Competition keeping lid on most mortgage rates, but inflation data could be game changer

The latest data show our economy has more pep in its step than expected. That’s the good news.

The bad news is that hotter inflation expectations have driven yields higher this month. That’s made it significantly more expensive to fund a mortgage, leading several lenders to ratchet up fixed-mortgage rates.

Fortunately, Canada’s most competitive lenders are showing consumers some love by not hiking yet. That speaks to how voracious the competition is for mortgage customers.

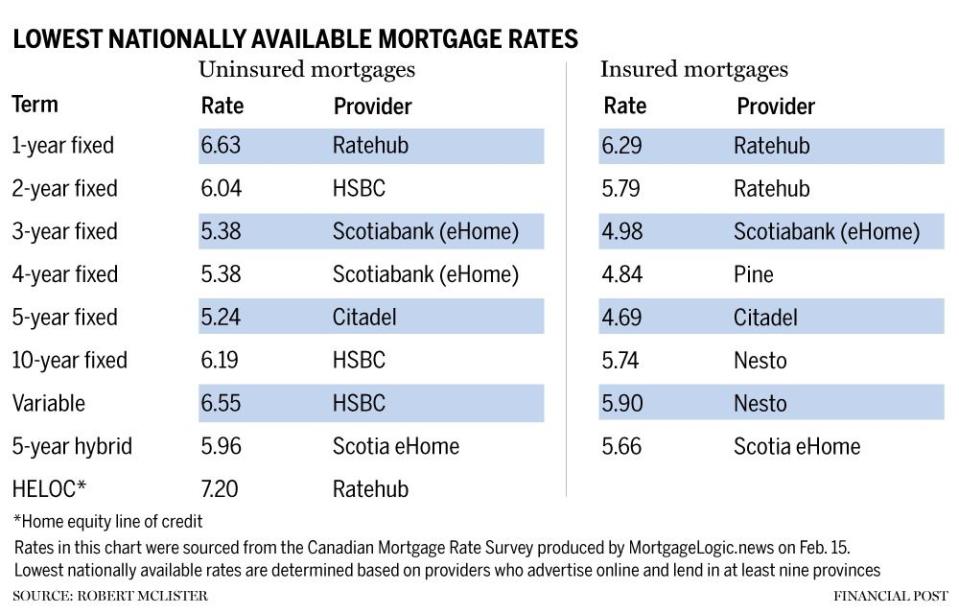

Among the leading nationally advertised rates, there were only two changes this week. The lowest three- and four-year fixed rates fell one and six basis points respectively, thanks to more aggressive pricing from Scotiabank’s online eHOME arm. The bank is trying hard to push its online mortgage channel as more automation lowers its costs and speeds up processing for customers.

Looking out to next week, the rate market has a lot riding on Tuesday — when Canada’s critical CPI report lands. If inflation doesn’t show some headway from December’s 3.4 per cent reading, the bond market could nudge fixed-mortgage rates skyward.

Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic.news. You can follow him on Twitter at @RobMcLister.

Yahoo Finance

Yahoo Finance