CME Group: Threat of New Competition Is Fully Priced In

CME Group Inc. (NASDAQ:CME) has a long history of delivering solid results for investors. Over the past 10 years, the financial services company has delivered investors a total return of roughly 325%. Comparably, the S&P 500 has posted a total return of roughly 230% over the same period.

The stock's move higher has been a result of strong earnings growth for the company. CME has benefited from steady increases in trading volume for key products and the launch of additional products.

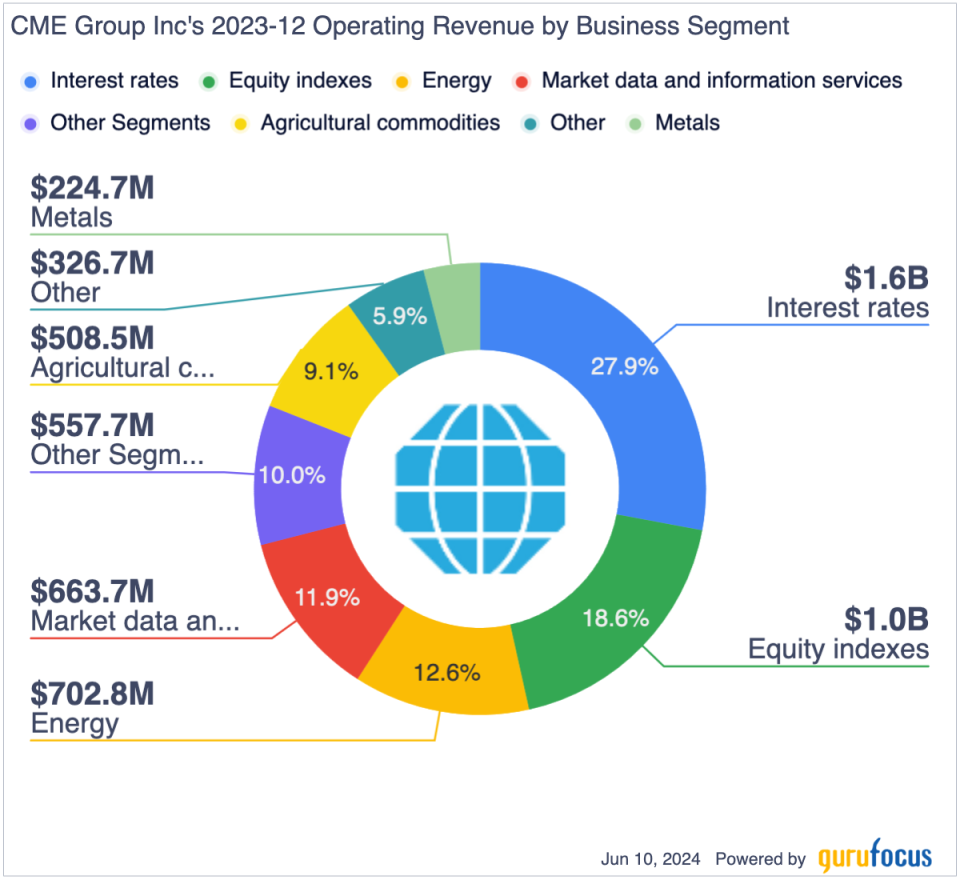

While CME is fairly diversified in terms of its product offerings, the company's biggest business segment is interest rates, which account for roughly 28% of total revenue. Key product offerings in this segment include U.S. Treasury futures and secured overnight financing rate futures.

Threat of new competition

CME has long dominated the U.S. interest rate futures market as its market share of trading volume in this segment is estimated to be more than 99%. The company's dominance of this business has given it solid pricing power and helped it deliver industry best profit margins. Its net profit margin of roughly 57% compares favorably to peers such as Intercontinental Exchange Inc. (NYSE:ICE) and CBOE Global Markets (CBOE), which have profit margins of roughly 24% and 21%.

Despite its strong position in the interest rate futures market, Howard Lutnick, CEO of Cantor Fitzgerald and BGC Partners (NASDAQ:BGC), has recently decided to challenge CME in this market. BGC's FMX trading platform, which has an estimated 28% market share in cash Treasuries trading, is expected to introduce SOFR futures in September 2024 followed by U.S. Treasury futures in early 2025.

The FMX futures platform is backed by large financial institutions, including Bank of America (NYSE:BAC), Citadel Securities, Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), Morgan Stanley (NYSE:MS) and others. Lutnick has said the FMX plans to compete with CME by offering lower trading fees and more product innovation.

Not the fist time CME has faced competition

During CME's first-quarter earnings call, CEO Terry Duffy responded to an analyst question regarding new competition from FMX:

I have sat here for 22 years as the chairman and CEO of this company since we went public, and I've seen nothing but competition my entire career, so this is no different. I take every single bit of competition seriously, as I'm sure others do about CME as we continue to move our business forward.

In 2009, Lutnick-backed ELX Futures tried to compete with CME on interest rate futures, but failed to gain much traction due to a lack of clearing arrangements. In 2011, it also faced a challenge from NYSE Euronext, now owned by Intercontinental Exchange, which also failed to gain traction.

FMX poses a more serious threat, but CME still has the advantage

The key difference between BGC's FMX futures offering and previous challenges to CME's dominance in interest rate futures is the fact the company has arranged for trades to be cleared through LCH. Historically, no competitor was able to deliver interest rate futures through a well-established clearing house as CME did not allow competitors to clear through its clearing house. LCH is one of the largest clearing houses in the world and thus, has the potential to offer FMX futures users efficient margining, which is similar to what CME can offer.

FMX poses a significant threat to CME due to the fact it is backed by a large consortium of sophisticated financial services companies and has arranged for clearing through LCH. However, I believe that as the incumbent, CME has a significant advantage. Market participants are likely to require a significant incentive to move over to a new exchange, which could increase operational complexity related to trading.

CME could temporarily lower trading fees to eliminate any incentive for market participants to move over to FMX. While such an approach might result in a near-term hit to profits, CME would remain highly profitable due to its other businesses and would be able to raise fees again in the future once the FMX threat is gone.

As the incumbent, CME also benefits from already having a much more liquid marketplace than BGC's FMX platform is likely to have initially. Thus, large trade orders are likely to continue to be routed through CME due to superior liquidity, which may make it difficult for FMX to gain market share.

Valuation is below historical norms

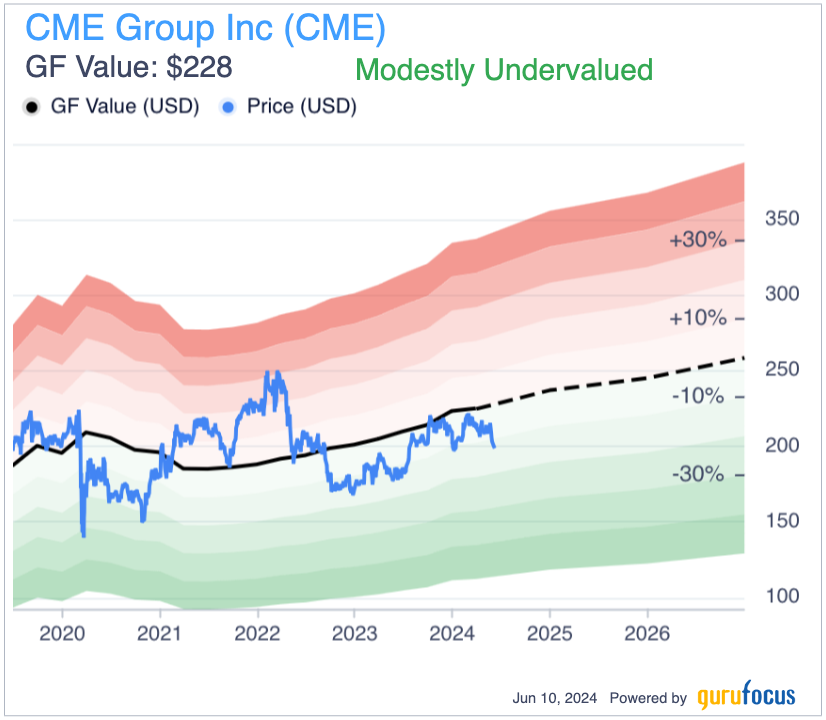

CME currently trades at roughly 20 times forward earnings. While this valuation level represents a slight discount to the broader market, it is a significant discount to the valuation it has traded at over the past several years.

While the company has only moderate growth prospects, which tend to be heavily impacted by market moves and volatility, I believe the stock deserves to trade at a premium to the broader market. Historically, over the past 10 years, the company has grown earnings per share at a compound annual rate of roughly 11%. In addition to delivering strong earnings growth, CME benefits from limited cyclicality as trading activity, which drives fees, tends to increase during times of market stress. For this reason, I believe investors should be willing to pay a premium for CME shares as it is one of the few that benefits from challenging economic conditions.

Since the SEC approved BGC's proposed interest rate futures offering on Jan. 22, CME shares have fallen by roughly 3%. The S&P 500 has risen by roughly 10% over the same period, while BGC Group shares have risen by roughly 16%.

Over the past five years, CME has traded at an average price-earnings ratio of roughly 29.50. Thus, the stock's current valuation represents a discount to recent historical norms. Moreover, the stock has a GF Value of $228 per share, which suggests the stock is modestly undervalued based on historical ratios, past financial performance and analysts' future earnings estimates.

Regulatory risk

While I am a bullish on CME and believe the company is well positioned to fend off the challenge from BGC's FMX, regulatory risk remains a potential concern. Given its massive scale and unique position within the financial system, the company faces extensive regulation. While CME enjoys a near monopoly position in the U.S. interest rate futures market, regulators could decide that this poses a threat to the financial system and create incentives to increase competition. For example, regulators could require CME to open its clearing house to other exchanges. Moreover, regulators could also challenge its right to exclusively list other key products such as S&P 500 Index futures, which represent a key revenue driver.

Conclusion

CME benefits from a dominant position in the U.S. interest rate futures market, which has helped the company maintain very high profit margins historically. The highly profitable nature of this business has drawn competition previously, but no other exchange has successfully challenged it in this business.

BGC's FMX futures represent a new challenger to CME and is a potential threat due to the sophistication of its backers and agreement with LCH on clearing. The threat has helped drive CME shares lower in recent months and the stock now trades at a discount to its own historical average.

As the incumbent, CME is well position to fend off competition from the FMX platform. Thus, I believe its shares are undervalued and investors currently have the chance to purchase a very high-quality company at an attractive valuation.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance