CompX International And Two More Dividend Stocks For A Steady Income Stream

In recent market activities, the United States has seen a mix of reactions to economic indicators and Federal Reserve Chair Jerome Powell's comments, reflecting a cautiously optimistic outlook on employment and inflation. Amid these conditions, dividend stocks like CompX International offer an appealing option for investors seeking steady income streams in a fluctuating economic landscape.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Premier Financial (NasdaqGS:PFC) | 6.23% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.49% | ★★★★★★ |

Lakeland Bancorp (NasdaqGS:LBAI) | 4.79% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.74% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.41% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.20% | ★★★★★★ |

Sandy Spring Bancorp (NasdaqGS:SASR) | 6.25% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.69% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.91% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.24% | ★★★★★★ |

Click here to see the full list of 273 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

CompX International (NYSEAM:CIX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CompX International Inc. is a company that specializes in the manufacturing and sale of security products and recreational marine components, mainly serving the North American market, with a market capitalization of approximately $422.24 million.

Operations: CompX International Inc.'s revenue is generated from two primary segments: marine components, which brought in $40.11 million, and security products, contributing $121.18 million.

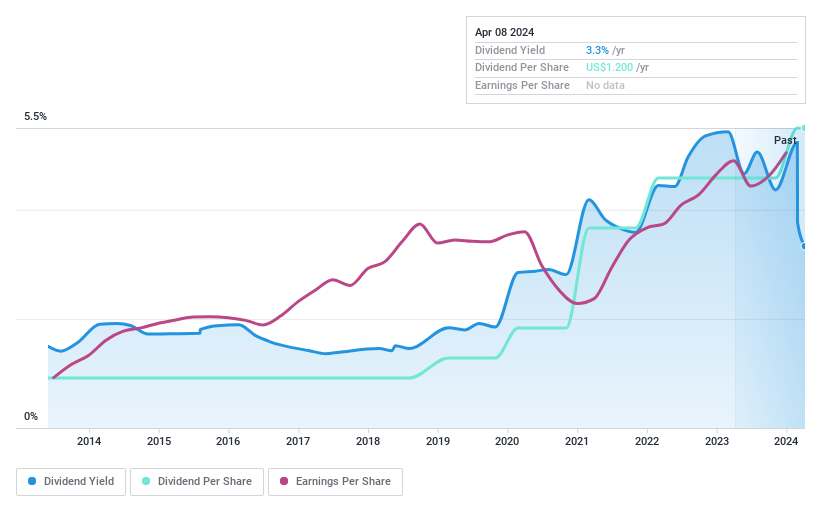

Dividend Yield: 3.3%

CompX International Inc. recently increased its quarterly dividend to US$0.30 per share, signaling confidence in its financial health amidst a year of solid performance with sales reaching US$161.29 million and net income at US$22.59 million, up from the previous year. The company's earnings per share also saw growth, indicating a positive trajectory. Despite this progress and a reasonable payout ratio ensuring dividend coverage by earnings and cash flows, CompX's dividend yield remains modest at 3.33%, below the top quartile of U.S market payers, reflecting potential concerns for yield-focused investors but highlighting reliability and sustainability in its dividend payments over the past decade.

Dive into the specifics of CompX International here with our thorough dividend report.

Our valuation report here indicates CompX International may be undervalued.

Cal-Maine Foods (NasdaqGS:CALM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cal-Maine Foods, Inc. operates in the egg industry, focusing on the production, grading, packaging, marketing, and distribution of shell eggs with a market capitalization of approximately $3.08 billion.

Operations: Cal-Maine Foods, Inc. generates its revenue primarily through the sale of shell eggs, amounting to $2.37 billion.

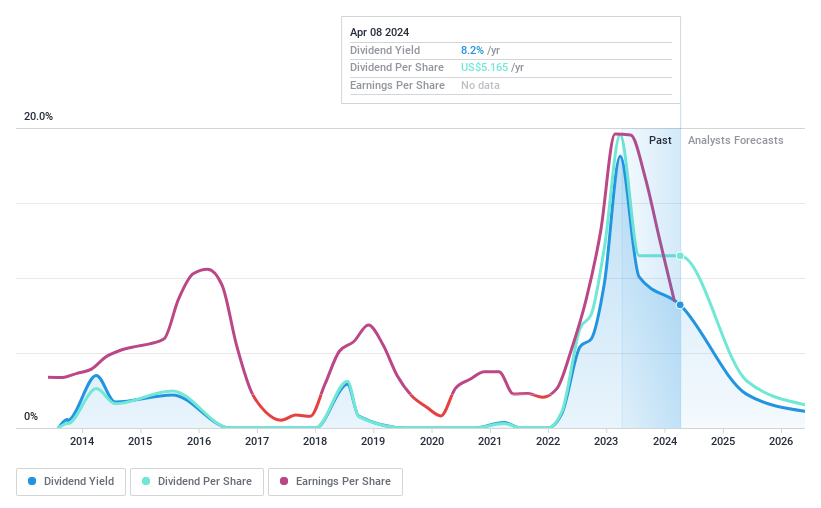

Dividend Yield: 8.2%

Cal-Maine Foods recently announced a dividend of US$1.00 per share for Q3 2024, adhering to its variable dividend policy linked to quarterly net income, showcasing a commitment to returning value to shareholders despite recent challenges. The company's sales dropped from US$997.49 million to US$703.08 million year-over-year in the third quarter, with net income also declining significantly from US$323.22 million to US$146.71 million, reflecting operational and market pressures including a recent avian influenza outbreak affecting production capacity. Despite these hurdles and a high cash payout ratio suggesting potential sustainability concerns for its generous 8.21% yield, Cal-Maine maintains a lower than average price-to-earnings ratio at 11.2x versus the U.S market average, indicating value potential amidst volatility in dividend payments and performance metrics.

Navigate through the intricacies of Cal-Maine Foods with our comprehensive dividend report here.

Our valuation report here indicates Cal-Maine Foods may be overvalued.

Eastman Chemical (NYSE:EMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastman Chemical Company is a global specialty materials company with operations in the United States, China, and other international markets, boasting a market capitalization of approximately $11.74 billion.

Operations: Eastman Chemical Company generates its revenue through diverse segments, including Fibers ($1.30 billion), Advanced Materials ($2.93 billion), Chemical Intermediates ($2.14 billion), and Additives & Functional Products ($2.83 billion).

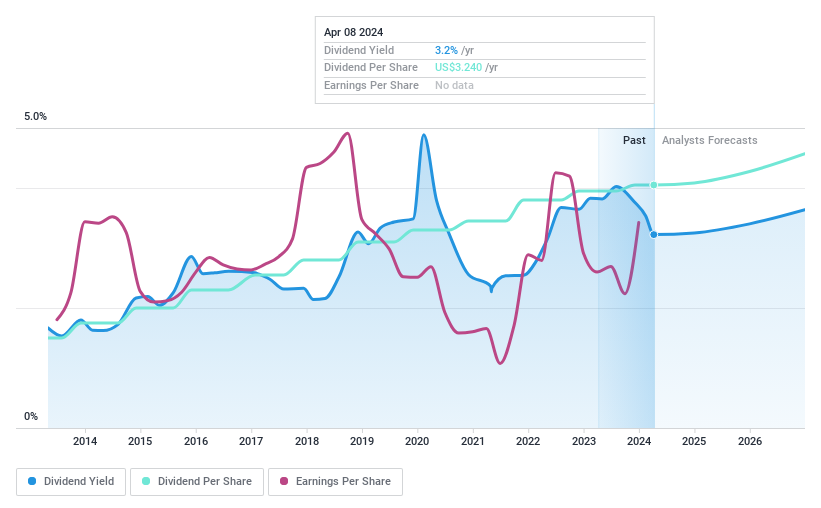

Dividend Yield: 3.2%

Eastman Chemical, with a 3.22% dividend yield, demonstrates a balanced approach to shareholder returns through its dividends, supported by a modest payout ratio of 42.2%, indicating sustainability from earnings and cash flows (Cash Payout Ratio: 70.4%). Despite this reliability and growth in dividends over the past decade, it's noted that the yield is below the top quartile of U.S market payers at 4.69%. Recent strategic expansions like the new molecular recycling facility in Kingsport signal potential for future growth but are juxtaposed against concerns over high debt levels and significant insider selling in the last quarter, suggesting areas for investor caution amidst an otherwise stable dividend profile.

Summing It All Up

Delve into our full catalog of 273 Top Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance