Cloudera's (CLDR) Q2 Earnings Beat, Revenues Increase Y/Y

Cloudera CLDR reported second-quarter fiscal 2022 adjusted earnings of 15 cents per share, which beat the Zacks Consensus Estimate by 87.5%. The bottom line also increased 50% year over year.

Revenues of $236.1 million beat the consensus mark by 3.84% and also increased 10.1% year over year. The uptick can be attributed to rapid adoption of its cloud-based products and services.

Annualized recurring revenues (ARR) at the end of the fiscal second quarter were $832 million, up 13% year over year.

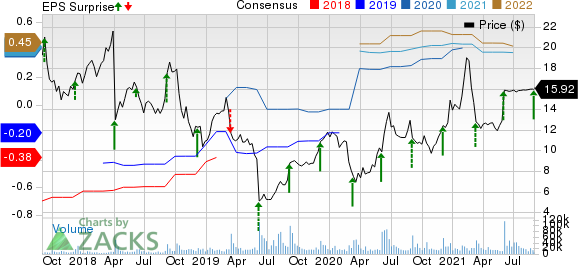

Cloudera, Inc. Price, Consensus and EPS Surprise

Cloudera, Inc. price-consensus-eps-surprise-chart | Cloudera, Inc. Quote

Quarter in Detail

Subscription revenues (90.4% of revenues) rose 11.4% year over year to $213.3 million, benefiting from the fast uptake of its cloud-based products and services.

Cloudera’s services (9.6% of revenues) decreased marginally by 0.2% year over year to $22.8 million.

In the reported quarter, non-GAAP gross margin expanded 330 basis points (bps) on a year-over-year basis to 84.6%. Non-GAAP subscription gross margin expanded 200 bps year over year to 91%. Non-GAAP services gross margin expanded 730 bps year over year to 25.3%.

Research and development (R&D) expenses increased 6.7% to $48.3 million year over year while sales and marketing (S&M) expenses increased 3.2% on a year-over-year basis to $77.5 million. General and administrative (G&A) expenses rose 21.5% year over year to $29.6 million. As a percentage of revenues, R&D and S&M contracted 70 bps and 220 bps while G&A expenses rose 120 bps.

For the second quarter of fiscal 2021, the company reported non-GAAP income from operations of $44.5 million compared with $42.5 million reported in the previous quarter and $29.8 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Jul 31, 2021, Cloudera had total cash, cash equivalents, marketable securities and restricted cash of $796.1 million compared with $902.5 million reported in the previous quarter.

Moreover, reported operating cash outflow was $12.1 million compared with cash flow of $32.4 million in the year-ago quarter.

Zacks Rank & Key Picks

Currently, Cloudera carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Microsoft MSFT, Cadence Design Systems CDNS and Texas Instruments TXN, all carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for Microsoft, Cadence Design and Texas Instruments is currently pegged at 11.09%, 11.68% and 9.33%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Cloudera, Inc. (CLDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance