Will Coronavirus Test Aid Thermo Fisher's (TMO) Q1 Earnings?

Thermo Fisher Scientific Inc. TMO is slated to release first-quarter 2020 results on Apr 22, before market open.

In the last reported quarter, the company’s earnings of $1.67 exceeded the Zacks Consensus Estimate by 0.3%. Its earnings surpassed estimates in each of the trailing four quarters, the average beat being 1.48%.

Let's discuss the factors that are likely to get reflected in the upcoming results.

Factors at Play

For the past few quarters, Thermo Fisher has been witnessing robust revenue growth and improvement in its earnings performance, banking on the continued focus on significant value creation from the company’s R&D investments.

In the last reported quarter too, Thermo Fisher benefited from the launch of Analytical Instruments products for the diagnostic laboratory. We are upbeat about the continued robust performances of Thermo Fisher’s three systems (which are FDA-listed Class I medical devices) — Vanquish MD High Performance Liquid Chromatography (HPLC), TSQ Altis MD Series mass spectrometer and Quantis MD Series mass spectrometer.

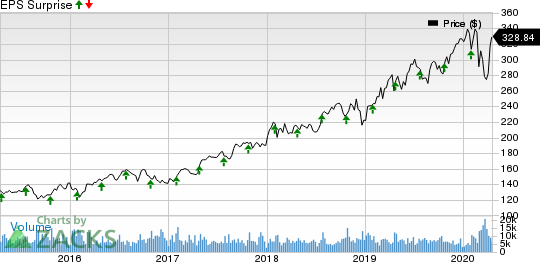

Thermo Fisher Scientific Inc. Price and EPS Surprise

Thermo Fisher Scientific Inc. price-eps-surprise | Thermo Fisher Scientific Inc. Quote

The company is likely to have continued gaining from the same during the first half of the March-end quarter (when COVID-19 had an insignificant impact on the United States).

However, shares of Thermo Fisher have been on a declining trend for the past two months like most stocks in the industry. The coronavirus outbreak has massively disrupted the global supply chain. Hence, with a huge international base, Thermo Fisher too is expected to have recorded a significant fall in its quarterly Analytical Instruments revenues.

However, within Specialty Diagnostics, in the first half of March, the company successfully attained EUA from the FDA for its diagnostic test to be used by the CLIA high-complexity laboratories in the United States. The test has been developed for the detection of nucleic acid, exclusively from SARS-CoV-2. The authorized test utilizes the Applied Biosystems TaqPath Assay technology and has been developed to deliver patient outcomes within four hours of a sample reaching a laboratory. This authorization was amended on Mar 24, to include additional instruments, such as the company's Applied Biosystems 7500 Fast Real-Time PCR System. This boosts the testing capabilities in the United States from approximately 1,000 instruments to more than 3,000 instruments, on which Thermo Fisher's diagnostic test can be run. The expansion also includes manual sample extraction using the MagMax Viral/Pathogen Nucleic Acid Isolation Kit as well as Applied Biosystems COVID-19 Interpretive Software.

On Mar 26, the company announced that this test has also received the CE mark in the European Union. Europe, being another major spot of the virus outbreak, is anticipated to have generated strong demand for this test during the first quarter. In addition, this diagnostic test has received the designated approvals in Canada, Singapore, India, Australia and New Zealand.

Though this test was rolled out in the second half of the to-be-reported quarter both in the United States and Europe, it is likely to have contributed to the company’s global Specialty Diagnostics business’ quarterly revenues.

Meanwhile on Apr 6, during its preliminary first-quarter announcement, the company noted that it estimates both reported and organic (excluding the impact of acquisitions and divestitures and foreign currency translation) revenue growth to be in the range of 1-2%.

Q1 2020 Estimates

The Zacks Consensus Estimate for total revenues of $6.21 billion for the first quarter suggests growth of 1.3% from the prior-year quarter’s reported figure. However, the consensus mark for earnings of $2.79 per share indicates a 0.7% fall from the year-ago quarter reported figure.

What Our Quantitative Model Predicts

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has good chances of beating estimates. This is not the case as you can see:

Zacks Rank: Thermo Fisher currently carries a Zacks Rank #3.

Earnings ESP: The company has an Earnings ESP of -5.24%.You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Worth a Look

Here are a few other medical stocks worth considering, as these have the right combination of elements to post an earnings beat this quarter.

Chemed Corporation CHE has an Earnings ESP of +1.78% and currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health, Inc. CAH has an Earnings ESP of +1.03% and flaunts a Zacks Rank of 1, at present.

DexCom, Inc. DXCM has an Earnings ESP of +143.90% and currently carries a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance