Cooling inflation raises odds of Bank of Canada interest rate hold

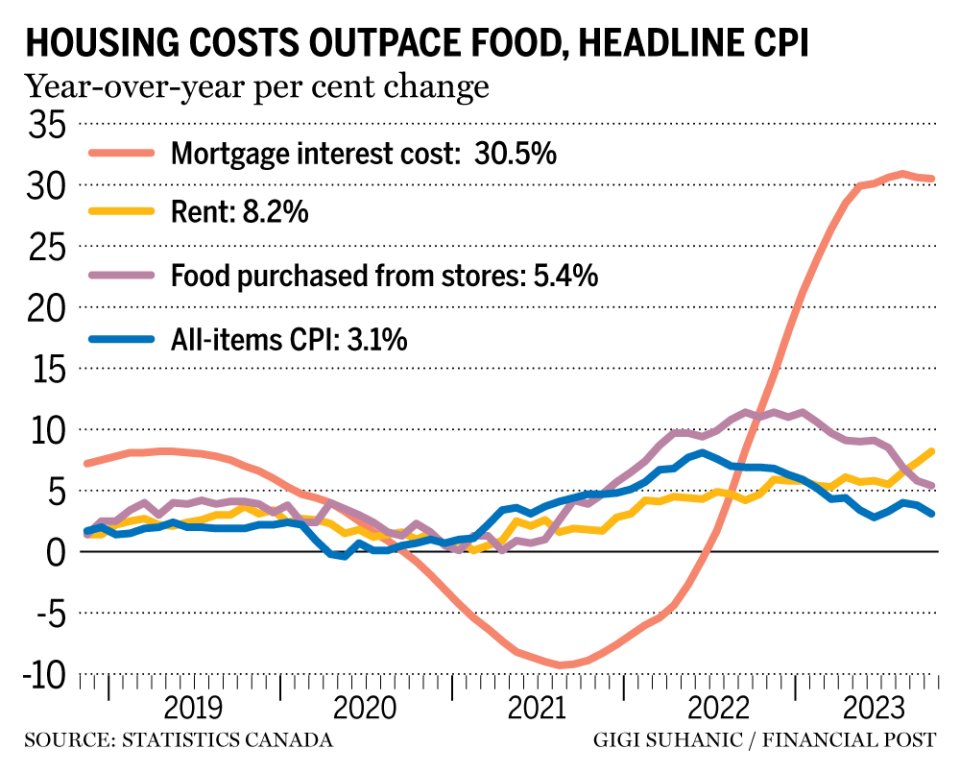

Inflation in Canada slowed to 3.1 per cent year over year in October from 3.8 per cent the month before, leading some economists to predict an interest rate cut by the Bank of Canada as early as next spring.

The deceleration was mainly driven by gas prices, which were down 7.8 per cent from last October, Statistics Canada said on Nov. 21. Prices for food also increased at a slower pace, rising 5.4 per cent from a year ago, compared with an increase of 5.8 per cent in September.

The consumer price index (CPI) reading matched Bloomberg analyst estimates.

On a monthly basis, CPI rose 0.1 per cent in October, following a 0.1 per cent decline in September, said Statistics Canada. Seasonally adjusted, CPI fell 0.1 per cent, which BMO chief economist Douglas Porter says is “the first such decline since the opening months of the pandemic in 2020.”

“Importantly, most of the major core measures are now within or very close to the Bank of Canada’s comfort zone,” said Porter, adding the report wasn’t all good news as services inflation remains “sticky.”

Services inflation quickened to 4.6 per cent year over year from 3.9 per cent in September as prices rose for travel tours, rent and property taxes and other special charges. Rents rose 8.2 per cent from last year and municipal taxes increased 4.9 per cent, those most since 1992, said TD Economics.

This latest reading places headline CPI within striking distance of the Bank of Canada’s target range of one to three per cent.

Stephen Brown of Capital Economics predicts that inflation will drop below three per cent this month as gasoline prices continue to fall and expects it to hit the Bank’s target of two per cent by the third quarter of 2024.

Here’s what economists say about the inflation numbers, what it means for the Bank of Canada and where interest rates go from here.

Douglas Porter, BMO Economics

“While no one expected inflation to go quietly into the night, this is a generally good news step in the right direction.

“Overall, today’s result drives home the point that there is no need for further BoC tightening, especially with the economy already struggling to grow at all and underlying inflation calming. However, before the Bank can even begin seriously considering rate relief, we’ll need to see more evidence that services inflation is also moderating — that could be at least another six months down the road.”

Tu Nguyen, RSM Canada

“Looking ahead, price pressures will continue abating. Consumer spending in aggregate has plateaued, even with immigration. On a per capita basis, consumer spending has actually dropped. Households who get hit with higher mortgage payments find themselves cutting back on discretionary spending. And this is just the beginning: more mortgage terms are up for renewal at higher rates in the upcoming months.

“The CPI report is the latest sign of a cooling economy that should make the Bank of Canada feel comfortable keeping the policy rate unchanged at the December announcement. At this point, the Bank can sit back and let the forces of monetary policy work its way through the economy, keeping inflation near three per cent.”

Alexandra Ducharme, National Bank of Canada

“Overall, although the rise in services prices in this morning’s report is not what the Bank would have liked to see, the overall trend in price pressures remains downward as signs of an economic slowdown persist.”

Stephen Brown, Capital Economics

“There was good news all round in the October CPI report, with the overall CPI falling in month-on-month seasonally adjusted terms for the first time since May 2020, and the average three-month annualized change in CPI-trim and CPI-median falling to three per cent, the lowest since early 2021. With gasoline prices falling further this month and the economy already seemingly in recession, we expect headline inflation to fall to two per cent by the third quarter of next year.”

Simon Harvey, Monex Europe and Canada

“In conjunction with data showing slack building within the labour market and growth data suggesting the economy is in a shallow recession, today’s constructive inflation report has completely undermined the BoC’s hawkish bias. This is yet another confirmatory point for our view that the BoC, having led the Fed during the hiking cycle, will once again be the pace setter in the 2024 easing cycle, with a cut likely as early as April.”

Claire Fan, RBC Economics

Details in today’s inflation report showed further moderation in domestic price pressures in Canada, extending a downside surprise in price growth in September. Not only were the readings themselves lower among many components, the scope of inflation has also continued to narrow.

“Ongoing signs of deterioration in consumer spending and labour market conditions support our outlook for inflation to keep moderating in the quarters ahead. We continue to expect the BoC is done with rate hikes, and for them to cautiously pivot to cuts over the latter half of 2024.”

Charles St-Arnaud, Alberta Central

“The continued deceleration in headline and underlying measures of inflation practically eliminated the probability of another rate increase. Nevertheless, we believe it may still be too early for the BoC to officially declare victory and signal that it is no longer considering a rate hike, especially considering the broadness of inflation and continued strong wage growth. Looking ahead, the BoC is unlikely to contemplate rate cuts until inflation has been brought sustainably below three per cent. This is unlikely to happen until the spring.”

Leslie Preston, TD Economics

“It is encouraging to see another leg down in CPI inflation in October, but the Bank of Canada will likely need to see further progress on core inflation before it feels confident that inflation is headed back to the two per cent target. There is little doubt that Canada’s economy has cooled in recent months, but the chill in inflation that should follow is proving slow to show up. We expect weaker demand in the economy will ultimately dampen price pressures, but given tightness in the labour market, it will take time.”

Bryan Yu, Central 1 credit union

“October’s rapid downshift in inflation adds to a drumbeat of weaker economic data that should keep the Bank of Canada on the sideline at its Dec. 6 meeting. Economic data has stagnated. Gross domestic product is trending flat, with per capita GDP in outright decline, and a cooling labour market, albeit with more robust wage growth. Conditions are expected to worsen going forward as past Bank of Canada hikes continue to impact activity and mortgage renewals through 2024 further lead consumers and businesses to retrench. We expect the Bank of Canada to cut rates late in the second quarter of 2024 provided inflation continues to ease and wage growth abates.”

• Email: gmvsuhanic@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance