Columbia Sportswear (COLM) Up 20% in 3 Months Despite Cost Woes

Columbia Sportswear Company COLM appears well-poised with its focus on strengthening brand awareness and robust direct-to-consumer (DTC) operations. A continued focus on innovation is also an upside.

These abovementioned factors fueled third-quarter 2022 results, wherein the top and the bottom line rose year over year and beat the respective Zacks Consensus Estimate. Earnings and sales reflected solid business momentum and the strength of the company’s brand portfolio.

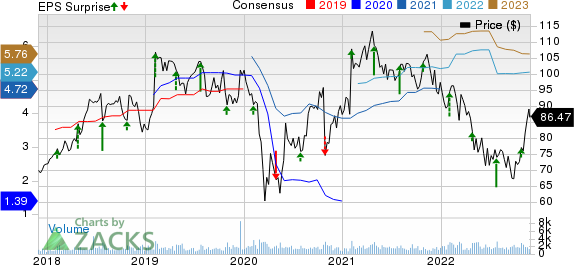

Shares of this Zacks Rank #3 (Hold) company have rallied 20.4% in the past three months compared with the industry’s rise of 7.9%. The consensus mark for the current-year EPS has gone up from $5.17 to $5.22 over the past 30 days.

However, high SG&A costs and increased freight costs remain a concern. Volatile foreign currency movements are also a downside. Let’s delve deeper.

Columbia Sportswear Company Price, Consensus and EPS Surprise

Columbia Sportswear Company price-consensus-eps-surprise-chart | Columbia Sportswear Company Quote

Factors Working Well for Columbia Sportswear

Columbia Sportswear remains committed to expanding and enhancing its global DTC business through accelerated investments. In the third quarter of 2022, the company’s DTC business rose 8%, backed by a 9% rise in e-commerce sales and an 8% jump in brick-and-mortar sales.

During the quarter, the company’s U.S. net sales rose 19%, with the DTC business growing in the high single digits. DTC e-commerce has been seeing robust momentum, with more consumers opting to shop online. This channel is likely to continue performing well in the forthcoming periods.

Management remains focused on its strategic priorities. To this end, it intends to continue with its demand creation investments, which are aimed at driving brand awareness and aiding sales. Further, the company remains committed to enhancing consumers’ experience and its digital capacity in all networks and regions.

COLM will also continue exploring growth opportunities in the DTC business and improving support processes. Finally, the company is keen on investing in its people and optimizing its organization across its brand portfolio. Columbia Sportswear undertakes brand-enhancing and unique marketing initiatives that strengthen its presence in the apparel industry.

In its third-quarter earnings release, management stated that it remains encouraged about its innovative products for the Fall season, including the expanded Omni-Heat Infinity collection and the new poly fleece innovation – Omni-Heat Helix. Earlier, the company launched its fifth annual Star Wars collection in December 2020.

Columbia Sportswear’s 2020 collection based on the hit Disney series helped generate a spectacular consumer response. Thus, a continued focus on innovation helps the company attract more consumers and drive sales.

High Costs a Worry

Columbia Sportswear has been seeing higher SG&A costs for a while now. In the third quarter of 2022, the company’s SG&A expenses escalated by 14% to $319 million. The year-over-year rise in SG&A expenses can be attributed to expenses related to business growth and investments to aid COLM’s brand-led consumer-focused strategies.

Moreover, higher SG&A expenses reflect a rise in personnel, demand creation and global retail costs, somewhat offset by the reduced accrued incentive compensation. SG&A expenses are anticipated to rise nearly in line with sales growth in 2022. The company expects demand creation (as a percentage of net sales) to be 6% in 2022 compared with 5.9% in 2021.

In the third quarter of 2022, Columbia Sportswear’s gross margin declined 270 basis points (bps) to 48% due to elevated inbound freight costs, an adverse channel and regional sales mix, higher inventory provisions and reduced DTC product margins. These were somewhat negated by increased wholesale product margins. Further, the operating margin contracted from 16.6% to 15.2%.

For 2022, management expects the gross margin to contract 250-220 bps to 49.1-49.4%. Earlier, this was anticipated to decline by 210-180 bps and reach 49.5-49.8%.

For 2022, the operating income is now expected in the band of $410-$443 million, with the operating margin expected at 11.9-12.7%. Earlier, the operating income was expected in the band of $415-449 million, implying an operating margin of 12.1-12.8%. In 2021, the operating margin came in at 14.4%.

In its third-quarter earnings release, management stated that it continues to expect order cancelation risks and an increased promotional environment in the fourth quarter.

Nonetheless, Columbia Sportswear expects net sales to grow 10-12% to the $3.44-$3.50 billion band in 2022. For the fourth quarter, the company expects net sales to grow 1-7% to the $1.14-$1.21 billion range. We believe that the abovementioned upsides are likely to keep Columbia Sportswear on the growth trajectory.

3 Solid Consumer Discretionary Stocks

GIII Apparel Group GIII, which designs, sources and markets women's and men's apparel, carries a Zacks Rank #2 (Buy). GIII Apparel has a trailing four-quarter earnings surprise of 20.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for GIII’s current financial-year EPS suggests 13.7% growth from the year-ago reported number.

lululemon athletica LULU, which designs, distributes and retails athletic apparel and accessories, carries a Zacks Rank #2. lululemon has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for LULU’s current financial-year earnings suggests growth of 26.7% from the year-ago reported number.

Crocs CROX, which designs, develops, manufactures, markets and distributes casual lifestyle footwear and accessories, currently carries a Zacks Rank #2. Crocs has a trailing four-quarter earnings surprise of 18.2%, on average.

The Zacks Consensus Estimate for CROX’s current financial-year earnings suggests 51.5% growth from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance