Columbia Banking System Inc (COLB) Q1 2024 Earnings: Surpasses Analyst EPS Estimates

Earnings Per Share (EPS): Reported at $0.59, surpassing the estimated $0.53.

Net Interest Income: Totaled $423 million, a decrease from the previous quarter, reflecting higher deposit costs and lower investment securities income.

Non-Interest Income: Fell to $50 million, a decline driven by fair value adjustments and hedging activities.

Non-Interest Expense: Reduced to $288 million, down $50 million from the prior quarter due to lower discretionary spending and special assessment costs.

Net Charge-Offs: Increased to 0.47% of average loans and leases, up from 0.31% in the previous quarter.

Provision for Credit Losses: Recorded at $17 million, significantly lower than the previous quarter's $55 million.

Capital Ratios: Estimated total risk-based capital ratio stood at 12.0%, indicating a stable financial position.

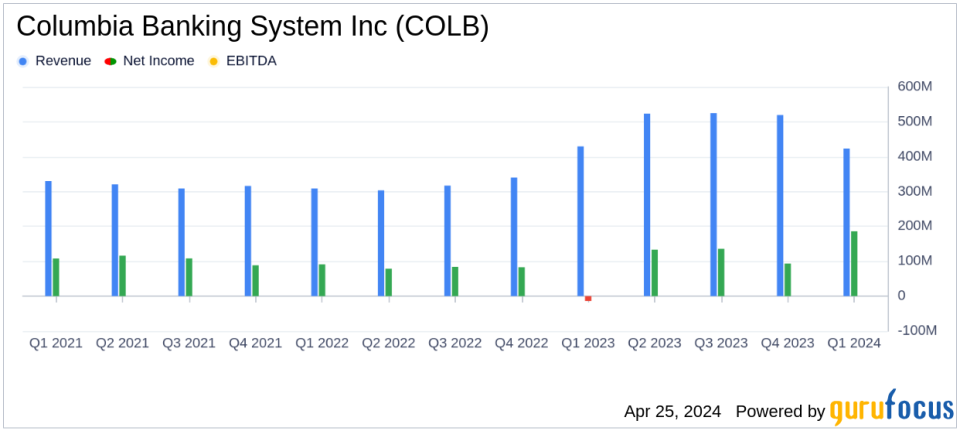

Columbia Banking System Inc (NASDAQ:COLB) released its 8-K filing on April 25, 2024, revealing a first quarter that surpassed analyst expectations for earnings per share (EPS). The company reported an EPS of $0.59, comfortably above the estimated $0.53. Despite challenges in net interest income and margin pressures, strategic operational adjustments have begun to reflect positively on the bank's financial health.

Columbia Banking System Inc, headquartered in Tacoma, Washington, operates primarily through its subsidiary, Columbia State Bank. The bank offers a wide range of services to small and medium-sized businesses, professionals, and individuals in multiple states including Washington, Oregon, Idaho, and California. With a robust presence in personal banking, business banking, and wealth management, Columbia is poised to leverage its extensive network and diversified service offerings to enhance shareholder value.

Financial Highlights and Performance Metrics

The first quarter of 2024 saw Columbia Banking System Inc grappling with a $30 million decrease in net interest income compared to the previous quarter, totaling $423 million. This decline was attributed to higher deposit costs and lower income from investment securities. The net interest margin also contracted by 26 basis points to 3.52%, reflecting the full-quarter impact of deposit repricing and balance mix shifts.

Non-interest income decreased by $15 million due to fluctuations in fair value accounting and hedges, settling at $50 million. However, non-interest expenses saw a significant reduction, dropping by $50 million to $288 million, thanks to stringent expense management and lower discretionary spending.

The bank's credit quality showed mixed signals with net charge-offs increasing to 0.47% of average loans and leases, and non-performing assets rising slightly to 0.28% of total assets. Despite these challenges, the provision for credit losses decreased substantially to $17 million from $55 million in the prior quarter, reflecting improved credit management and a recalibrated commercial CECL model.

Capital Strength and Strategic Focus

On the capital front, Columbia reported a stable risk-based capital ratio of 12.0% and a common equity tier 1 risk-based capital ratio of 9.8%, both figures showcasing the bank's robust capital position. The tangible book value per common share stood at $16.03, slightly down from $16.12 in the previous quarter.

"Our first quarter results reflect early progress on our targeted actions to improve our financial performance and drive shareholder value," said Clint Stein, President and CEO of Columbia Banking System Inc. "We will continue to exercise prudent expense management, and we expect to see the positive financial impact of near-term initiatives fully reflected in the fourth quarter's expense run rate."

Stein's comments underline the bank's commitment to optimizing performance through strategic initiatives focused on revenue enhancement, cost control, and profitability improvements.

Investor and Market Implications

The first quarter results of Columbia Banking System Inc demonstrate a strategic realignment aimed at stabilizing and enhancing financial metrics. While there are challenges in the form of increased deposit costs and credit quality concerns, the bank's proactive management strategies and strong capital ratios position it well for future growth. Investors might find Columbia's approach and its potential for improved profitability in subsequent quarters an attractive proposition.

For detailed financial figures and further information, refer to Columbia Banking System Inc's official earnings release.

Explore the complete 8-K earnings release (here) from Columbia Banking System Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance