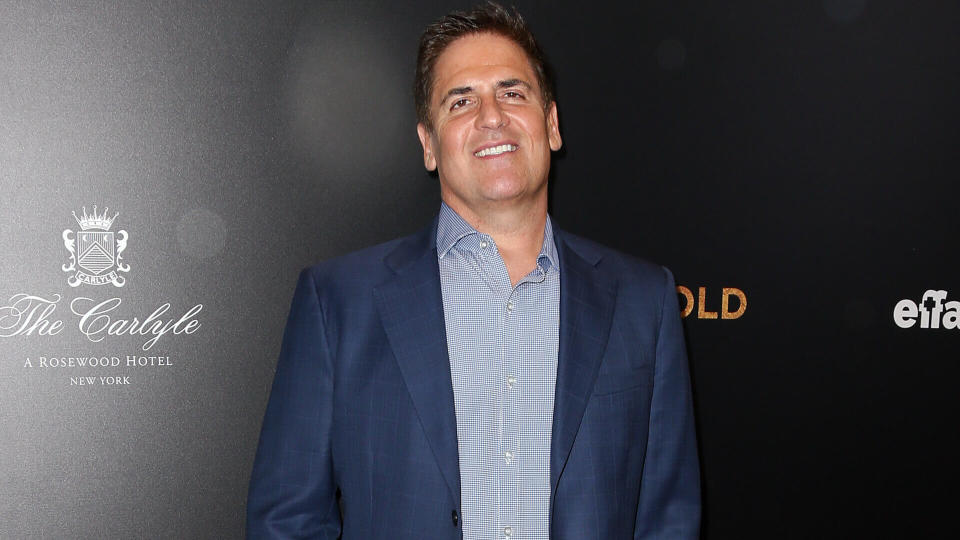

What Companies Has Mark Cuban Invested In?

Mark Cuban is best known as the billionaire owner of the Dallas Mavericks, but it turns out he has a number of diverse interests — and he's willing to support them financially. A look at the website of Mark Cuban Companies shows the variety of companies he either owns outright or has invested in, and the list is impressive in both its volume and breadth.

Read: ‘Shark Tank’ Stars Share 50 Business Tips

Check Out: Mark Cuban's Top Investing Advice

His investments include businesses owned by minorities or women and those started by entrepreneurs with ties to the military. His portfolio is growing in the block chain sector. Cuban's interests in companies include those that focus on health, fitness and eating well, as well as the environment.

The investments Cuban has made through the television show "Shark Tank," where he and other business experts hear pitches from entrepreneurs who need an infusion of cash for their startups, mirror the depth of the billionaire's interests. Read on to learn more about 10 of the companies Mark Cuban has bought into through "Shark Tank" — and some of the impressive financial gains so far.

Last updated: Oct. 13, 2021

Gameday Couture

In 2014, Marl Cuban invested $500,000 for a 30% stake of Gameday Couture, which started out making officially licensed college apparel for women. Co-owners Kurt and Shawnna Feddersen began the Oklahoma-based company to help women look stylish while cheering for their favorite team. By 2018, Gameday Couture had annual sales of $12 million. At the time of Cuban’s investment, Gameday Couture held licenses with more than 30 universities. Today, it holds more than 200 NCAA licenses and is sold in more than 2,500 stores nationwide.

Find Out: These Billionaires Got Richer During The Pandemic

Nuts ‘N More

A meeting between three forty-something friends in 2010 in Providence, Rhode Island, led to the creation of Nuts ‘N More, which started out selling high-protein nut butter spread with fitness enthusiasts in mind. An appearance on “Shark Tank” in 2013 garnered the young company an investment of $75,000 from Cuban and fellow shark Robert Herjavec in exchange for 35% of the company. Today, the company has more than 20 flavors and sells high-protein peanut and almond butter spreads, snack packs and more. Before the appearance on “Shark Tank,” the company made sales of about $100,000 a year. By 2018, sales reached about $6 million annually.

More: 16 Money Rules That Millionaires Swear By

InstaFire

Konel Banner long had recognized the need for fire-starting technology, and when he met outdoor enthusiast Frank Weston, who also had a background in firefighting, they partnered to develop InstaFire. They met mornings for nine months in an abandoned, owl-infested warehouse to develop a product that was safe, easy to use and reliable – something that could be counted on in an emergency. Cuban teamed with fellow investor Lori Greiner to put $300,000 into the company in exchange for 30% ownership in 2016. The company has expanded its product offerings, especially those that boost environmental friendliness. On her website, Greiner said the InstaFire had $7.5 million in retail sales in the first three years since its “Shark Tank” appearance.

See: Stocks That Would Have Made You Rich Today

Mrs. Goldfarb’s Unreal Deli

Jenny Goldfarb grew up in a family that ran a Jewish deli business in New York. Once she went vegan, she decided that the deli staple of a corned beef sandwich could co-exist with her lifestyle and created Mrs. Goldfarb’s Unreal Deli in 2018, producing plant-made deli meats. Her products are kosher, animal-free, cholesterol-free, nitrate-free, low in fat, low carb and full of protein. In a 2019 “Shark Tank” episode, Cuban gave Goldfarb $250,000 for a 20% stake in the company, and it’s one of just several investments he’s made in plant-based businesses. Cuban is a vegetarian.

Look: 13 Toxic Investments You Should Avoid

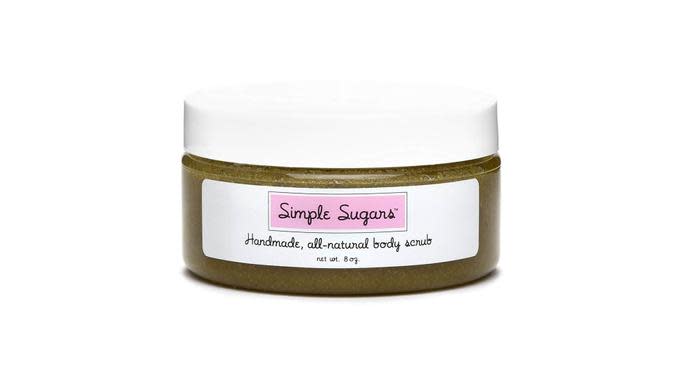

Simple Sugars

Lani Lazzari was a young teen looking to find relief from her eczema. Despite numerous visits to the dermatologist, she had no solution for her sensitive skin until she started experimenting with her own concoctions in the family kitchen. By 2005, for the first time ever, she had relief and was eczema-free, thanks to her own recipes. She appeared on “Shark Tank” in 2013, and Cuban walked away with 33% of the company for his $100,000 investment. Sales for the Pittsburgh-based company rose from $44,000 to $6 million after the “Shark Tank” appearance.

Learn More: Want to Invest in Bitcoin but Don’t Know How? We’ve Got You Covered

Grouphug

In 2018, first-generation American Krystal Persaud decided to use her experience designing consumer electronics at a New York company to start Grouphug and emphasize sustainability. Her creation: window solar panels that connect to charges for cell phones and other devices. “While the sun hits your solar panel during the day, all of that energy gets stored in an internal battery, meaning you can charge your favorite devices day or night,” she said on a 2020 episode of “Shark Tank.” Sold on the promise of the concept, Cuban gave her $150,000 for a 25% stake in the company.

There currently is a waiting list for the $149 solar charger.

Check Out: Just How Rich Are Oprah, Bill Gates and Other Big Names?

Coconut Girl

Spurred by his belief in healthy eating (and maybe a sweet treat, too), Cuban bought a 20% stake of Coconut Girl in 2020 for $180,000. The company was founded by Francheska "Frankie" Yamsuan, who developed the dairy-free, gluten-free line of ice cream sandwiches in 2018. Coconut Girl’s products are sold in flavors that include Hang Loose Vanilla and Aloha Chocolate. Coconut Girl doesn’t use cane sugar and products are sweetened with dates, honey and maple syrup. The company’s website boasts the treats are "grain free, paleo and pretty much guilt free."

Advice: 20 Things Mark Cuban Says To Do With Your Money

Shower Toga

An outdoor enthusiast, Georgia mom Kressa Peterson knew what it’s like to get grimy and muddy with no way to remove her dirty clothes to wash off – without creating a public spectacle. So she created Shower Toga – which users put over their clothes before pulling them off from underneath – with campers, bikers, endurance athletes and more in mind. It’s washable and reusable. While at least one of the investors on “Shark Tank” likened it to a plastic trash bag, Cuban and guest Shark Alli Webb saw the value and plunked down $80,000 for a 40% ownership of the company.

See: 6 Small Investment Ideas When You Have Less Than $500

Ready. Set. Eat!

Founded in 2017, the company – Ready. Set. Eat! – introduces children as young as 4 months old to peanut, egg and milk allergens with the goal of reducing kids’ risk of developing allergies to them by as much as 80%. That is achieved by supplementing a baby’s bottle or food with a packet of the allergens. Cuban made an initial investment of $350,000 through “Shark Tank” and then took part in a $3 million financing round.

“As a parent of a child with a severe peanut allergy, I know firsthand the impact it has on families across the country. ... We will work on making sure every parent knows about early allergen introduction,” Cuban said in a news release. He is a father of three.

Take a Look: Ways Investing Will Change in 25 Years

The Living Christmas Co.

As a teenager in Southern California, Scott Martin used to deliver Christmas trees to customers. “Because I worked in a nursery I thought, 'Why do people cut down trees to bring in the house when there are perfectly good living trees that can be brought in the house and afterwards they keep on living,'" he told Spectrum News in 2019. So as an adult, he founded The Living Christmas Co., which delivers live, potted trees that families care for during the holidays, and he’ll return to pick them up. Then, he will rent the same tree to another family next year, saving the life of a tree. Needing money for capital and infrastructure, he went on “Shark Tank” and found some disbelievers. But Cuban, calling himself a “believer in convenience with a conscience,” invested $150,000 for 40% of the company. The company is still in business, but not much is known about its growth and revenues.

[rock-component slug="more-from-gobankingrates"]

Photo Disclaimer: Please note some photos are for representational purposes only and may not reflect the exact product listed.

This article originally appeared on GOBankingRates.com: What Companies Has Mark Cuban Invested In?

Yahoo Finance

Yahoo Finance