CommScope (COMM) Q1 Loss Narrower Than Expected, Sales Fall

CommScope Holding Company, Inc. COMM reported soft first-quarter 2024 results, with a decrease in revenues and earnings on a year-over-year basis. Lower capital spending from customers, inventory adjustments, macroeconomic challenges and decrease in net sales in major business verticals led to top-line contraction year over year. However, both the bottom line and top line beat the respective Zacks Consensus Estimate.

Net Income

On a GAAP basis, the company recorded a net loss of $375.2 million or a loss of $1.77 per share compared with a net loss of $11.7 million or a loss of 6 cents per share in the year-ago quarter. The considerably wider loss was primarily due to top-line contraction.

Non-GAAP net loss from continuing operations was $20.3 million or a loss of 8 cents per share against net income from continuing operations of $86.7 million or 34 cents per share in the prior-year quarter. The bottom line was narrower than the Zacks Consensus Estimate of a loss of 23 cents.

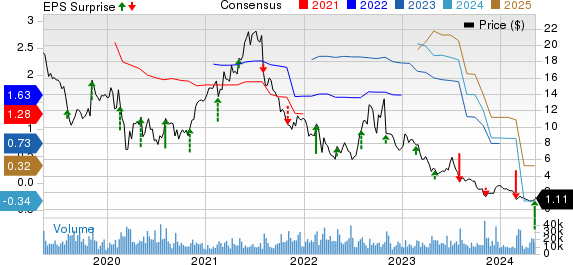

CommScope Holding Company, Inc. Price, Consensus and EPS Surprise

CommScope Holding Company, Inc. price-consensus-eps-surprise-chart | CommScope Holding Company, Inc. Quote

Revenues

Revenues for the reported quarter were $1.17 billion, down from $1.66 billion in the prior-year quarter. Net sales declined in major business verticals due to lower demand owing to larger-than-expected customer and channel inventory buildup, global economic slowdown and cautious customer spending. Revenues, however, beat the consensus estimate of $1.04 billion.

Sales in Connectivity and Cable Solutions were down 26.4% to $604.7 million, primarily due to a decline in broadband business.

Sales in Outdoor Wireless Networks came in at $196 million, down 24.1% year over year, owing to lower product sales in Base Station Antennas and HELIAX.

Sales in Networking, Intelligent Cellular and Security Solutions decreased 36.6% to $180.3 million, primarily on a decline in Ruckus and Intelligent Cellular Networks.

Sales in Access Network Solutions totaled $187.4 million, down 37.6% year over year due to a decline in Access Technologies and Broadband Network Solutions.

Other Details

Gross profit decreased to $402.2 million from $630.2 million in the year-ago quarter due to lower revenue generation. Due to a decline in asset impairment charges, total operating expenses fell to $408.9 million from $447.1 million in the year-ago quarter. Operating income totaled $2.9 million compared with $183.1 million in the year-ago quarter. Non-GAAP adjusted EBITDA was $153 million compared with $313.7 million a year ago.

Cash Flow & Liquidity

In the first quarter of 2024, CommScope utilized $177.7 million in cash for operating activities compared with a cash utilization of $46.1 million in the prior-year period. As of Mar 31, 2024, the company had $357.2 million in cash and cash equivalents with $9,244.6 million long-term debt. The company had no outstanding debt under its asset-based revolving credit facility and had $550.5 million available, with total liquidity of approximately $907.7 million.

Zacks Rank

CommScope currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Sohu.com Limited SOHU is scheduled to release first-quarter 2024 earnings on May 20. The Zacks Consensus Estimate for SOHU is pegged at a loss of 22 cents per share.

Keysight Technologies, Inc. KEYS is set to release second-quarter fiscal 2024 earnings on May 20. The Zacks Consensus Estimate for earnings is pegged at $1.38 per share, implying a decline of 34.9% from the year-ago reported figure.

Keysight has a long-term earnings growth expectation of 4.1%. KEYS delivered an average earnings surprise of 6.4% in the last four reported quarters.

Workday, Inc. WDAY is slated to release first-quarter fiscal 2025 earnings on May 23. The Zacks Consensus Estimate for earnings is pegged at $1.57 per share, indicating growth of 19.8% from the year-ago reported figure.

Workday has a long-term earnings growth expectation of 22.7%. WDAY delivered an average earnings surprise of 12.7% in the last four reported quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sohu.com Inc. (SOHU) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance