Columbia Sportswear (COLM) Cuts View Despite Q2 Earnings Beat

Columbia Sportswear Company COLM posted second-quarter 2022 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate and the former increased year over year. The second quarter is usually the lowest-volume sales quarter, wherein performance trends varied strongly by region. Several markets saw solid sales growth, whereas some were hurt by external hurdles and shipment delays.

Management remains encouraged about introducing its innovative product as it enters the Fall season. It remains encouraged to accelerate brand awareness, enhance consumer experience and digital capabilities and expand global direct-to-consumer (“DTC”) operations.

However, with 2022 progressing, the operating landscape has become more difficult. Given the current scenario, management lowered its guidance for 2022.

Columbia Sportswear Company Price, Consensus and EPS Surprise

Columbia Sportswear Company price-consensus-eps-surprise-chart | Columbia Sportswear Company Quote

Quarter in Detail

This designer, marketer and distributor of outdoor and active lifestyle apparel, footwear and accessories posted earnings of 11 cents per share, declining sharply from the 61 cents recorded in the year-ago quarter. However, the bottom line surpassed the Zacks Consensus Estimate of 4 cents per share.

Net sales rose 2% year over year to $578.1 million, driven by growth in the United States, Canada, Europe-direct, Japan and Korea, somewhat negated by a significant decline in Russia-based distributor and China sales. On a constant-currency or cc basis, net sales increased 4%. However, net sales missed the Zacks Consensus Estimate of $592 million.

DTC sales jumped 5%, whereas wholesale businesses sales dipped 1%. Under the DTC business, brick-and-mortar rose 11%, whereas e-commerce was down 5%, with the latter resulting from reduced product and China e-commerce sales.

The gross margin contracted 240 basis points (bps) to 49.2%, mainly due to increased inbound freight costs and reduced wholesale product margins. These were somewhat offset by the improved channel and the regional sales mix.

SG&A expenses escalated by 7% to $281.3 million. As a percentage of sales, the same expanded from 46.2% to 48.7%. The year-over-year rise in SG&A expenses can be attributed to higher personnel expenses stemming from the increased headcount and escalated wages.

Columbia Sportswear’s operating income came in at $8.8 million, down 75% from the $35 million reported in the year-ago quarter. The operating margin fell from 6.2% to 1.5%.

Image Source: Zacks Investment Research

Regional Segments

In the United States, net sales jumped 9% year over year to $412.5 million. Net sales decreased 7% to $72.8 million in Latin America and the Asia Pacific. In the EMEA, net sales tumbled 35% to $57.6 million. In Canada, net sales surged 69% to $35.2 million.

Sales by Product Category & Brand

Net sales in the Apparel, Accessories and Equipment category increased 3% to $468.4 million and the same for Footwear decreased 3% to $109.7 million. Columbia brand sales remained flat year over year at $485.9 million. SOREL, prAnaand and Mountain Hardwear brands registered sales growth of 24%, 3% and 18%, respectively.

Other Financial Updates

This Zacks Rank #3 (Hold) company ended the quarter with cash, cash equivalents and short-term investments of $414.2 million and shareholders’ equity of $1,731.7 million. The company had no borrowings on its balance sheet as of Jun 30, 2022. For the six months ended Jun 30, 2022, net cash used by operating activities came in at $112.7 million. Capital expenditures were $29 million during this time. For 2022, COLM expects operating cash flow of about $150 million, while capital expenditures are envisioned in the band of $80-$100 million.

During the six months ended Jun 30, the company repurchased 3,235,327 shares for $286.9 million. On Jun 30, 2022, the company had $529.4 million available under its current share buyback authorization.

Columbia Sportswear declared a quarterly cash dividend of 30 cents per share. This is payable on Aug 31, 2022 to shareholders of record as of Aug 17.

Guidance

Management updated its guidance for 2022, which considers the recent weakening of market conditions and the economic landscape – especially in the United States. This, in turn, is adversely impacting the retail space and the company’s business. Management’s guidance considers estimates as of Jul 27, 2022 for the impact of the pandemic on its operations as well as economic conditions like inflation, supply-chain headwinds, labor shortages, limitations and expenses, among others.

For 2022, Columbia Sportswear now expects net sales to grow 10-12% to the $3.44-$3.50 billion band. Earlier, the metric was anticipated to rise 16-18% to the $3.63-$3.69 billion range. The company expects foreign currency translation to hurt net sales growth by roughly 300 bps in 2022, up from the 120 bps projected before.

Management expects the gross margin to contract 210-180 bps and reach 49.5-49.8%. Earlier, the metric was expected to contract about 130 bps to nearly 50.3%.

SG&A expenses are anticipated to rise nearly in line with sales growth compared with a slightly softer rate than the net sales growth expected before. As a percentage of net sales, SG&A expenses are anticipated in the range of 37.6-38% compared with the 37.3-37.7% range projected earlier and 37.8% in 2021. The company still expects demand creation (as a percentage of net sales) to be 6% in 2022 compared with 5.9% in 2021.

For 2022, the operating income is now expected in the band of $415-$449 million, with the operating margin expected at 12.1-12.8%. Earlier, the operating income was expected in the band of $477-502 million, implying an operating margin of 13.2-13.6%. In 2021, the operating margin came in at 14.4%.

Management now envisions earnings per share (EPS) in the range of $5.00-$5.40 for 2022 compared with the $5.70-$6.00 band expected earlier. The company expects foreign currency translation to hurt earnings by 15-20 cents.

For the second half of 2022, the company expects net sales growth of 9-12%. The gross margin is likely to contract 220-170 bps, and SG&A expenses are anticipated to grow approximately in line with net sales growth in the second half. The company expects flat to modest SG&A leverage. Finally, the EPS in the second half is envisioned in the band of $3.85-$4.25 compared with the $3.91 reported in the same period last year.

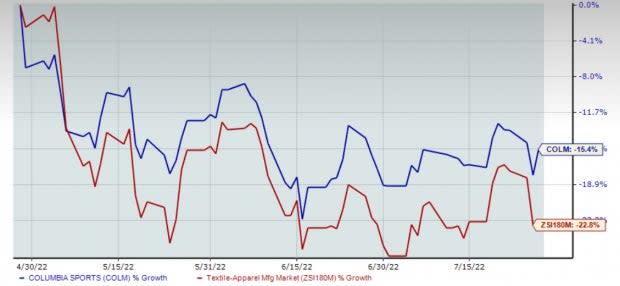

COLM shares have dropped 15.4% in the past three months compared with the industry’s 22.8% decline.

3 Consumer Discretionary Stocks Worth Noting

GIII Apparel GIII, which designs, sources and markets women's and men's apparel, sports a Zacks Rank #1 (Strong Buy). GIII Apparel has a trailing four-quarter earnings surprise of 97.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII’s current financial-year EPS suggests 28.2% growth from the year-ago reported number.

lululemon athletica LULU, which designs, distributes and retails athletic apparel and accessories, carries a Zacks Rank #2 (Buy). lululemon has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for LULU’s current financial-year earnings suggests growth of 12.7% from the year-ago reported number.

Vince Holding VNCE, which designs, merchandises and sells luxury apparel and accessories, currently carries a Zacks Rank #2. Vince Holding has a trailing four-quarter negative earnings surprise of around 49%, on average.

The Zacks Consensus Estimate for VNCE’s current financial-year earnings suggests considerable growth from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Vince Holding Corp. (VNCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance