ConocoPhillips' Barossa Development Plan Gets Regulatory Nod

ConocoPhillips COP recently got consent from National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) of Australia for developing an offshore gas field, per media reports.

The Barossa field is situated roughly 300 kilometers north of Darwin – the capital of Australia’s Northern Territory. Annually, the field will likely generate 3.7 million tons of LNG and 1.5 million barrels of condensate. Barossa project, with a lifespan of as high as 25 years, is expected to come online by 2023.

Investors should know that before giving the approval, the Australian watchdog assessed the risks posed on the environment by the project over its lifespan. Along with the operatorship, the development’s 37.5% interest is possessed by ConocoPhillips. The remaining 37.5% and 25% stakes are in possession of SK E&S Australia and Santos Offshore.

Headquartered in Houston, TX, ConocoPhillips is among the leading upstream energy players in the world. Over the past year, the stock gained 28.1%, outperforming the industry’s 10.7% increase. Also, its earnings surprise history is impressive with an average positive surprise of 144.5% for the prior four quarters.

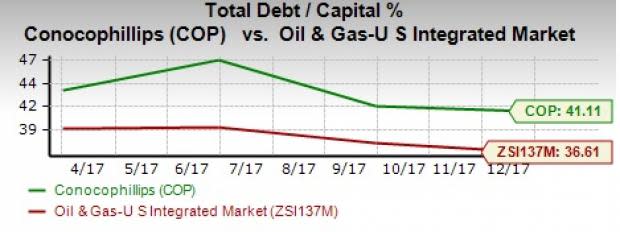

However, the company’s balance sheet picture is weaker as compared with the industry. ConocoPhillips’ debt to capitalization ratio stands at 41.1%, higher than the industry’s 36.6% rally.

As a result, ConocoPhillips carries a Zacks Rank #3 (Hold). Meanwhile, some better-ranked players in the energy space include W&T Offshore, Inc. (WTI), Pioneer Natural Resources Company (PXD) and Concho Resources Inc. (CXO). W&T Offshore carries a Zacks Rank #2 (Buy), while Pioneer and Concho Resources sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Headquartered in Houston, TX, W&T Offshore is primarily an upstream energy player. It is expected to witness year-over-year earnings growth of 3.6% in 2018.

Headquartered in Irving, TX, Pioneer Natural Resources is an upstream energy firm. It has an average positive earnings surprise of 66.9% for the last four quarters.

Headquartered in Midland, TX, Concho is also an upstream energy company. It will likely see a year-over-year surge of 73.2% in 2018 earnings.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance