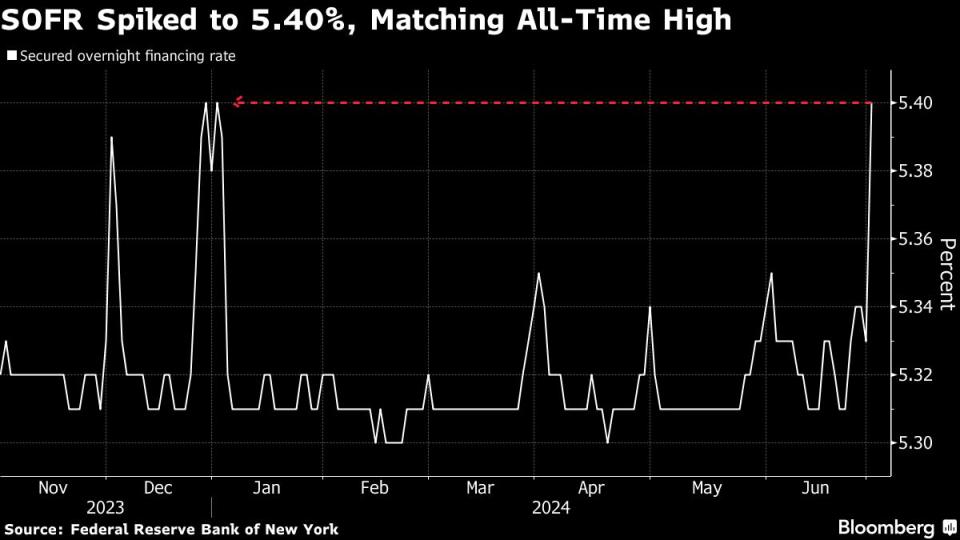

Clogged Bank Balance Sheets Cause Key Repo Funding Rate to Spike

(Bloomberg) -- A key rate tied to the day-to-day borrowing needs of the financial system hit the highest level since the beginning of the year as chunky Treasury auction settlements and clogged primary dealer balance sheets curbed lending capacity.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

S&P 500 Closes Above 5,500 in Record-Breaking Run: Markets Wrap

US Allies Allege China Is Developing Attack Drones for Russia

The Secured Overnight Financing Rate spiked seven basis points to 5.40% on July 1, according to Federal Reserve Bank of New York data published Tuesday. That matches the highest fixing in the six-year-old benchmark reached on Jan. 2 and and Dec. 28.

The return of such swings in SOFR is largely thanks to the Federal Reserve, which is still removing liquidity from the system via quantitative tightening, or QT, albeit at a slower pace with the intention to reduce potential strains on the market.

Still, that’s reawakened volatility around key quarter-end funding periods as seen last week, when banks tend to pare repo activity to shore up balance sheets for regulatory purposes and borrowers either find alternatives or pay up. At the same time, the glut of government debt sales means more collateral needs financing from the repo market.

“This might be the new normal and explains why the Fed reduced the cap on runoffs,” said Subadra Rajappa, head of US rates strategy at Societe Generale SA. “Record coupon issuance sizes and bond settlements, primary dealer holdings near highs, so ultimately balance-sheet constraints. This feels more like what we saw year-end and repo might take a few days to normalize.”

While the latest move is akin to the turmoil seen late last year, it’s far from the extremes experienced in September 2019 when SOFR more than doubled overnight. Yet the indicators that warned of strains in 2018-2019 have started to re-appear. Dealer holdings of Treasuries are near all-time highs and overnight repo rates continue to creep up. As a result, it has taken overnight rates and by extension SOFR, which is calculated from repo data, longer to normalize after auction settlement days.

Still, there are backstops put in place to address potential strains in funding markets. Sponsored repo, which allows easier access to financing sources, is in place, according to Barclays Plc. Volumes in sponsored repo have more than doubled since the market blowup in 2019, and reached a record $1.22 trillion as of June 28, before dropping to $1.2 trillion on July 1, according to Depository Trust & Clearing Corporation data.

There’s also the Fed’s Standing Repo Facility, which allows eligible institutions to borrow cash in exchange for Treasury and agency debt at a rate in line with the top of the Fed’s policy target range. This has helped put a ceiling on repo rates, though questions remain on how it handles moments of stress.

Ultimately, this is likely a harbinger for what’s to come, especially as Treasury will likely have to eventually ramp up issuance to fund growing US deficits, making funding strains more acute.

“Stopping QT would help prevent the background from deteriorating further, but I don’t think stopping QT would materially improve the environment,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities. “It’s really a function of the cost of cash starting to rise somewhat as we go from extreme abundance of liquidity to a more ‘normal’ environment.”

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance