Will Columbus join the rest of Georgia & South in hosting clean energy manufacturing?

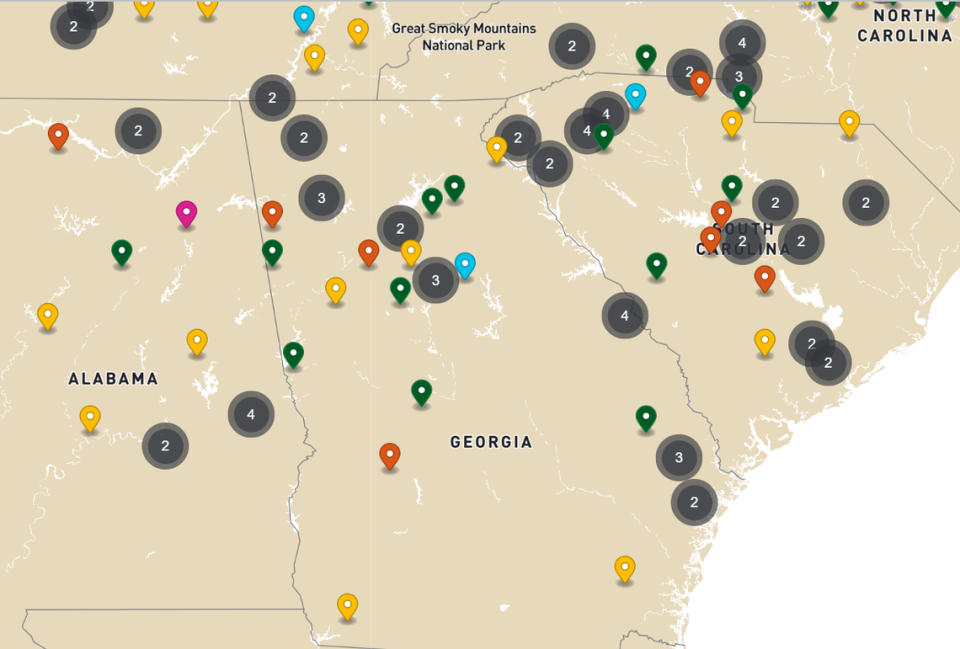

Georgia has been dubbed the battery belt of the South, the e-mobility capital of the U.S., and a clean energy manufacturing leader by the governor and business executives across the state.

“We’re the buckle of the battery belt,” said Chris Clark, president and CEO of the Georgia Chamber of Commerce. “North Carolina has some projects and South Carolina has a few. Tennessee has a few. But no one has near the capacity that Georgia has built out when you consider Frayer, SK Battery, Hyundai, KIA, Rivian, and Archer Aviation.”

Since 2021, more than $32 billion dollars have been invested in clean energy projects, the most of any state in the country – by $14 billion, according to the U.S. Department of Energy.

Columbus and Muscogee County have been left out of the clean energy boom so far due to reasons out of the city’s control, such as location and available land to develop. However, business leaders say they are working to create more available land and higher education systems in Columbus are creating a force of workers to entice manufacturers.

“This is an industry that has added billions of dollars and thousands of jobs to Georgia,” said Greg King Associate vice president of economic development for Georgia Tech.

SK Battery, Rivian, and Archer Aviation are in northern Georgia or Atlanta metro. Q-cells, the U.S.’ largest solar panel manufacturer with over 4,000 employees is in Dalton–and expanded to Cartersville, Georgia–both outside of Atlanta.

Augusta, Savannah, West Point and parts of rural Georgia have all attracted (and in some cases, sustained) clean energy manufacturing.

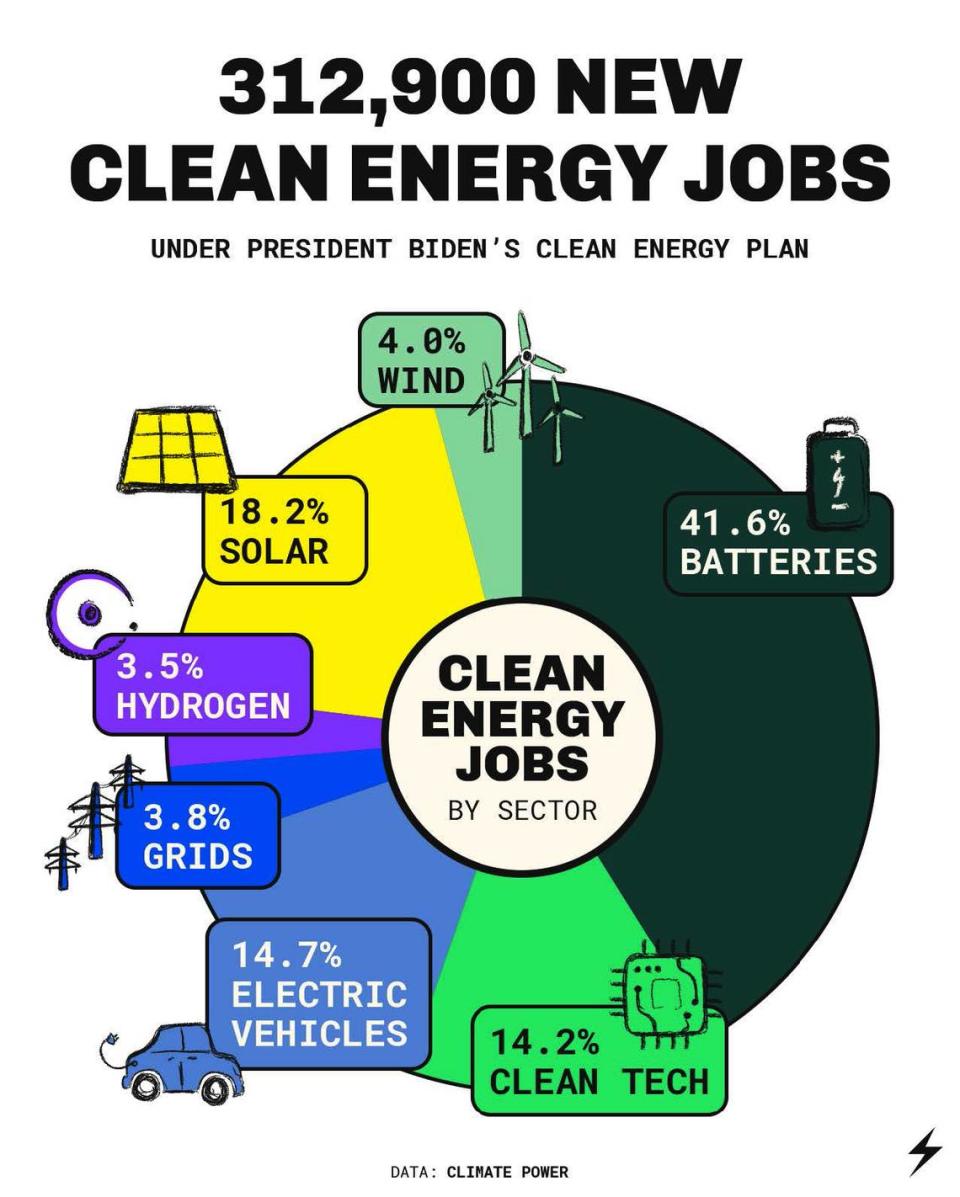

This week Climate Power, the climate communication organization, reported Georgia has amassed 30,661 clean energy jobs since 2022 from 41 projects, creating an up swell of economic growth while transitioning energy sources and phasing out fossil fuels.

The biggest sector in the U.S., by far, is battery manufacturing. Those batteries are used mainly for utilities to pair with solar to store energy, or for electric vehicles.

Georgia’s clean energy ecosystem is a diverse mix of solar panel parts, battery manufacturing, and EV manufacturing and components.

Columbus’ big ticket employers are in cybersecurity with TSYS Global Payments and Synovus, and aviation from Pratt and Whitney. These three combined businesses pull in 8,000 employees. Pratt & Whitney currently has 1,850 and their $200 million expansion will add 400 employees, according to Mitchell.

But Kia in West Point draws about 30% of its 2,700 employees from Muscogee County, Mitchell said.

Clark said Columbus does have some “unique challenges” when it comes to its location and population.

What attracts manufacturers: land and location

Land, a skilled workforce and proximity to transportation hubs like airports, shipping ports and railways are what experts say attract these large manufacturing investments.

“The average economic development project requires 70 to 100 acres of land,” Jerald Mitchell, president of the Columbus Chamber of Commerce, said. “Large plants are more in the 1,000-acre range.”

KIA Georgia in West Point is 2,200 acres, for example.

“A large swath of our county is taken up by the military installation (Fort Moore),” Mitchell added. Plus most of Muscogee County does not have land suitable for construction.

North Muscogee is “covered in rock” and most of Southern Muscogee is “wetlands”, according to Mitchell.

Clark said the Norwegian battery company, Freyr, selected Newnan, likely because of location and the workforce that they could get from Georgia Tech.

“They are centrally located to I-85 and surrounded by highly populated countries to draw workforce,” Clark said. “(Manuacturing in Columbus) could draw workforce from Harris County and Troup County but when you go further south you don’t have the pull nor if you go east.”

The $2 billion, 300-acre plant currently under construction in Bridgeport Industrial Park in Newnan will bring 700 jobs, explained Jason Peace, senior vice president of business development at Freyr.

“We needed a certain amount of land, we needed an adequate talent pipeline, and we needed good logistic plans via rail,” Peace said. “We sourced 130 sites in 35 states and narrowed the criteria down. Then narrowed again to 50. Then narrowed to six sites across six states.”

“The final two were between a site in Arizona and Newnan,” Peace told the Ledger-Enquirer.

Columbus did not come up on the consulting site search team, JLL’s radar, he added.

Outside of Savannah, Hyundai Motor Group Metaplant America poured billions into expanding its Metaplant operations in Bryan County to add EV capacity and 400 jobs to its existing workforce of 8,000.

“Hyundai’s Metaplant is less than 30 miles from the Port of Savannah, the single-largest and fastest-growing container terminal in the U.S. with two Class 1 rail facilities on-site provided by Georgia Central Railway,” said Michael Stewart, director of public relations for Hyundai. “It is adjacent to Interstate 16 with immediate access to I-95 and I-16 highways.”

Bainbridge, a town of 15,000 people tucked in the Southwest corner of the state, is two hours south of Columbus. It was selected to host Anovion, a synthetic graphite lithium-ion battery plant. The company invested $800 million and reports that it will add 400 jobs once the 300-acre plant is complete in 2026.

“We have excellent rail and available land,” said Rick McCaskill, executive director of the Bainbridge and Decatur County Economic Development Authority. “We have CSX and Georgia SW railways that connect to Norfolk Southern.”

Columbus Chamber of Commerce President, Jerald Mitchell, believes Columbus is “well positioned” to attract clean energy and has been approached by clean energy groups recently. Mayor Skip Henderson did not respond to multiple requests asking whether clean energy businesses have inquired about setting up shop in Columbus.

“We’re doing the hard work as it relates to addressing land and workforce,” he said. “We have two sites that are currently ready for industrial construction at the Muscogee Technology Park that are 17 and 36 acres,” he said. The Columbus Chamber of Commerce president said they are in the processing of clearing and grading a 64-acre site and another 62-acre site at the Tech Park.

CSU & Columbus Tech prep the talent pipeline

The workforce that the EV megaplants, solar cell, or battery manufacturing plants require are “people to manage the robots,” explained Martha Todd, president of Columbus Technical College.

Peace, Freyr’s business development leader, said they look for troubleshooters who can solve problems and good collaborators. “A two-year tech degree with heavy automation background in robots, controllers, sensors, and being able to troubleshoot is our workforce profile.”

Computers and robotics are second to the health science associates degree in popularity at Columbus Tech, according to Todd.

To answer to the call of what Todd calls the increased need for maintenance technology within the automotive technology program, Columbus Tech created an electric vehicle technology program last year. Last year there were about a dozen students in the classroom, but Todd is confident that this program will continue to grow.

About 75% of the students work part-time while attending Columbus Tech, and the average age is 27.

“Students who work in automotive shops are recognizing this need,” Todd said. “They say, ‘My shop is getting more and more calls for electric repair’”.

The needs of manufacturing are different now than 30 or 40 years ago. It’s learning how to maintain systems and keep them operating.

Both Columbus Technical College and Columbus State University (CSU) are the linchpins that are prepping the clean energy workforce.says who?

The robotics program at CSU is just a few years old with about 60 students in the program, President Stuart Rayfield told the Ledger-Enquirer. “We have seen exponential growth in this program.”

Rayfield also said CSU is positioning itself well for the clean energy industry with advanced manufacturing programs.

“Clean energy industries are going to require a bachelor or masters to support the advanced part of advanced manufacturing,” she said. “We’re looking at how we can develop curricula to support that degree program that spans across computer science, business, to support the advanced manufacturing industry.”

Mitchell emphasized that the workforce is the most critical piece he hears about in every deal.

It’s not just the robotics jobs, but the EV ecosystem products that Mitchell thinks could have a place in Columbus.

“I believe we will attract these jobs because this industry is hot in the South. Tire’s for EVs will be different from combustion engine vehicles, for example. The entire EV ecosystem needs to be supported.”

Yahoo Finance

Yahoo Finance