Should You Consider Invesco (IVZ) for Its Dividend Yield?

In this current backdrop, when the finance sector is facing uncertain macroeconomic conditions, investors should watch solid dividend-yielding stocks. Today, we are discussing one such stock, Invesco IVZ.

Headquartered in Atlanta, GA, IVZ provides a wide range of investment products and services, with its footprints across 20 countries and assets under management (AUM) worth $1.54 trillion as of Jun 30, 2023.

IVZ has been paying quarterly dividends on a regular basis and raising the same. The last hike of 6.7% to 20 cents per share was announced in April 2023. In the past five years, it increased dividends four times.

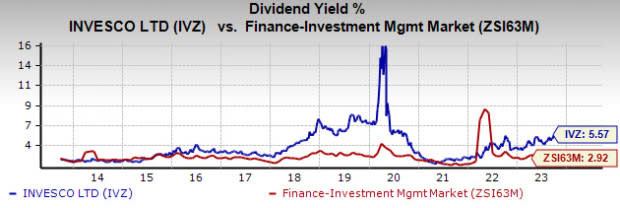

Considering the last day’s closing price of $14.36 per share, Invesco’s dividend yield currently stands at 5.57%. This is impressive compared with the industry’s average of 2.92%, in turn, attracting investors as it represents a steady income stream.

Image Source: Zacks Investment Research

Is the Invesco stock worth a look to earn a high dividend yield? Let’s check the company's financials to understand the risks and rewards.

Apart from regular quarterly dividend payouts, IVZ has a share repurchase program in place. In July 2016, the company’s board approved the share repurchase authorization. As of Jun 30, 2023, it had nearly $382.2 million worth of shares remaining under the authorization.

Invesco has been undertaking initiatives to improve operating efficiency. Though its total operating expenses increased marginally in the first half of 2023, the metric recorded a negative compound annual growth rate (CAGR) of 4.8% over the last three years ended 2022. We project adjusted total expenses to witness a modest rise this year despite undertaking several efficiency-improving measures.

The company’s AUM witnessed a CAGR of 2.2% over the last three years ended 2022, with the momentum continuing in the first half of 2023. The acquisition of OppenheimerFunds in 2019 primarily resulted in a significant rise in its AUM balance. Invesco is also taking advantage of the increasing demand for passive products and alternative asset classes, which were 33.9% and 11.8% of total AUM, respectively, as of Jun 30, 2023. We project passive AUM and alternate asset class AUM balance to witness a CAGR of 9.3% and 6.9%, respectively, by 2025.

Further, Invesco maintains a solid foothold in Europe, Canada and the Asia-Pacific regions. As of Jun 30, 2023, the company’s client AUM outside the United States constituted nearly 28% of total AUM. Acquisitions of U.K.-based advisor, Intelliflo, along with Europe-based Source, will likely help the company generate further momentum from business in those regions.

On the flip side, a challenging operating backdrop and macroeconomic headwinds are likely to hurt Invesco’s revenues in the near term. Also, the presence of high levels of goodwill on the balance sheet is a concern.

Therefore, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as this will likely help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Over the past six months, shares of IVZ have declined 6.4% against the industry‘s upside of 11.3%.

Image Source: Zacks Investment Research

Other Finance Stocks Worth Considering

A couple of other finance stocks like Premier Financial PFC and Citigroup C are worth a look, as these too have solid dividend yields.

Considering the last day’s closing price, Premier Financial’s dividend yield currently stands at 7.27%. In the past three months, shares of PFC have increased 4.8%. Currently, it carries a Zacks Rank #3.

Citigroup carries a Zacks Rank #3 at present. Based on the last day’s closing price, its dividend yield currently stands at 5.17%. In the past three months, shares of C have declined 11.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Premier Financial Corp. (PFC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance