Should Cooper Tire & Rubber Company (NYSE:CTB) Focus On Improving This Fundamental Metric?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Cooper Tire & Rubber Company (NYSE:CTB).

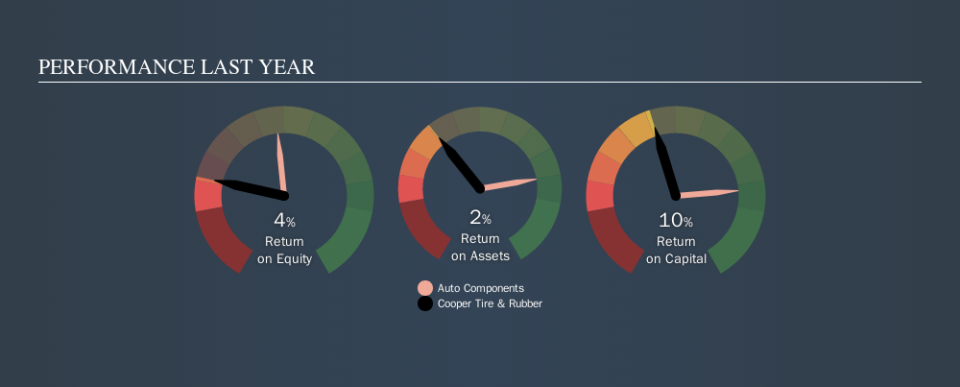

Our data shows Cooper Tire & Rubber has a return on equity of 3.6% for the last year. That means that for every $1 worth of shareholders' equity, it generated $0.04 in profit.

Check out our latest analysis for Cooper Tire & Rubber

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for Cooper Tire & Rubber:

3.6% = US$45m ÷ US$1.3b (Based on the trailing twelve months to September 2019.)

It's easy to understand the 'net profit' part of that equation, but 'shareholders' equity' requires further explanation. It is the capital paid in by shareholders, plus any retained earnings. You can calculate shareholders' equity by subtracting the company's total liabilities from its total assets.

What Does Return On Equity Mean?

ROE looks at the amount a company earns relative to the money it has kept within the business. The 'return' is the yearly profit. The higher the ROE, the more profit the company is making. So, all else being equal, a high ROE is better than a low one. That means ROE can be used to compare two businesses.

Does Cooper Tire & Rubber Have A Good Return On Equity?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As shown in the graphic below, Cooper Tire & Rubber has a lower ROE than the average (15%) in the Auto Components industry classification.

Unfortunately, that's sub-optimal. We'd prefer see an ROE above the industry average, but it might not matter if the company is undervalued. Still, shareholders might want to check if insiders have been selling.

Why You Should Consider Debt When Looking At ROE

Most companies need money -- from somewhere -- to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Combining Cooper Tire & Rubber's Debt And Its 3.6% Return On Equity

Cooper Tire & Rubber has a debt to equity ratio of 0.24, which is far from excessive. Its ROE is rather low, and it does use some debt, albeit not much. That's not great to see. Judicious use of debt to improve returns can certainly be a good thing, although it does elevate risk slightly and reduce future optionality.

But It's Just One Metric

Return on equity is one way we can compare the business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to check this FREE visualization of analyst forecasts for the company.

Of course Cooper Tire & Rubber may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance