Companies Insiders Just Bought In May

One indicator for beating the market, which has held up extremely well over time is: if executives, directors or others with inside knowledge of a public company are buying or selling shares, investors should consider doing the same thing. This is because these insiders have unique insights into their own companies compared to individual investors. Should you followsuit? Below, I’ve selected three TSX companies which insiders have recently accumulated more shares in.

SSR Mining Inc. (TSX:SSRM)

SSR Mining Inc. engages in the acquisition, exploration, development, and operation of precious metal resource properties in the Americas. Formed in 1946, and currently run by Paul Benson, the company size now stands at 1,030 people and with the company’s market capitalisation at CAD CA$1.60B, we can put it in the small-cap category.

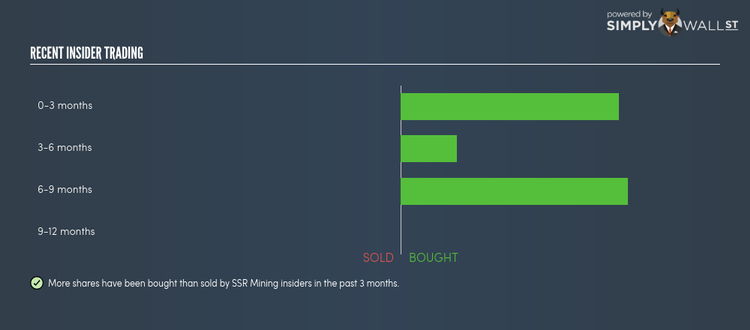

SSR Mining Inc’s (TSX:SSRM) insiders have invested 13,450 shares in the large-cap stocks within the past three months. In total, individual insiders own less than one million shares in the business, or around 0.17% of total shares outstanding.

Latest buying activities involved the following insiders: Alan Pangbourne (management) . and Paul Benson (management and board member) .

With revenues predicted to grow 46.65%, over the next three years from today’s level, which is an underlying driver of the impressive earnings growth of 85.72%, insiders may be buying based on SSRM’s optimistic outlook which they believe are not yet priced into the stock. Dig deeper into SSR Mining here.

Golden Star Resources Ltd. (TSX:GSC)

Golden Star Resources Ltd. operates as a gold mining and exploration company. Formed in 1992, and now run by Samuel Coetzer, the company size now stands at 1,176 people and with the market cap of CAD CA$338.93M, it falls under the small-cap stocks category.

Golden Star Resources Ltd (TSX:GSC) is one of Canada’s small-cap stocks that saw some insider buying over the past three months, with insiders investing in 106,000 shares during this period. In total, individual insiders own over 2 million shares in the business, which makes up around 0.55% of total shares outstanding.

Insiders that have recently bought more shares are: Karen Walsh (management) . and Timothy Baker (board member) .

Analysts anticipate a relatively flat top-line growth year-on-year over the next couple of years. However, earnings are predicted to grow at an impressive rate of 20.53% in the upcoming year, from today’s level, which could indicate the company’s cost controls will show meaningful results, offsetting the slow revenue growth. Insiders may have confidence in these cost initiatives, or believe the market has overly penalized the company’s shares, leading to an opportune time to buy. More detail on Golden Star Resources here.

AGT Food and Ingredients Inc. (TSX:AGT)

AGT Food and Ingredients Inc. produces and exports pulses, staple foods, and food ingredients worldwide. Started in 2009, and currently headed by CEO Murad Al-Katib, the company currently employs 2,100 people and with the stock’s market cap sitting at CAD CA$387.06M, it comes under the small-cap group.

AGT Food and Ingredients Inc’s (TSX:AGT) insiders have invested 201,784 shares in the small-cap stocks within the past three months. In total, individual insiders own over 4 million shares in the business, which makes up around 17.13% of total shares outstanding.

Latest buying activities involved the following insiders: Bradley Martin . , Drew Franklin (management and board member) . , Gaetan Bourassa (board member) . , John Gardner . , Lori Ireland (board member) . , Murad Al-Katib (management) . , Paul Rivett . and Randy Rosen (management) .

The entity that bought on the open market in the last three months was

Hamblin Watsa Investment Counsel Ltd.. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

On average, analysts expect a robust revenue growth of 12.52% per year for the next five years, which will drive the meaningful bottom-line growth of 103.16%. AGT’s positive future sentiment could be a key driver of insiders ramping their shares if they believe the growth is not yet reflected in the current share price. More on AGT Food and Ingredients here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance