Colgate (CL) to Retain Earnings Momentum in Q1: Wise to Buy?

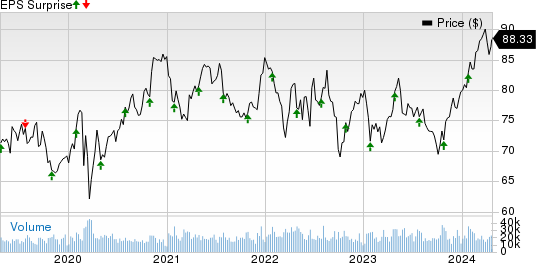

Colgate-Palmolive Company CL is slated to report first-quarter 2024 earnings on Apr 26. The New York City-based company has been reporting steady earnings outcomes, as evident from its positive top and bottom-line surprise trends in the trailing four quarters. CL has a trailing four-quarter earnings surprise of 4.2%, on average. Additionally, the company’s top line surpassed the Zacks Consensus Estimate in the trailing five quarters. Given the company’s positive record, the question is, can it maintain the momentum?

CL’s aggressive pricing actions, along with solid business momentum, supported by robust consumer demand, have been the key to the earnings success of this global leader in the oral care hygiene market. In addition, accelerated revenue growth management plans have been bolstering organic sales of Colgate, with 2023 marking the fifth straight year of organic sales growth either in line or ahead of its 3-5% long-term goal.

Make sure to keep an eye on the company’s volume and pricing, which are the key components driving organic sales. For the first quarter, we estimate year-over-year organic sales growth of 4.3%, with a 7.8% rise in pricing and a 3.5% decline in volume.

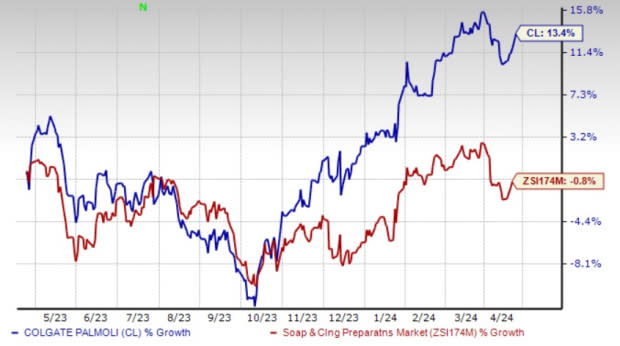

The stock has risen steadily in the past year. It has notched a gain of 13.4% in the past year against the industry’s decline of 0.8%.

Image Source: Zacks Investment Research

The company’s business strategy of increasing its leadership in key product categories through innovation in core businesses, tracking adjacent categories’ growth and expansion into new markets and channels has gone a long way in bolstering its position in the consumer goods space. CL has been ranked the leading consumer goods company, with a global household penetration of 61.6%.

Is Colgate a Wise Buy Ahead of This Event?

Colgate looks well-placed to retain its earnings and sales surprise trend when it reports results for the first quarter of 2024, driven by its bold pricing initiatives, which have helped deliver solid revenue growth and maintain healthy profit margins.

The company has adopted aggressive pricing in six of the last seven quarters mainly to combat the inflation in raw materials, particularly agricultural products. Colgate, on its last reported quarter’s earnings call, expected to see a moderation in agricultural prices going into 2024. Consequently, it anticipates a moderation in the pricing for its products and a comeback in volume growth, eventually driving household penetration in its markets.

Concurrently, the company’s first-quarter performance is poised to reflect the improved market share momentum, backed by strong innovation and higher levels of brand investment, with a focus on enhancing the efficacy of every dollar spent. Colgate’s innovation strategy is focused on growing in adjacent categories and product segments. It is also focused on the premiumization of its Oral Care portfolio through major innovations.

Additionally, CL’s progress on its digital transformation endeavors, along with the finest data analytics, is slated to have contributed meaningfully to its revenues and profitability. We are also looking up to the company’s revenue growth management initiatives, the strength of its funding to growth efforts, and the global productivity initiative, as these position it well for margin expansion and improved profitability for several quarters ahead.

The Zacks Consensus Estimate for Colgate’s annual earnings is expected to increase 8.4% year over year in 2024 and 8.9% in 2025 to $3.50 per share and $3.81, respectively. The consensus estimate for revenues is forecast to improve 3.6% to $20.2 billion in 2024, with revenue growth of 4.9% to $21.1 billion for 2025.

Q1 Earnings Whispers

Colgate is expected to register top and bottom-line growth when it reports first-quarter 2024 results. The consensus estimate for first-quarter revenues is pegged at $4.95 billion, indicating growth of 3.8% from the prior-year quarter’s reported figure. The consensus mark for earnings is pegged at 82 cents per share, suggesting growth of 12.3% from the prior-year quarter’s reported figure.

Colgate-Palmolive Company Price and EPS Surprise

Colgate-Palmolive Company price-eps-surprise | Colgate-Palmolive Company Quote

The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that is not the case here. CL has an Earnings ESP of -0.02%, while it carries a Zacks Rank #2.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Conclusion

Colgate has certainly proved its might in the past few years, retaining its top position in the industry. With its long-standing history of maintaining its beat or meet earnings trend, investors eagerly await the earnings release of this consumer goods behemoth. Whatever the results, the Colgate stock undoubtedly deserves a place in your portfolio.

Consumer Stocks in Focus This Earnings Season

Here are some Consumer Staples companies that you may want to consider on the basis of our model:

Church & Dwight Co. CHD currently has an Earnings ESP of +2.37% and a Zacks Rank #2. The company’s top and bottom lines are expected to increase year over year when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for CHD’s quarterly revenues is pegged at $1.5 billion, suggesting year-over-year growth of 4.3%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Church & Dwight’s quarterly EPS is pegged at 86 cents, indicating year-over-year growth of 1.2%. CHD has a trailing four-quarter earnings surprise of 9.7%, on average.

Coty COTY currently has an Earnings ESP of +12.93% and a Zacks Rank #3. The company’s top line is expected to increase year over year when it reports first-quarter 2024 results. The Zacks Consensus Estimate for Coty’s quarterly revenues is pegged at $1.4 billion, suggesting a rise of 6.4% from the prior-year quarter’s actual.

The Zacks Consensus Estimate for COTY’s first-quarter EPS is pegged at 6 cents, indicating a 68.4% decline from the year-ago period’s reported figure. COTY has a trailing four-quarter earnings surprise of 115.3%, on average.

Hershey HSY currently has an Earnings ESP of +0.90% and a Zacks Rank #3. HSY is likely to register top-line growth when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.1 billion, suggesting growth of 4.5% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Hershey’s quarterly earnings is pegged at $2.73 per share, suggesting a decline of 7.8% from the year-ago quarter’s reported number. HSY delivered an earnings surprise of 6.5%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance