Construction and Maintenance Services Stocks Q1 Teardown: Comfort Systems (NYSE:FIX) Vs The Rest

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the construction and maintenance services industry, including Comfort Systems (NYSE:FIX) and its peers.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 7 construction and maintenance services stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.2%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and construction and maintenance services stocks have held roughly steady amidst all this, with share prices up 2.9% on average since the previous earnings results.

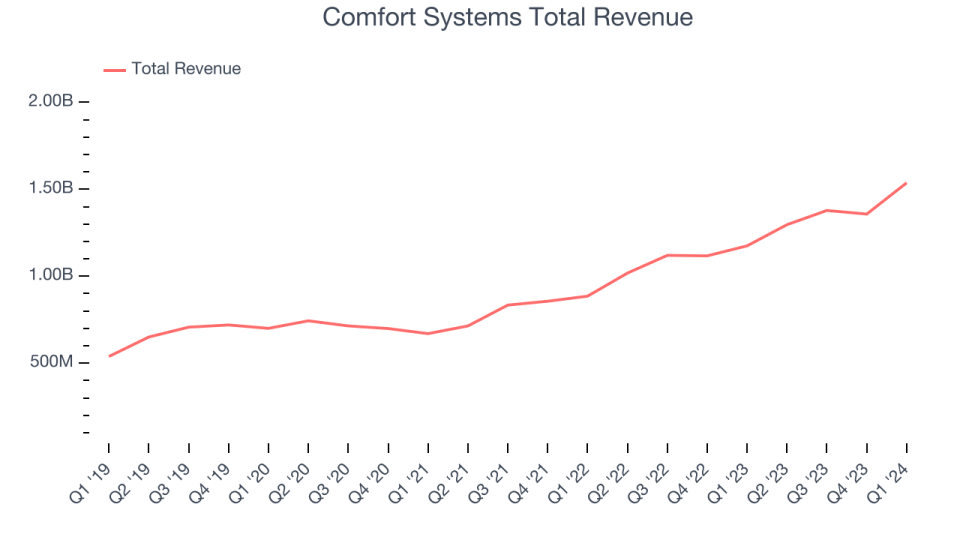

Comfort Systems (NYSE:FIX)

Having historically grown through organic means as well as acquisitions of numerous peers and competitors, Comfort Systems USA (NYSE:FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $1.54 billion, up 30.8% year on year, topping analysts' expectations by 4.8%. It was an incredible quarter for the company, with an impressive beat of analysts' backlog sales estimates.

Brian Lane, Comfort Systems USA’s President and Chief Executive Officer, said, “Our expert and dedicated employees achieved superb execution for our customers this quarter, and our newly acquired companies are off to a great start. First quarter results were extraordinary, with per share earnings more than a dollar above the same quarter last year, increased backlog, and over $140 million in cash flow. Our mechanical business improved, and our electrical segment profitability increased to unprecedented levels. Construction and service continue to flourish, demand remains supportive, and we are optimistic that we will continue to achieve strong results in 2024.”

Comfort Systems achieved the fastest revenue growth of the whole group. The stock is down 5.7% since the results and currently trades at $293.86.

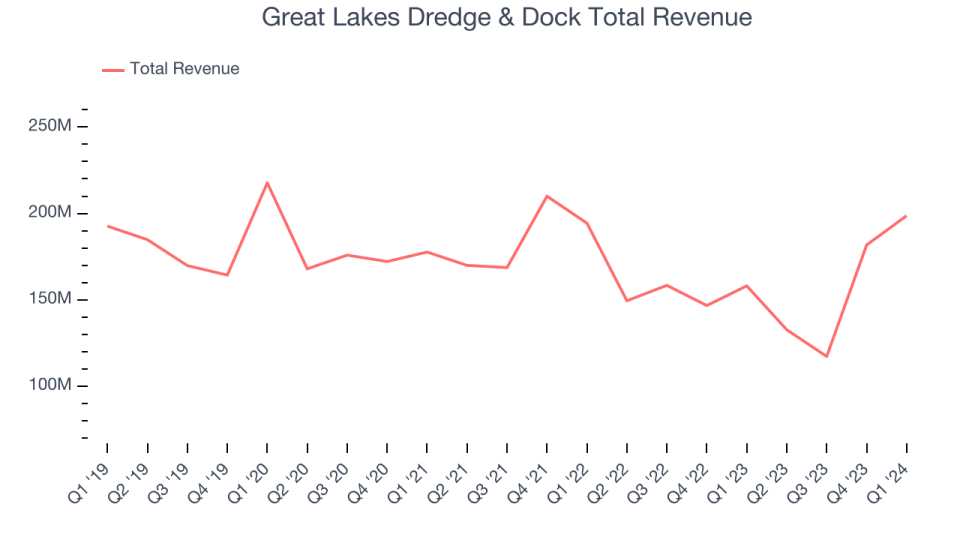

Great Lakes Dredge & Dock (NASDAQ:GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $198.7 million, up 25.7% year on year, outperforming analysts' expectations by 13.2%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

Great Lakes Dredge & Dock scored the biggest analyst estimates beat among its peers. The stock is up 22% since the results and currently trades at $8.6.

Is now the time to buy Great Lakes Dredge & Dock? Access our full analysis of the earnings results here, it's free.

Weakest Q1: APi (NYSE:APG)

Started in 1926 as an insulation contractor, APi (NYSE:APG) provides life safety solutions and specialty services for buildings and infrastructure.

APi reported revenues of $1.60 billion, down 0.8% year on year, falling short of analysts' expectations by 0.1%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

APi had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 3.4% since the results and currently trades at $36.52.

Read our full analysis of APi's results here.

Construction Partners (NASDAQ:ROAD)

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction Partners reported revenues of $371.4 million, up 14.3% year on year, in line with analysts' expectations. It was a decent quarter for the company, with an impressive beat of analysts' organic revenue estimates.

Construction Partners delivered the highest full-year guidance raise among its peers. The stock is down 1.5% since the results and currently trades at $53.02.

Read our full, actionable report on Construction Partners here, it's free.

Primoris (NYSE:PRIM)

Listed on the NASDAQ in 2008, Primoris (NYSE:PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Primoris reported revenues of $1.41 billion, up 12.4% year on year, surpassing analysts' expectations by 1.9%. It was a solid quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 0.8% since the results and currently trades at $47.41.

Read our full, actionable report on Primoris here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance