Consumer interest in wearables is picking up

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

In 2017, US consumers were more likely to own a wearable and to be interested in acquiring a wearable than they were in 2016, according to Deloitte’s Global Mobile Consumer Survey.

Wearables, connected technology that consumers wear, is a blanket category that includes fitness bands, smartwatches, virtual reality headsets, and smart glasses. Here’s how wearables fared among consumers this year:

Almost as many consumers are using a fitness band as are using an eBook. The share of consumers who said they owned or had access to a fitness band in 2017 rose to 23%, up from 17% in 2016. eBook ownership was 24% in 2017. Fitness bands are much more affordable than smartwatches, but have more limited use cases.

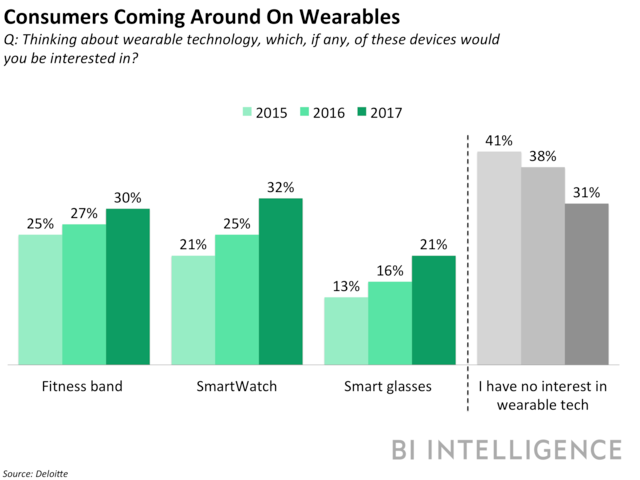

Smartwatches made marginal gains in 2017 but are primed to have a big 2018.Just 13% of respondents said they owned or had ready access to a smartwatch, up just 1 percentage point from last year and a full 10 percentage points behind fitness bands. When consumers were asked if they’d be interested in smartwatches, 32% of respondents said they would be, up from 25% in 2016. Stand-alone LTE connectivity, which lets a smartwatch function without being tethered to a smartphone, should drive smartwatch adoption in 2018.

One in 10 consumers has access to a VR headset. The share of consumers who owned or had access to a VR headset in 2017 rose to 10%, up from 8% in 2016. The increase in ownership is likely due to the increase in VR content across platforms. There should be a much more significant lift in VR headset access in 2018, as new products in the more affordable “stand-alone headset” category that don’t require a computer or smartphone to function come to market.

While smartglasses are not yet a major consumer tech category, interest in the nascent wearable is growing among US consumers. More than 1-in-5 respondents said they’d be interested in smart glasses in 2017, up from 16% in 2016 (see chart, below). This bodes well for overall augmented reality (AR) adoption, and indicates that once AR headsets come to market they’ll have a sizable addressable market. Snap is reportedly working on an AR-enabled version of its Spectacles connected glasses project that could launch in 2018, and it’s rumored that Apple is developing AR glasses that could launch in 2019.

To receive stories like this one directly to your inbox every morning, sign up for the Apps and Platforms Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo Finance

Yahoo Finance