Clarivate PLC (CLVT) Reports Mixed 2023 Financial Results and Provides 2024 Outlook

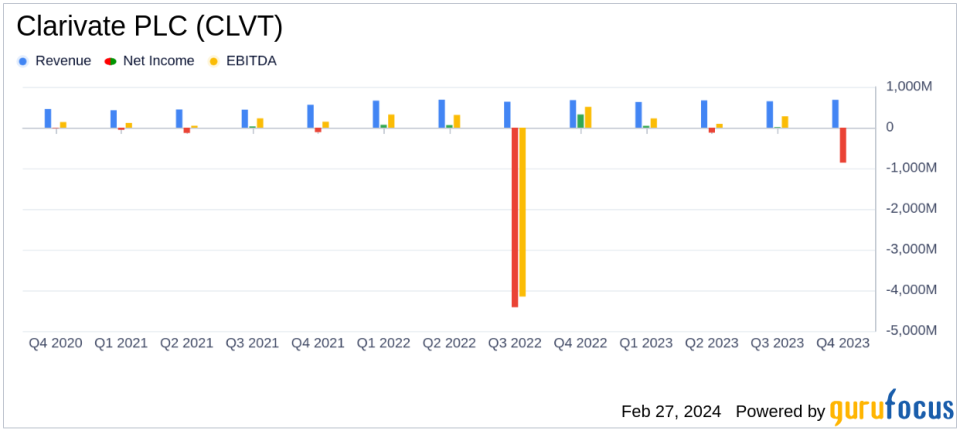

Revenue: Slight increase to $683.7 million in Q4; full-year revenue down 1.2% to $2.63 billion.

Net Loss: Significant net loss of $863.0 million in Q4 and $986.6 million for the full year, primarily due to non-cash goodwill impairment.

Adjusted EBITDA: Q4 adjusted EBITDA decreased by 2.0% to $298.2 million; full-year adjusted EBITDA marginally increased by 0.4%.

Free Cash Flow: Increased by $36.5 million in Q4 and $195.3 million for the full year, reaching $127.0 million and $501.7 million respectively.

Debt Reduction: Total debt decreased by $301.0 million as of year-end, with strong free cash flow facilitating accelerated repayment.

2024 Outlook: Projected revenue between $2.57 billion and $2.67 billion with organic growth of 0% to 2%.

On February 27, 2024, Clarivate PLC (NYSE:CLVT) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a global leader in providing transformative intelligence, faced a challenging year with a significant net loss due to a non-cash impairment of goodwill and intangible assets. Despite this, Clarivate achieved stable adjusted EBITDA and increased free cash flow, highlighting its operational resilience.

Clarivate operates in three segments: Academia and Government; Life Sciences and Healthcare; and Intellectual Property, with the majority of its revenue stemming from the Americas. The Academia and Government segment, which is the largest revenue contributor, focuses on driving research excellence and operational efficiency in academic institutions and libraries.

Financial Performance and Challenges

For the fourth quarter, Clarivate reported a marginal revenue increase to $683.7 million, up 1.2% year-over-year, but saw a decrease of 0.6% on a constant currency basis. Full-year revenues slightly declined by 1.2% to $2.63 billion, influenced by the divestiture of MarkMonitor. The company's net loss attributable to ordinary shares was substantial, at $863.0 million for the quarter and $986.6 million for the year, primarily due to the $844.7 million non-cash impairment charge.

Despite the net loss, Clarivate's adjusted EBITDA for the quarter decreased only slightly by 2.0% to $298.2 million, with a full-year increase of 0.4% to $1.12 billion. The adjusted EBITDA margin for the year improved by 70 basis points to 42.5%. These figures are crucial as they provide insight into the company's operational efficiency and its ability to generate earnings before interest, taxes, depreciation, and amortization.

Financial Achievements and Importance

Clarivate's financial achievements in 2023, particularly the increase in free cash flow, are significant as they demonstrate the company's ability to generate cash from its operations. Free cash flow for the year ended December 31, 2023, was $501.7 million, an increase of $195.3 million compared to the prior year. This financial metric is essential for value investors as it reflects the company's potential for growth, dividend payments, and debt reduction.

"In 2023, we delivered subscription revenue growth and navigated through market headwinds. We achieved cost synergy targets and generated significant cash flow, which allowed us to increase the pay down of debt and repurchase ordinary shares," said Jonathan Gear, Chief Executive Officer of Clarivate.

Balance Sheet and Cash Flow Analysis

Clarivate's balance sheet as of December 31, 2023, shows cash and cash equivalents of $370.7 million, an increase from the previous year. The company's total debt outstanding decreased to $4.77 billion, reflecting its commitment to debt reduction. The net cash provided by operating activities for the year was $744.2 million, a significant increase from the prior year, primarily due to lower one-time costs and improvements in working capital.

2024 Outlook and Strategic Focus

Looking ahead to 2024, Clarivate anticipates improved organic growth across subscription and re-occurring revenue, though this will be partially offset by soft transactional revenue. The company expects a modest contraction of its profit margin due to growth investments, net of cost inflation and savings initiatives. Capital spending is projected to increase to approximately 10% of revenues to drive product innovation, and the strong cash flow will continue to be used for debt reduction.

"With organic revenue growth below our expectations, we launched a multi-year transformation plan to return to market growth rates," Gear added, highlighting the company's strategic focus on accelerating new product development and divesting non-core assets.

For value investors, Clarivate's commitment to operational efficiency, cost management, and strategic investments, despite the challenges faced in 2023, may present a compelling narrative for potential investment opportunities.

For a detailed breakdown of Clarivate's financials and further insights, readers are encouraged to visit the full 8-K filing.

Media Contact: Amy Bourke-Waite, Senior Director, Corporate Communications (newsroom@clarivate.com)Investor Relations Contact: Mark Donohue, Vice President, Investor Relations (investor.relations@clarivate.com)

Explore the complete 8-K earnings release (here) from Clarivate PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance