expected long-term earnings growth rate of 15% and a trailing four-quarter earnings surprise of 36.2%, on average. Inter Parfums currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year sales and earnings suggests growth of 10.5% and 0.8%, respectively, from the year-ago reported numbers.

General Mills is a major designer, marketer and distributor of premium lifestyle products. It currently carries a Zacks Rank of 2. GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

The Zacks Consensus Estimate for General Mills’ current financial year sales and earnings suggests growth of 5.9% and 7.1%, respectively, from the year-ago reported numbers.

KimberlyClark is engaged in the manufacture and marketing of a wide range of consumer products around the world. It currently carries a Zacks Rank of 2. KMB has a trailing four-quarter earnings surprise of 1.4%, on average.

The Zacks Consensus Estimate for KimberlyClark’s current financial year sales and earnings suggests growth of 2% and 5.2%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Service Corporation International (SCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance