Corebridge Financial Inc (CRBG) Reports Mixed Results for Q4 and Full Year 2023

Premiums and Deposits: $10.5 billion in Q4, a 20% increase year-over-year; $39.9 billion for the full year, up 26%.

Base Spread Income: Grew by 21% in Q4 to $987 million; $3.7 billion for the full year, a 30% increase.

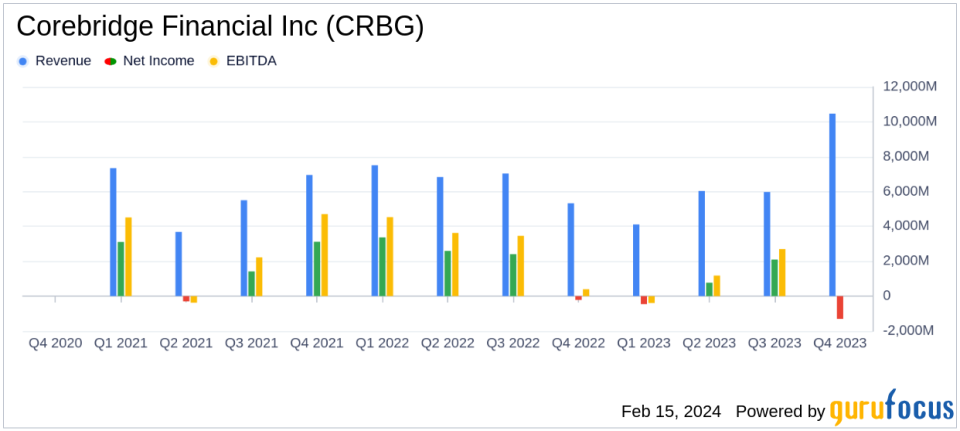

Net Loss: Reported a net loss of $1.3 billion in Q4, or $2.07 per share; net income for the full year at $1.1 billion, or $1.71 per share.

Adjusted After-Tax Operating Income: $661 million in Q4, with operating EPS of $1.04; $2.6 billion for the full year, with operating EPS of $4.10.

Capital Return to Shareholders: $1.1 billion in Q4, including share repurchases and dividends; $2.2 billion for the full year, resulting in an 84% payout ratio.

On February 15, 2024, Corebridge Financial Inc (NYSE:CRBG) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of retirement solutions and insurance products in the United States, operates through segments including Individual Retirement, Group Retirement, Life Insurance, and Institutional Markets.

Financial Performance and Challenges

Despite a robust increase in premiums and deposits, Corebridge reported a net loss of $1.3 billion in Q4, primarily driven by realized losses recorded for the Fortitude Re funds withheld embedded derivative. However, the company's adjusted after-tax operating income rose to $661 million, a 12% increase, reflecting the execution of strategic priorities and capitalization on market opportunities.

The company's base spread income and base yield showed significant improvement, contributing to healthy margins across its diversified portfolio. Corebridge's financial achievements are particularly important in the asset management industry, as they indicate the company's ability to generate consistent cash flows and maintain a strong balance sheet amidst market fluctuations.

Financial Metrics and Importance

Key financial metrics from the income statement, such as the 26% year-over-year increase in premiums and deposits, highlight the company's growth in sales across its product portfolio. The balance sheet reflects a robust financial position, with general account assets growing by 5% to $220 billion. The cash flow statement shows the company's ability to return capital to shareholders, with $2.2 billion returned in 2023, maintaining a Life Fleet RBC Ratio above 400%.

"Corebridge maintains a robust financial position and continues to generate consistent cash flows, supporting a strong balance sheet and meaningful capital return," said Kevin Hogan, President and CEO of Corebridge.

Analysis of Company's Performance

Corebridge's performance in 2023 demonstrates resilience and adaptability in a challenging market environment. The company's strategic investment partnerships and disciplined risk management have positioned it for continued success in 2024. However, the net loss in Q4 indicates exposure to market risks that could impact future profitability. The company's focus on creating long-term value for shareholders and its diversified business model are expected to support its growth trajectory.

For a more detailed analysis of Corebridge Financial Inc's earnings and to stay updated on the company's progress, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Corebridge Financial Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance