Comfort Systems (FIX) Up 56% YTD: Should You Buy Now?

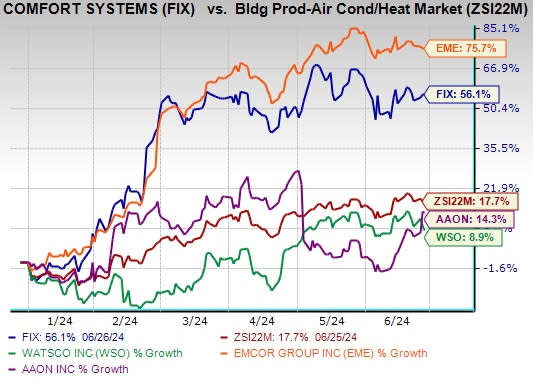

Comfort Systems USA, Inc.’s FIX shares have surged 56.1% in the year-to-date period, outperforming the Zacks Building Products - Air Conditioner and Heating industry’s 17.7% growth. The share price trend can be compared with a few similar companies including Watsco, Inc. WSO, AAON, Inc. AAON, and EMCOR Group, Inc. EME, whose shares gained 8.9%, 14.3%, and 75.7%, respectively.

This building and service provider for mechanical, electrical, and plumbing building systems notably benefits from robust demand trends, accretive acquisitions, and its focus on rewarding shareholders through dividends. The company’s focus on innovation while ensuring productivity growth, accompanied by a diversified mechanical, electrical, and modular construction and service portfolio, is aiding its uptrend. Continuous investments in new technologies, piloting emerging technologies, and seeking opportunities to partner with industry-leading tech firms stand out as its growth drivers.

Despite consistent investment activities and increased expense scenario, FIX focuses on rewarding its shareholders, on the back of a strong balance sheet and a consistent free cash flow.

The Zacks Consensus Estimate for the company’s 2024 earnings has risen to $11.90 per share from $11.42 in the past 60 days. The estimated figure indicates 36.2% growth from the prior year’s reported levels. Also, the consensus estimate for second-quarter earnings implies 57.5% year-over-year growth. FIX delivered a trailing four-quarter earnings surprise of 20%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper to understand the growth drivers of this Zacks Rank #1 (Strong Buy) company. You can see the complete list of today’s Zacks Rank #1 stocks here.

What Makes the Stock Worth Buying?

Increased Activity in Technology & Manufacturing Sectors: Comfort Systems is witnessing strength in demand in the technology and manufacturing sectors, particularly for data centers, chip plants, food and pharmaceuticals. Increased activity in these sectors is proving to be beneficial for the company’s growth prospects, highlighting the strong market conditions.

The first-quarter 2024 revenue growth was largely driven by same-store activity, resulting in increased same-store revenues. The mechanical segment (77.1% of total first-quarter revenues) contributed to the same-store revenue growth on the back of an increase in activity in the technology sector at two of its Texas operations and one North Carolina operation, along with the Technology and Manufacturing sectors at one of its Virginia operations. The Electrical segment (22.9% of total first-quarter revenues) added to the uptrend with the increase in activity in the technology sector at its Texas electrical operation and the manufacturing sector at its North Carolina electrical operation.

Accretive Acquisitions: Acquisitions have been playing a crucial part in driving Comfort Systems’ growth for many years now. This strategic investment has led to the company offering diversified services and catering to the needs of its customers. For the past 16 years, on average, its 75% of its capital allocation has been focused on acquisitions. On Feb 1, 2024, FIX acquired Summit Industrial Construction, LLC, and J & S Mechanical Contractors, Inc. under its mechanical segment.

The aforementioned acquisitions, along with the priorly acquired companies in 2023 including DECCO and Eldeco, added about 8.1% to the first-quarter revenue growth of Comfort Systems.

Rewarding Shareholders: For the past 16 years, Comfort Systems has been allocating 11% of its capital, on average, for dividend payments to its shareholders. Thanks to its consistent free cash flow and balance sheet strength, it has been able to increase its dividend for the last 12 consecutive years and abide by its commitment to rewarding its shareholders.

The company announced the recent dividend hike on Apr 25, 2024. The quarterly dividend was hiked by 20% to 30 cents per share ($1.20 per share annually) from 25 cents per share ($1.00 per share annually). The dividend was paid on May 24, 2024, to the shareholders of record as of May 13.

Valuation: FIX’s valuation seems a bit undervalued compared with its industry average. The price-to-earnings (P/E) ratio is one of the most commonly used valuation ratios and is best suited for evaluating companies offering mechanical and electrical services. The company currently has a forward 12-month P/E ratio of 25.33x. So, the stock is relatively undervalued compared with its peers, as the industry’s average P/E is currently 32.87x.

The notable outperformance in the year-to-date period and positive consensus estimate trend for 2024 are most likely backed by Comfort Systems’ positive business outlook for the year. The positive outlook is backed by strength in demand from its commercial sector along with its institutional sector, resulting in strong backlog levels of $5.91 billion, up 33.1% year over year. Given the positive business outlook, valuation, and impressive performance of the company’s metrics, investors must position themselves to take a “Strong Buy” stance based on FIX stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

AAON, Inc. (AAON) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance