Copper Road Resources Intersects 50 Metres of 1.00% Cu Eq at the Richards Breccia and 95 Metres of 0.51% Cu Eq at the Jogran Porphyry, JR Zone, Batchewana Bay, Ontario

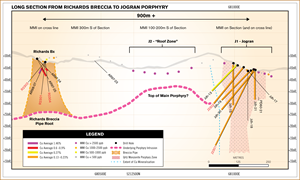

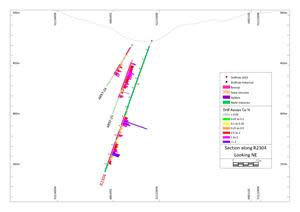

Figure 1: JR Zone Long Section

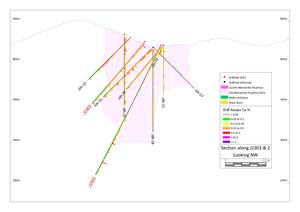

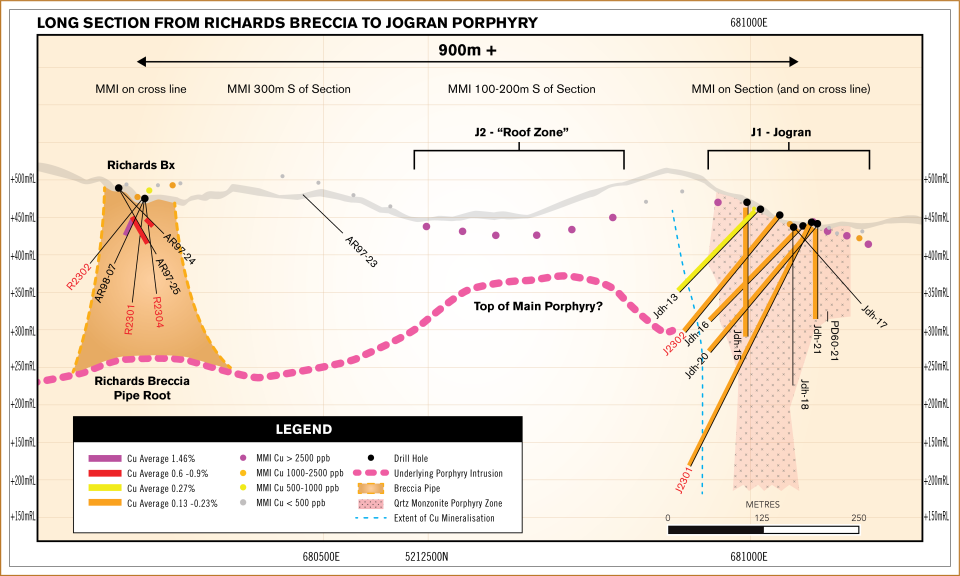

Figure 2: Jogran Porphyry: Cross-Sections Showing Drillhole Locations

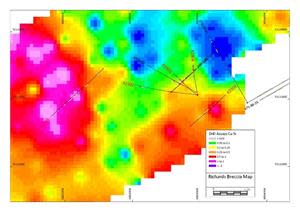

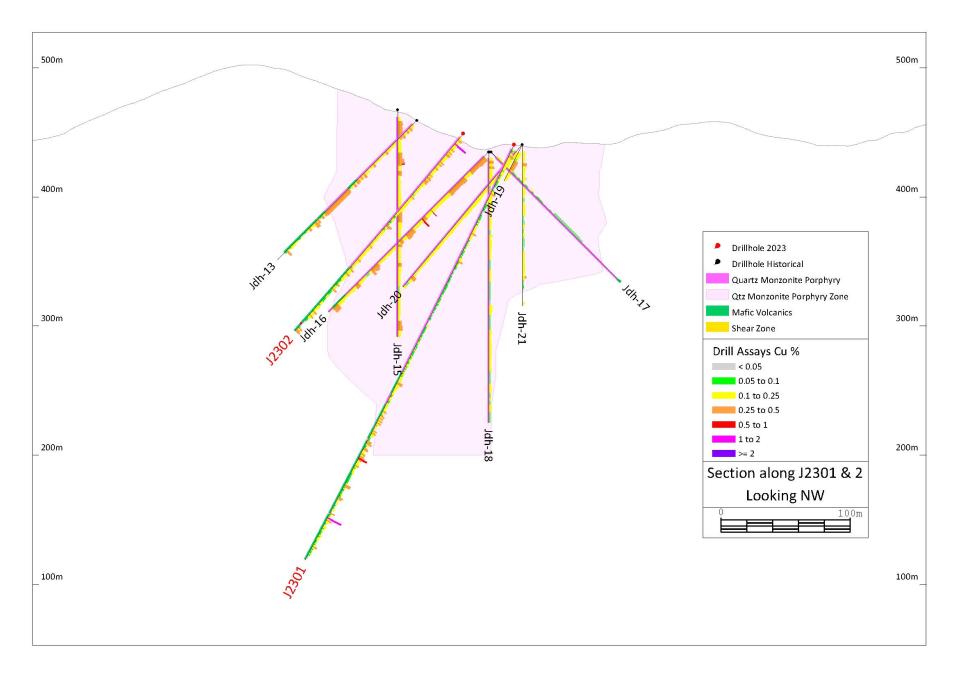

Figure 3: Richards Breccia Drillhole Location Map Showing Gradient IP Anomaly

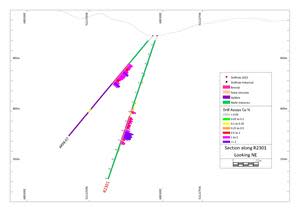

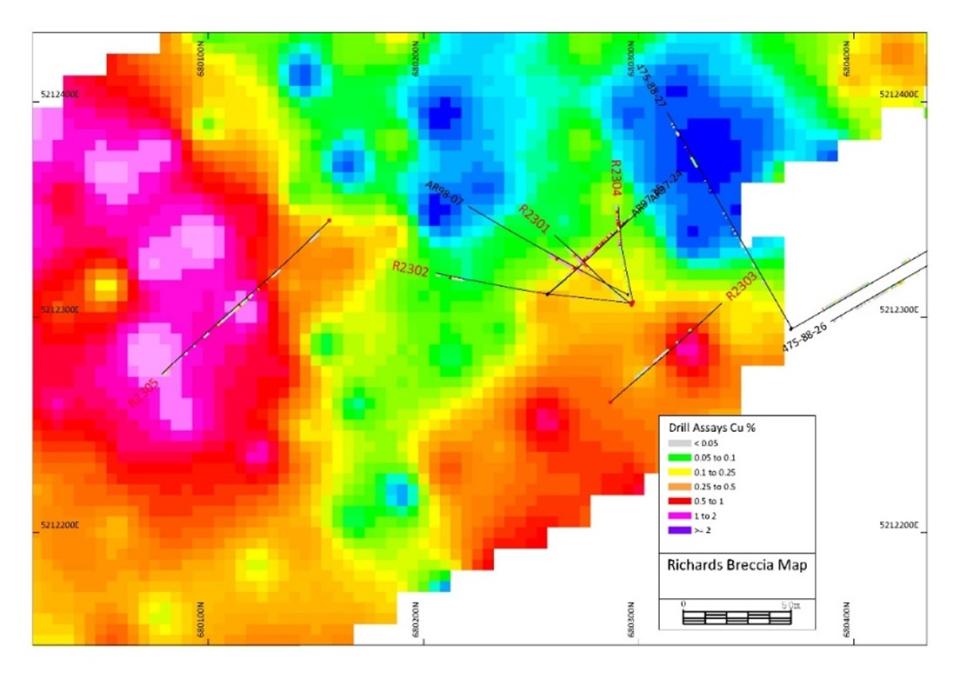

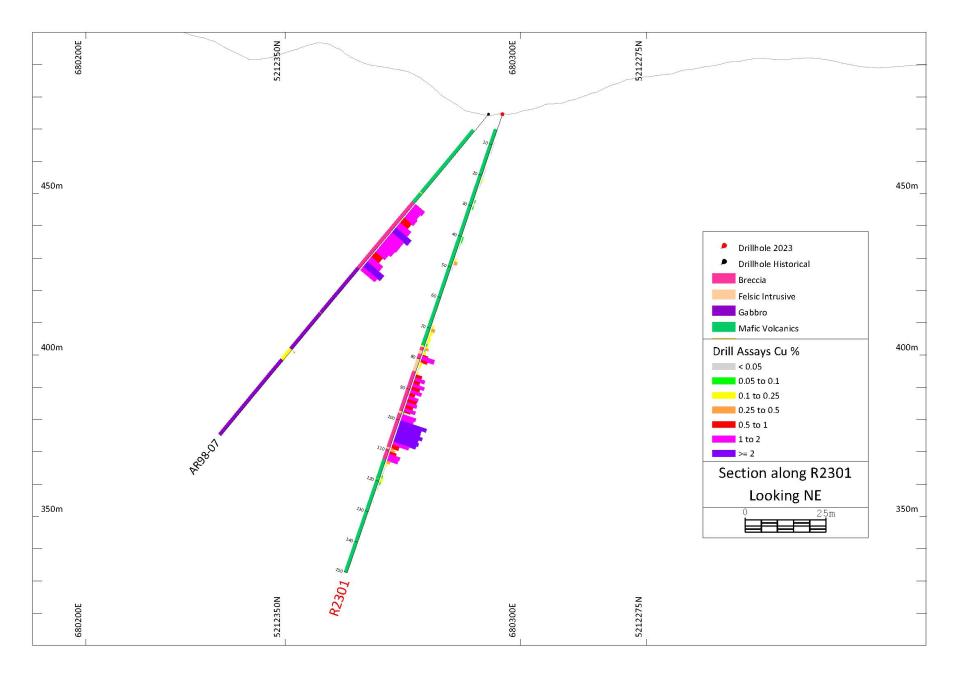

Figure 4: Richards Breccia: Section along R2301

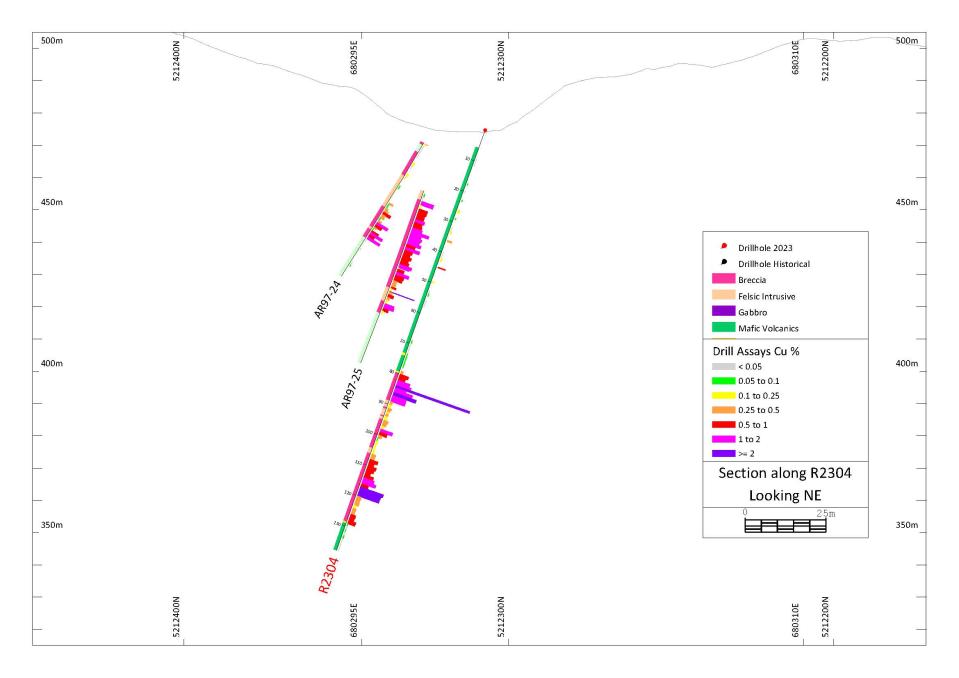

Figure 5: Richards Breccia: Section along R2304

Figure 6: Alkalic Porphyry Deposit Clusters Comparison

Highlights 2023 JR Zone Drill Program |

|

Richards Breccia |

|

Jogran Porphyry |

|

|

TORONTO, Nov. 30, 2023 (GLOBE NEWSWIRE) -- Copper Road Resources (TSXV: CRD) (“Copper Road” or “the Company”) is pleased to announce 2023 diamond drill results from its 1,250-metre drill program completed in the JR Zone at the 24,000-hectare Copper Road Project, Batchewana Bay, Ontario. The JR Zone is located approximately 8 km from the Tribag Zone which the Company drilled in 2022. The objective was to confirm the lengthy historical intersections of Copper and Molybdenum mineralization within the Jogran Porphyry and to demonstrate additional high-grade Copper mineralization at depth in the Richards Breccia.

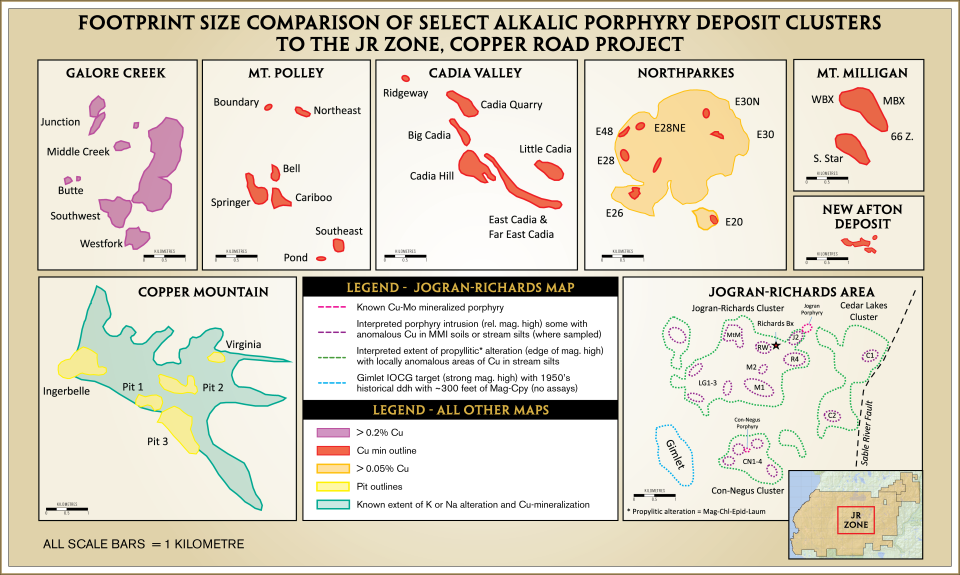

Copper Road President and CEO John Timmons comments: “The results from our initial drill program have established the presence of lengthy near-surface intersections of porphyry-hosted Copper/Molybdenum mineralization with shorter intersections of higher-grade Copper/Gold breccia-hosted mineralization. The Jogran Porphyry and Richards Breccia targets are approximately 1 km apart and form part of a wider array of alkalic porphyry and breccia targets in the JR Zone area, similar in areal scale to the established alkalic porphyry districts or “clusters” in British Columbia and in Australia.

“The Richards and Jogran targets are two of nineteen targets in the greater JR Zone area based on the ongoing compilation of historical and current exploration data. The Company believes the JR Zone has the potential to deliver multiple larger porphyry and breccia-hosted discoveries.”

Figure 1: JR Zone Long Section

Table 1: Richards Breccia Select Intercepts

Drillhole | Drill Intercept (metres) | Grade | ||||||

From | To | Length | Cu (%) | Ag (g/T) | Mo (%) | Au (g/t) | Cu Eq (%) 1 | |

R2301 | 76.37 | 115.00 | 38.63 | 1.06 | 3.55 | 0.002 | 0.07 | 1.17 |

Including | 98.00 | 108.00 | 10.00 | 2.19 | 7.96 | 0.002 | 0.11 | 2.35 |

| ||||||||

R2304 | 80.00 | 120.00 | 40.00 | 0.99 | 4.58 | 0.002 | 0.09 | 1.11 |

Including | 79.00 | 129.17 | 50.17 | 0.88 | 4.56 | 0.002 | 0.09 | 1.00 |

Including | 81.00 | 89.00 | 8.00 | 2.09 | 16.00 | 0.004 | 0.21 | 2.42 |

Including | 117.00 | 120.00 | 3.00 | 2.41 | 7.20 | 0.001 | 0.23 | 2.66 |

| ||||||||

R2305 | 72.00 | 85.00 | 13.00 | 0.31 | 1.72 | 0.000 | 0.03 | 0.35 |

Including | 73.83 | 75.00 | 1.17 | 2.03 | 11.17 | 0.001 | 0.18 | 2.27 |

1 Assumptions used in USD for the copper equivalent calculation are metal prices of $3.60/lb Copper, $22/oz Silver, $50/kg Molybdenum, $1900/kg Gold and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Silver (g/t) x 0.01) + (Molybdenum (%) x 6.30) + (Gold (g/t) x 0.77) | ||||||||

Table 2: Jogran Porphyry Select Intercepts

Drillhole | Drill Intercept (metres) | Grade | |||||

From | To | Length | Cu (%) | Ag (g/T) | Mo (%) | Cu Eq (%) 1 | |

J2301 | 8.00 | 350.00 | 342.00 | 0.13 | 1.18 | 0.015 | 0.23 |

Including | 39.00 | 52.00 | 13.00 | 0.16 | 2.26 | 0.027 | 0.35 |

Including | 69.00 | 98.00 | 29.00 | 0.10 | 1.60 | 0.040 | 0.37 |

Including | 188.00 | 284.00 | 96.00 | 0.18 | 1.23 | 0.015 | 0.28 |

Including | 198.00 | 212.00 | 14.00 | 0.20 | 1.12 | 0.053 | 0.55 |

Including | 234.00 | 245.00 | 11.00 | 0.20 | 1.22 | 0.004 | 0.24 |

Including | 256.00 | 279.00 | 23.00 | 0.25 | 1.55 | 0.009 | 0.33 |

Including | 318.78 | 350.00 | 31.22 | 0.17 | 0.88 | 0.010 | 0.24 |

Including | 318.78 | 335.00 | 16.22 | 0.21 | 1.17 | 0.016 | 0.32 |

| |||||||

J2302 | 4.00 | 201.00 | 197.00 | 0.17 | 1.62 | 0.025 | 0.35 |

Including | 4.00 | 99.00 | 95.00 | 0.20 | 1.97 | 0.048 | 0.51 |

Including | 5.00 | 26.00 | 21.00 | 0.27 | 2.15 | 0.120 | 1.04 |

1 Assumptions used in USD for the copper equivalent calculation are metal prices of $3.60/lb Copper, $22/oz Silver, $50/kg Molybdenum, $1900/kg Gold and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Silver (g/t) x 0.01) + (Molybdenum (%) x 6.30) + (Gold (g/t) x 0.77) | |||||||

Jogran Porphyry

Two (2) drillholes were completed at Jogran Porphyry to test the extent and continuity of the mineralization encountered in previous historical exploration by Jogran Mines and Phelps-Dodge in the early 1960s. The Jogran Porphyry is a quartz monzonite porphyry intrusion with a distinct alteration and mineralization style consistent with alkalic porphyry copper-molybdenum mineralization. Drilling has successfully confirmed the continuity of the copper and molybdenum mineralization in the porphyry over long intervals, beyond what was previously known laterally and at depth, and that the mineralization also extends to the southwest into the mafic volcanics where it is associated with localized and discrete potassic alteration (magnetite and biotite) occurring as haloes adjacent to quartz-carbonate veinlets and as local patches in the mafic volcanics.

Figure 2: Jogran Porphyry: Cross-Sections Showing Drillhole Locations

J2301: Drilled to test the continuity of the porphyry mineralization beneath historical hole JDH-16 (165 m @ 0.43% Cu Eq). This hole intersected an extensive zone of copper mineralization hosted by the porphyry (0.23% Cu Eq over 342 metres from 8 to 350 metres, including an interval of 0.37% Cu Eq over 29 metres from 69 to 98 metres). Historical drilling had traced the mineralized porphyry to a maximum vertical depth of 180-220 metres below surface. The current drilling has extended the mineralized porphyry to 320 metres below surface and is still open at depth. The broad intersection at JR-23-01 confirms the presence of near-surface copper mineralization with strong credit mineralization (Mo, Ag, Au) that increases proportionately with the higher copper grades. Copper mineralization extends into the mafic volcanics and appears as consistently mineralized as in the porphyry intrusion, thereby suggesting the presence of a larger intrusive system southwest of the Jogran porphyry (i.e. towards the J2 “Roof Zone” Cu-in-MMI and magnetic high anomaly).

J2302: Drilled to test the continuity of the porphyry mineralization below historical hole JDH-13 (147 m @ 0.53% Cu Eq). This hole intersected a broad zone of altered quartz monzonite porphyry containing consistent copper mineralization with associated strong molybdenum grades throughout the entire hole (0.35% Cu Eq over 197 metres from 4 to 201 meters including higher-grade intervals of 0.51% Cu Eq over 95 metres and 1.04% Cu over 21 metres). Copper and molybdenum mineralization also extends into the altered mafic volcanics, similar to that seen in J2301, again confirming the potential of higher-grade copper mineralization to the southwest

Richards Breccia

Richards Breccia is an altered polymictic and clast supported breccia. Clasts consist of altered volcanics, silicified cherty fragments and felsic intrusives. The presence of felsic intrusive clasts in the breccia indicates an emplacement related to an intrusive source at depth. Four (4) holes were drilled to test the continuity of the mineralization originally drill-tested by Aurogin Resources in 1997 and 1998, with an additional hole testing an area of high Gradient chargeability located approximately 200 metres to the west-northwest of Richards. Drilling successfully extended the breccia 50 to 60 metres vertically below the known mineralization, establishing the vertical extent of mineralization to 130 meters from surface. The breccia is still open at depth and is technically open to the northeast for at least a limited strike extent.

Figure 3: Richards Breccia Drillhole Location Map Showing Gradient IP Anomaly

Figure 4: Richards Breccia: Section along R2301

Figure 5: Richards Breccia: Section along R2304

R2301: Drilled to test the vertical extent of the mineralized breccia encountered by historical drillholes AR98-07, AR97-24, and AR97-25. This hole returned grades of 1.17% Cu Eq over 38.63 metres from 76.37 to 115 metres including a higher-grade interval of 2.35% Cu Eq over 10 metres from 98 to 108 metres. True widths are estimated to be 50% of the drill widths reported above. This hole extended the mineralization to 50 metres vertically below AR97-25.

R2302: This hole was designed to test the western strike extent of the breccia but may have been fault-displaced or dyked out by a mapped diabase. The hole did not return any significant mineralization.

R2303: This drillhole tested a historical gradient IP anomaly to the southeast of the breccia. The hole appears to have drilled down a moderately east-dipping fault that is sub-parallel to the trace of the hole, perhaps explaining the weak to moderate IP anomaly, but did not intersect any significant mineralization.

The Company continues to analyse the structural framework of the Richards Breccia regarding the negative results of R-23-02 and R-23-03, but it is initially interpreted that the breccia has been fault-displaced to both the east and the west.

R2304: Drilled to test the northeastern extent of mineralized breccia below AR98-07. It returned a composite grade of 1.00% Cu Eq over 50.17 metres from 79 to 129.17 metres. Within this broad zone of mineralization are higher grade zones of copper enrichment containing 1.11% Cu Eq over 40 metres and 2.42% Cu Eq over 8 metres. This hole has confirmed extension of mineralization to 60 metres vertically below AD98-07.

R2305: This hole tested the southeastern edge of a high Gradient IP anomaly located approximately 100 m to the northwest of the mineralized Richards Breccia. It intersected dominantly chlorite-carbonate-pyrite altered mafic volcanics with a few narrow diabase dikes. Notably, there are scattered patches of sulphide mineralization and associated alteration through out the length of the hole, with discontinuous anomalous copper values greater than 0.1% Cu from 52.0 to 148.0 metres (the hole was not continuously sampled). The zones are characterized by pyrite mineralization in hairline fractures and as disseminations and, to a lesser extent, quartz-calcite veinlets containing chalcopyrite+pyrite±bornite±pyrrhotite. Best results from this hole returned 2.27% Cu Eq over 1.17 metres within a 13-metre-wide interval of 0.35% Cu Eq from 72 to 85 metres. These results indicate possible proximity to a mineralized porphyry intrusion or breccia pipe that may be centred just to the north and/or just below the drill hole.

Exploration Outlook

The Jogran Porphyry and Richards Breccia targets are approximately 1 km apart and form part of a wider array of alkalic porphyry and breccia targets in the JR Zone area, similar in areal scale to the established alkalic porphyry districts or “clusters” in British Columbia and in Australia (see Figure 8 below).

Currently the established porphyry and breccia targets within the JR area are a combination of MMI soil, stream silt, and lake sediment geochemical anomalies with local magnetic highs that may indicate intrusive centres within a larger area of elevated magnetics that is interpreted to indicate a broad area of propylitic alteration. Within this broad halo, numerous historical surface showings are reported, and virtually every historical drill hole has reported at least locally anomalous Copper-Molybdenum mineralization and related alteration (many not assayed).

The Company is currently planning a large (3 x 4 kilometre), semi-3D, deep-penetrating IP survey over the main JR area to further advance the targets as it has only had limited patches of historical IP surveying (mostly Gradient). This will be followed up with additional drill testing of coincident geochemical and geophysical anomalies.

Figure 6: Alkalic Porphyry Deposit Clusters Comparison

Sources: the maps above are original and created from publicly available information and technical reports

Marketing Update

The Company also announces that it has finalized the following sponsorship arrangements with the Rocks and Stocks News YouTube channel and news website (“Rocks and Stocks”) and Ahead of the Herd (“AOTH”) newsletter.

Rocks and Stocks is a private entity owned and operated by Allan Laboucan. Rocks and Stocks is based in Mexico where it operates an online portal for news related to mining stocks and the precious metals industry. The Company had paid sponsorship fees to Rocks and Stocks in the amount of $15,000 on May 4th, 2023, for the period commencing on May 4th, 2023 and ending on November 4th, 2023. In exchange for such sponsorship fees, Rocks and Stocks provided coverage of video interviews with the Company’s management on its various online platforms. No equity compensation was paid to Rocks and Stocks in connection with the sponsorship. Rocks and Stocks and the Company are unrelated and unaffiliated entities, and the Company is not aware of any interest, directly or indirectly, of Rocks and Stocks or its principal in the Company or its securities.

The Company had paid sponsorship fees to AOTH in the amount of $12,000 over a 6-month period commencing on May 5th, 2023, paid monthly at $2,000, and ending on November 15th, 2023. AOTH is based in Prince George, BC, Canada, owned and operated by Rick Mills. AOTH provides written commentaries of public companies based on public information and approved by Copper Road management. In exchange for such sponsorship fees, AOTH provided written interviews with the Company’s management discussing publicly available information regarding the Company’s project. No equity compensation was paid to AOTH in connection with the sponsorship. AOTH and the Company are unrelated and unaffiliated entities, and the Company is not aware of any interest, directly or indirectly, of AOTH or its principal in the Company or its securities.

The Company also announces an ongoing contract with Grove Corporate Services (“Grove”) to assist in developing presentation materials, press releases, content for social media posts relating to broad market statements relating to the copper mining industry, and incoming investor relations calls. Grove, owned by Stephen Coates, is based in Toronto, Canada, providing incoming investor relations services and social media content creation and postings among other services. The contract commenced on March 31, 2023 and is ongoing at a monthly rate of $4,000. No equity compensation was paid to Grove in connection with the sponsorship. Grove and the Company are unrelated and unaffiliated entities, and the Company is not aware of any interest, directly or indirectly, of Grove or its principal in the Company or its securities.

Qualified Person

Augusto Flores IV, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Quality Assurance and Quality Control (QA/QC)

QA/QC include the systematic insertion of blanks and certified reference materials (CRM), with blanks and CRM making up about 10% of the sample stream. Drill core samples are logged, and samples were split into half using a diamond core saw. The other half of the drill cores are stored on site in a safe and secure facility. Half-core samples are labelled, placed in sealed bags, and shipped directly to ACTLABS in North Bay, ON, an accredited mineral analysis laboratory.

About Copper Road Resources

Copper Road Resources Inc. is a Canadian based explorer engaged in the acquisition, exploration and evaluation of properties for the mining of precious and base metals. The Company is exploring for large copper/gold deposits on the 24,000-hectare Batchewana Bay Project, 80 km north of Sault St. Marie, Ontario, Canada.

For further information, please contact:

John Timmons

President/CEO and Director

Copper Road Resources Inc.

Cellular: (416) 931 2243

Email: jtimmons@copperroad.ca

Web: www.copperroad.ca

Caution Regarding Forward-Looking Information

This news release contains forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Copper Road. Forward-looking statements include estimates and statements that describe Copper Road Resource’s future plans, objectives or goals, including words to the effect that Copper Road Resources or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Copper Road Resources, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, details of the exploration results, potential mineralization, Copper Road Resource’s treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure or inability to complete the Offering on disclosed terms or at all, regulatory approval processes, failure to identify mineral resources, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Copper Road Resources disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ac7c0af1-51b7-4a20-9357-c5f4fac4c3cc

https://www.globenewswire.com/NewsRoom/AttachmentNg/61e04e5f-a9b5-4a39-a1c7-1bcec87fad74

https://www.globenewswire.com/NewsRoom/AttachmentNg/936a1ea7-91da-4f38-a302-d45b9c60adbc

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2ab0b19-a1e6-49c1-bf04-2973fee1ac25

https://www.globenewswire.com/NewsRoom/AttachmentNg/984c0c2c-e122-459e-abc7-55153a51ec5c

https://www.globenewswire.com/NewsRoom/AttachmentNg/37d2a66c-b74e-466d-be2b-9829a85a793e

Yahoo Finance

Yahoo Finance